- The Senate is proposing a permanent extension of the Opportunity Zone (OZ) program, replacing the current 2028 sunset with rolling 10-year designations starting in 2027.

- Revised eligibility criteria would tighten income thresholds and add safeguards to prevent high-income areas from qualifying.

- Investors would benefit from incremental basis step-ups over time, with triple benefits for rural-focused Qualified Opportunity Funds (QOFs).

- New reporting requirements and reduced improvement thresholds aim to spur development, especially in rural areas.

Expanding a Key Tax Tool

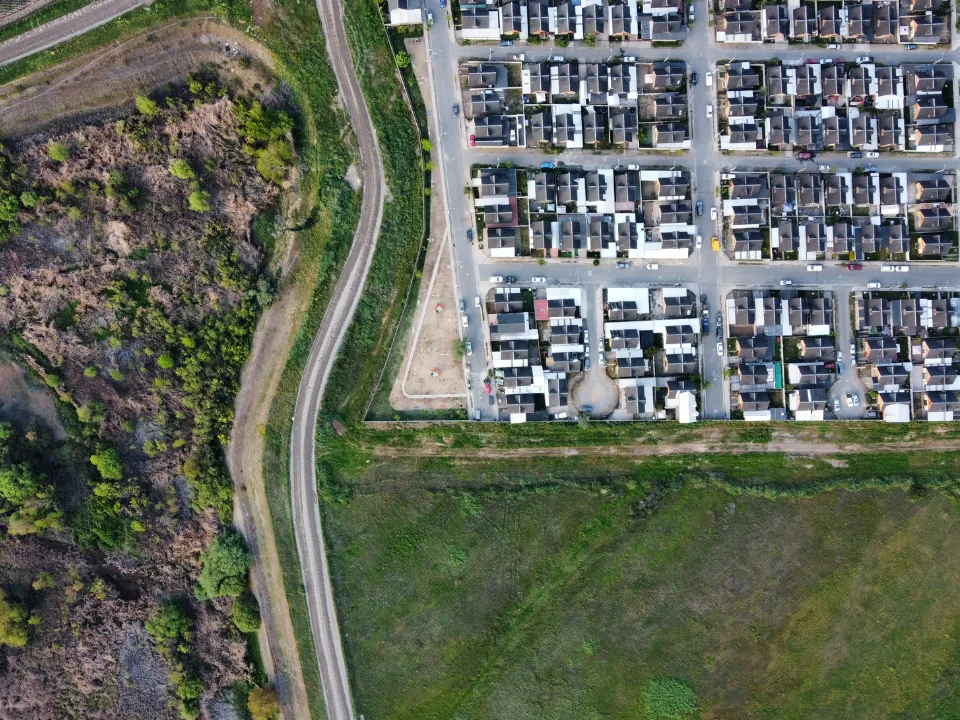

According to GlobeSt, the Senate is moving to extend and revise the Opportunity Zones program. Originally part of the 2017 Tax Cuts and Jobs Act, the initiative offers tax breaks to spur investment in underserved areas. The new proposal would eliminate the 2028 expiration and launch rolling 10-year designations starting in 2027.

Sharper Focus on Need

The bill tightens eligibility for census tracts. Areas must have either a poverty rate of at least 20% or a median income below 70% of the area average. A new “guardrail” would also exclude tracts where median income exceeds 125% of the area median. Some language in this section may need clarification.

Investor Perks Remain—And Grow

The updated Opportunity Zones structure keeps the original three tax benefits: deferred gains, step-up in basis, and tax-free appreciation. It also adds annual basis increases. Investors get a 1% step-up in years 1–3, 2% in years 4–5, and 3% in year 6. Rural-focused QOFs receive triple those benefits.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Rural Edge

The proposal introduces Qualified Rural Opportunity Funds. These funds gain extra incentives, including a lower “substantial improvement” requirement. Instead of improving a property by 100%, rural investors need only meet a 50% threshold.

Greater Oversight Coming

The bill includes new reporting requirements specifically for Opportunity Zones. It also allocates funding to the IRS to enforce compliance. These steps aim to improve accountability and ensure OZ investments benefit the communities they’re meant to serve.

Still in Flux

Barrett Linburg, co-founder of Savoy Equity Partners, says the proposal is still evolving. He noted two possible additions: allowing non-capital gains and interim gains to roll into QOFs. Both would broaden the program’s impact without significantly affecting the budget.

Why It Matters

If passed, the bill would bring long-term stability to the Opportunity Zones program. It would also sharpen its focus on truly distressed areas. The changes could reshape how investors deploy capital in underserved communities for years to come.