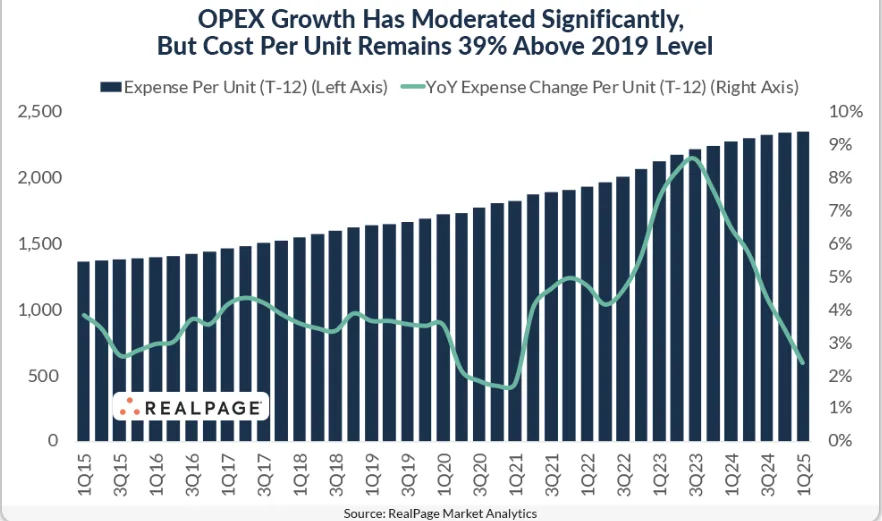

- Multifamily operating expenses have cooled notably over the past 12 months, with growth slowing to its lowest level since early 2021.

- Despite the moderation, cost per unit remains roughly 39% higher than pre-pandemic benchmarks, reflecting lasting inflationary pressures.

- Insurance and tax expenses saw the steepest declines, while utility and payroll costs continue to rise.

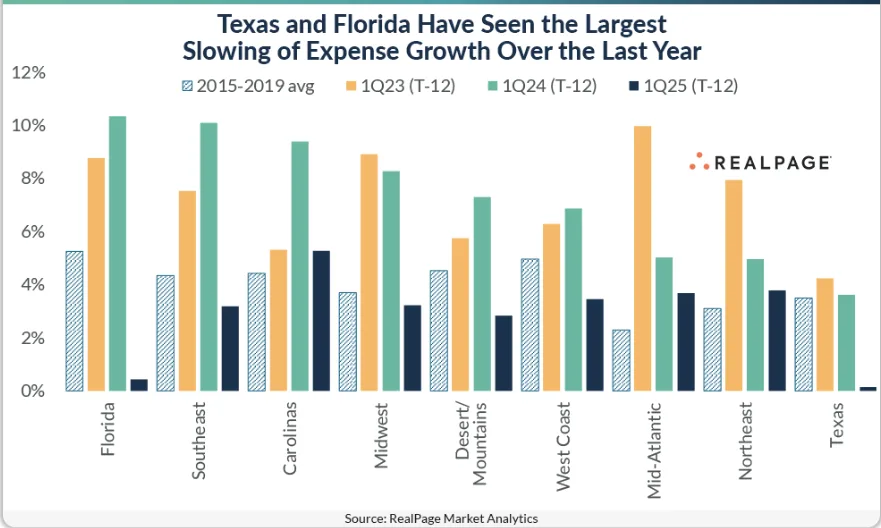

- Texas and Florida posted the slowest year-over-year OPEX growth among major regions, signaling potential regional budget relief.

Multifamily operators are finally catching a break—at least somewhat. After years of post-pandemic cost surges, operating expenses for market-rate multifamily properties are decelerating sharply, reports Real Page. But even with this welcomed moderation, the average cost per unit remains significantly elevated compared to pre-COVID levels.

Expense Moderation Takes Hold

Between Q1 2021 and Q1 2024, average annualized operating expenses rose by $445 per unit, a 24.4% increase. That spike followed a pandemic-fueled surge in inflation and supply chain disruptions. While sharp, this pace has now cooled: OPEX growth peaked in 2023 at 8.6% year-over-year but has since slowed to a multi-year low. For context, typical pre-pandemic growth between 2015 and 2019 averaged just 3.5%.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

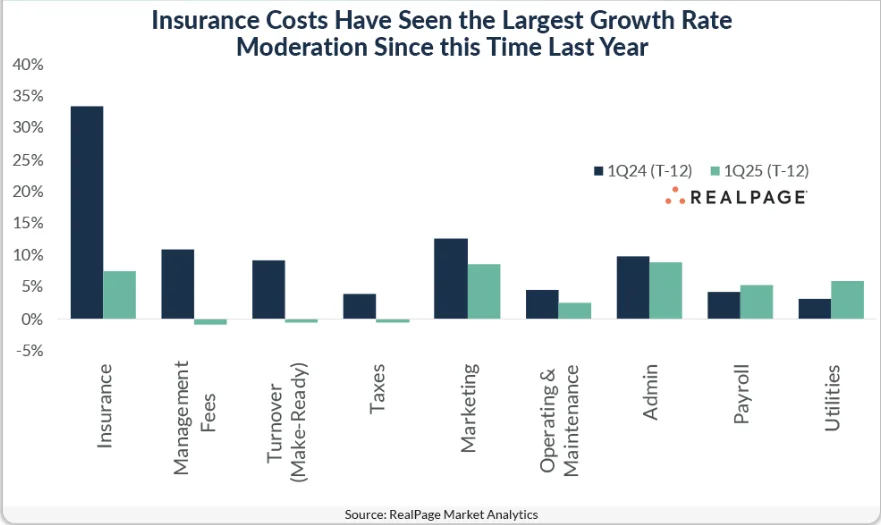

Biggest Cost Relief: Insurance And Taxes

Among the nine operational expense categories tracked by RealPage Market Analytics, seven recorded slower growth over the past year.

- Insurance costs, which ballooned by 33.5% in early 2024, dropped to just over 7% annualized growth by Q1 2025.

- Property taxes, a major budget line item accounting for about 30% of total operating costs, fell 50 basis points year-over-year. This follows average annual growth of nearly 4% just a year ago.

Only utilities and payroll costs continued to climb, albeit at a more tempered rate.

Regional Breakdown

Expense moderation wasn’t isolated to one area—it spanned the country. In fact, two-thirds of US regions saw annual growth in Q1 2025 fall below their five-year pre-pandemic averages.

- Texas led the nation with the smallest year-over-year change in multifamily expenses—just 15 basis points.

- Florida followed closely, registering sub-1% growth and the largest year-over-year drop in pace (down 10 percentage points).

Why It Matters

The deceleration in expense growth could offer operators some breathing room as they navigate persistent cost pressures. With expense inflation easing, asset managers may find it easier to balance operational budgets without sacrificing performance.

What’s New

While 2025 has brought some short-term relief, questions loom about how sustainable the moderation will be. Ongoing macroeconomic uncertainty—including inflationary risks, interest rate policy, and potential new tariffs—could reignite cost pressures in the coming quarters.

For now, the data signals cautious optimism—but operators should remain vigilant.