- Hotel operating costs rose faster than revenue in 2024, reducing profit margins and challenging financial sustainability in 2025.

- Labor remains the largest and fastest-growing expense, requiring tighter oversight, cross-utilization, and productivity tracking.

- Guest service and loyalty-related costs are rising sharply, driven by third-party bookings and brand standards.

- Owners and operators must evaluate tech investments, renegotiate contracts, and focus on right-sizing operations to control expenses.

Margins Under Pressure

According to CBRE’s February 2025 Hotel Horizons® forecast, hotel profit margins continued to shrink in 2024 and are expected to decline further in 2025. A combination of slow revenue growth and surging costs—both operational and ownership-related—are driving this trend across all major property types.

Expense Growth Exceeds Revenue

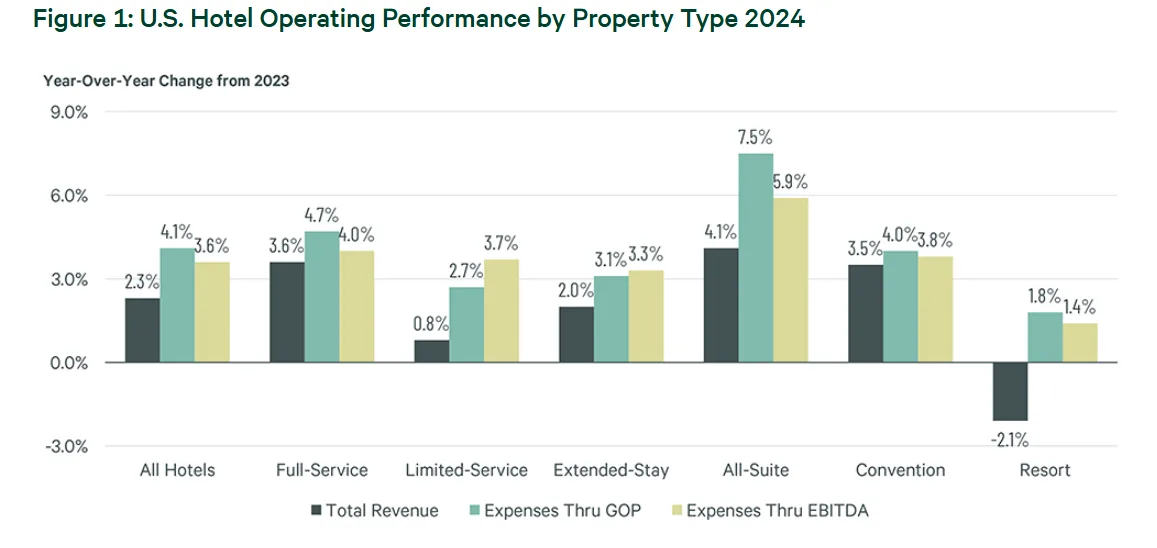

Expenses above GOP rose 4.1% in 2024, while expenses below GOP grew by 3.6%—both outpacing total hotel revenue growth of just 2.3%. This dynamic hit full-service properties hardest, while limited-service and extended-stay hotels fared slightly better.

Departments Facing Cost Pressures

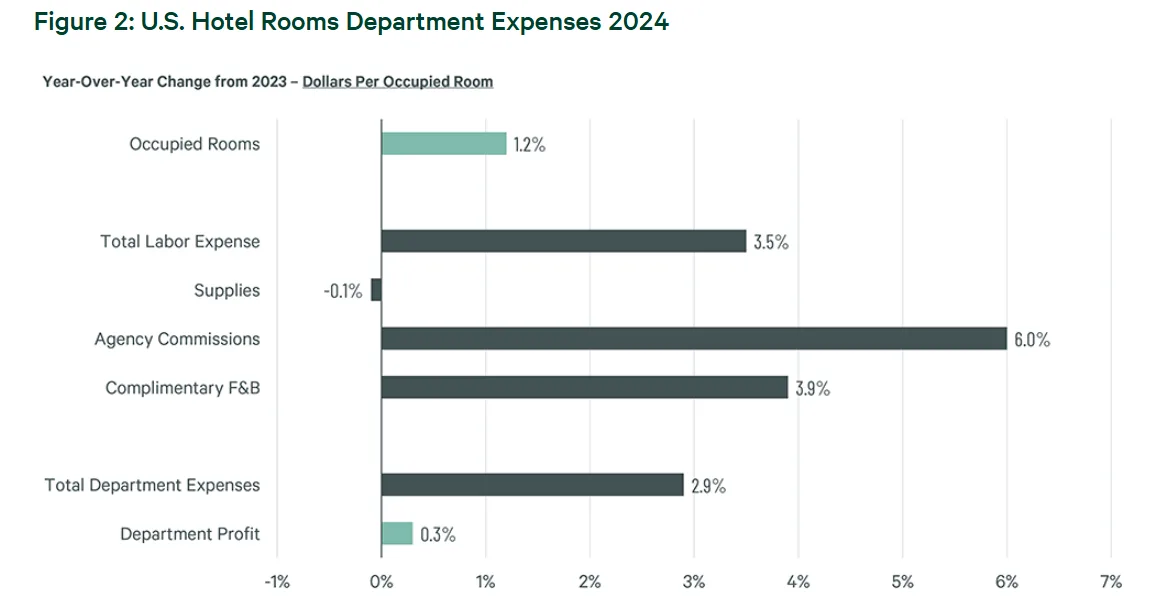

- Rooms: Agency commissions rose 6.0%, driven by increased third-party bookings. Complimentary food and beverage costs climbed 3.9%, tied to loyalty program demands and brand standards.

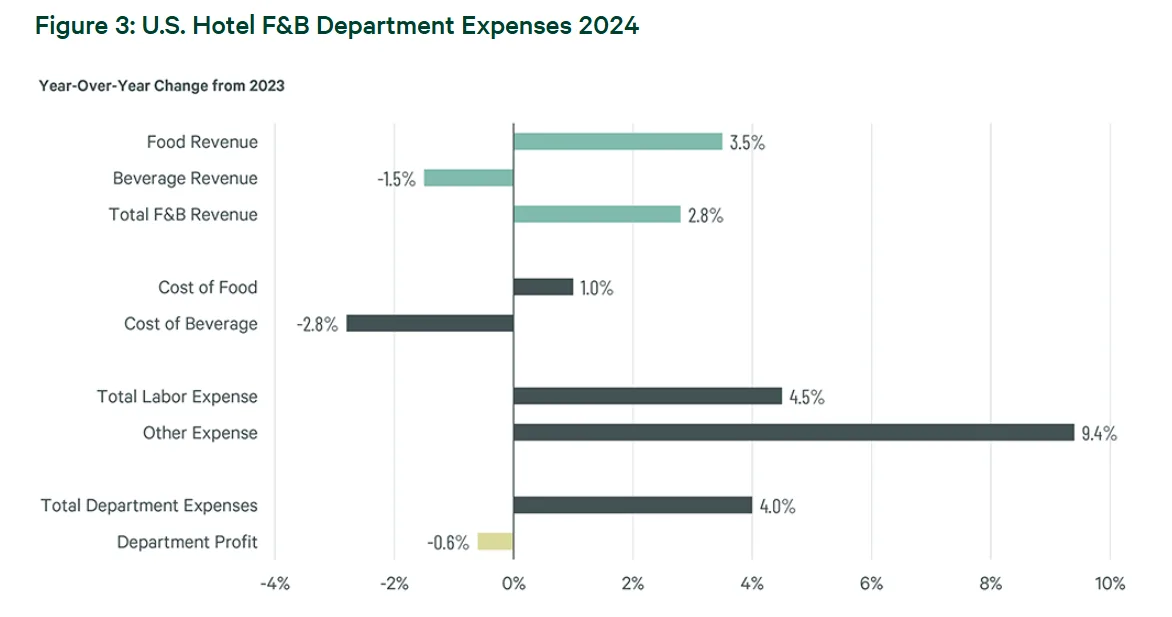

- F&B: Despite a 2.3% decline in food and beverage purchases, labor (+4.5%) and supplies (+9.4%) drove cost increases, especially as group business returned with buffet-heavy offerings.

- Undistributed Expenses: Credit card commissions rose by 4.4% and franchise-related fees climbed 3.9%, both outpacing revenue growth. Technology and IT expenses jumped 5.1%, largely due to new system implementations. Maintenance costs also increased by 5.0%, driven by higher labor and supply costs, as well as deferred capital expenditures. One bright spot in the data was utility costs, which saw a more modest rise of just 2.0%.

A Persistent Challenge

Labor, the single largest cost driver, rose 4.8% in 2024. Operators are paying 22.1% more than in 2019 for 7.4% fewer hours worked. Contract labor and understaffing have driven inefficiencies, directly pressuring hotel profit margins. This has prompted asset managers to call for detailed position-by-position reviews and cross-utilization of staff to enhance productivity and financial performance.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Inflation Bites Hard

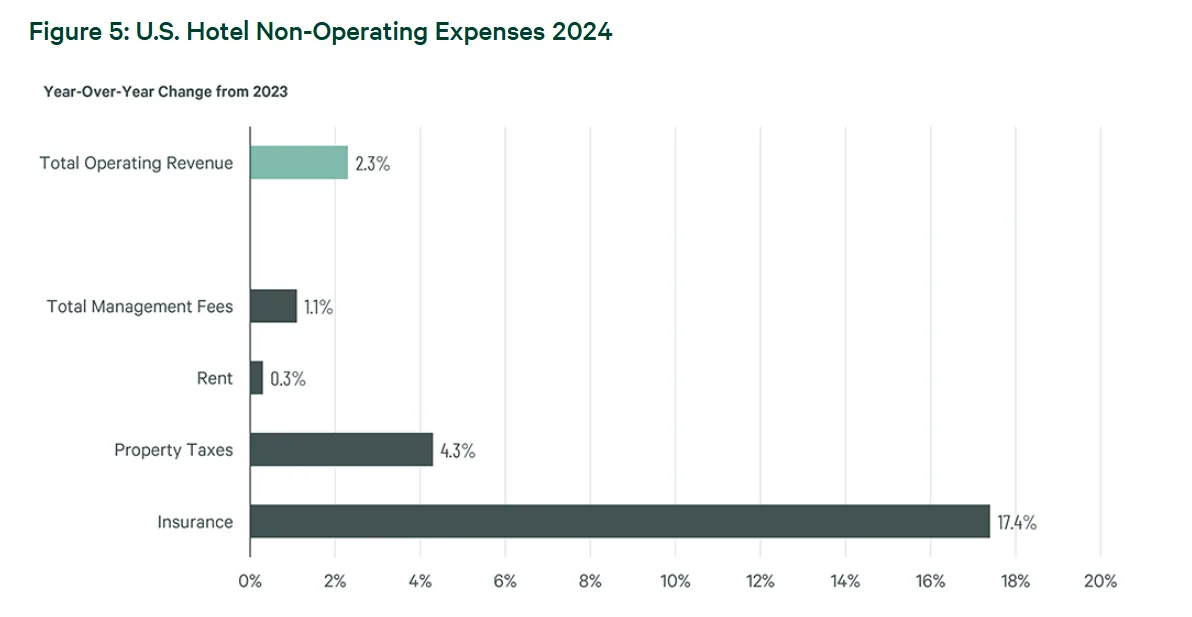

Owners also face rising below-GOP costs:

- Insurance premiums jumped 17.4%, continuing a multi-year trend of double-digit increases.

- Property taxes increased 4.3% as municipalities seek post-COVID revenue.

- Management fees grew just 1.1%, and fewer operators qualified for incentive-based compensation.

A Call to Action

To maintain sustainable hotel profit margins, CBRE Asset Management offers targeted strategies:

- Labor: Oversight must intensify. Evaluate labor productivity by shift, position, and manager ratios. Prioritize cross-utilization and right-size operations.

- Guest Service Costs: Commissions and loyalty perks must be scrutinized. Prioritize genuine service delivery over costly gifts and freebies.

- Corporate Resources: Use brand-level buying power to secure better terms on contracts, supplies, and labor.

- Technology: Treat IT as capex. All investments must be justified by measurable returns and replace outdated systems.

What to Watch in 2025

The path forward involves more than cost-cutting. The goal is to adopt smarter business practices—eliminating waste, improving labor efficiency, and restoring hotel profit margins to sustainable levels in an increasingly expensive operating environment.