- Opportunity zone (OZ) funds raised $810M in Q1 2025, a slower pace compared to earlier peaks but still the second-highest quarter since mid-2023.

- Investors and developers expect a flood of capital once Congress finalizes an OZ program extension, with speculation about expanded eligibility for non-capital gains investment.

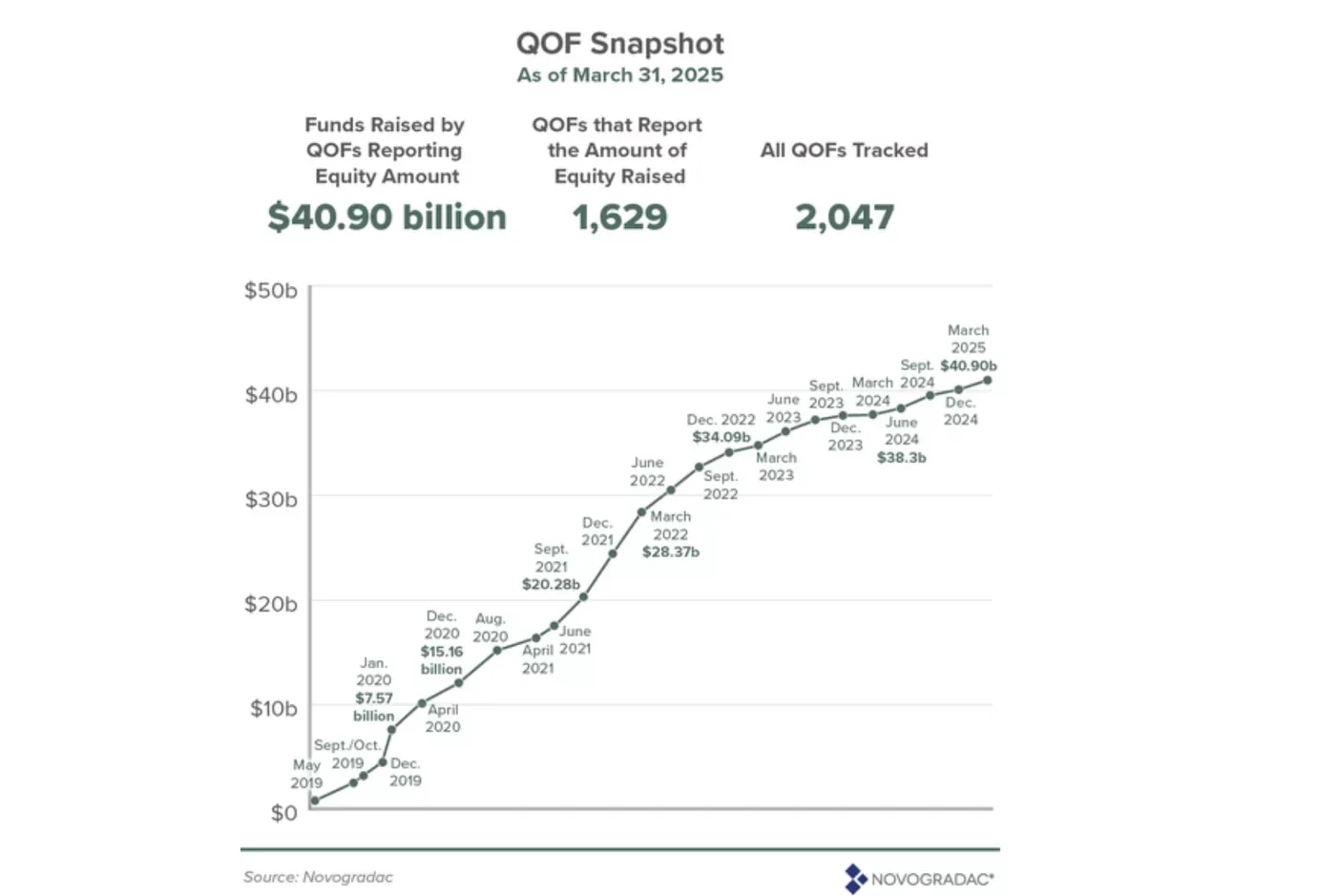

- More than $40B has been raised since the program’s 2017 launch, primarily fueling multifamily development across the country.

Despite uncertainty around the future of the opportunity zone program, investors continue to funnel capital into funds while awaiting potential legislation that could broaden and extend the tax incentive. Established under former President Donald Trump’s 2017 tax reforms, the program faces key expirations next year, but many stakeholders are betting on a renewal, per Bisnow.

The Current Landscape

In the first quarter of 2025, opportunity zone funds tracked by Novogradac raised $810M — a noticeable slowdown from 2021’s peak but still a strong showing relative to the past two years. Fundraising remains cautious, with executives like Redbrick LMD’s Louis Dubin and Jackson Dearborn’s Ryan Tobias saying major investors are waiting for clarity around “Opportunity Zones 2.0.”

Investors must reinvest capital gains within 180 days to qualify for OZ benefits, prompting some to act now even amid legislative uncertainty. However, many are staying sidelined, waiting for a clearer picture of any program reforms.

What’s At Stake

The opportunity zone program designates 8,764 census tracts across the US and has helped raise over $40B for projects, according to Novogradac — although the real total is likely higher. The funds have primarily supported multifamily housing, with over 199,000 units financed through OZ incentives.

Major projects like Redbrick’s 757-unit Bridge District development in D.C. exemplify the scale made possible by OZ equity. Redbrick has already raised $335M across two phases and is planning additional fundraising for future expansion.

Possible Changes Ahead

Talks around the program’s extension include potential major reforms, such as allowing funds to accept investments beyond just capital gains. If enacted, that change could significantly broaden the investor pool and accelerate project pipelines, Tobias said.

Congressional leaders aim to wrap the broader budget and tax package — including the OZ extension — by Memorial Day, though most experts believe a later passage is more likely. Even so, opportunity zone advocates are optimistic a renewal is on the horizon.

Why It Matters

A program extension would not only preserve an important economic development tool but could also unlock a wave of new investment. Developers like Jackson Dearborn and Redbrick are already preparing their project pipelines, banking on a revival in activity once new rules are finalized.

As Dubin put it: “You want to really keep close dibs on it, because it’s going to accelerate — it’s going to get louder and louder.”

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes