- Office recovery gained momentum in April 2025, marking the third-busiest month since the pandemic, with visits down just 30.7% from April 2019.

- New York City and Miami led the RTO surge, with NYC nearly matching pre-pandemic levels and midweek attendance surpassing 2019 figures.rn

- Hybrid work patterns remain strong, with Tuesdays and Wednesdays seeing the highest traffic, while Fridays continue to lag.rn

- San Francisco posted the highest year-over-year growth, signaling tech-sector mandates may be driving a localized office rebound.rn

A Stronger-Than-Expected April

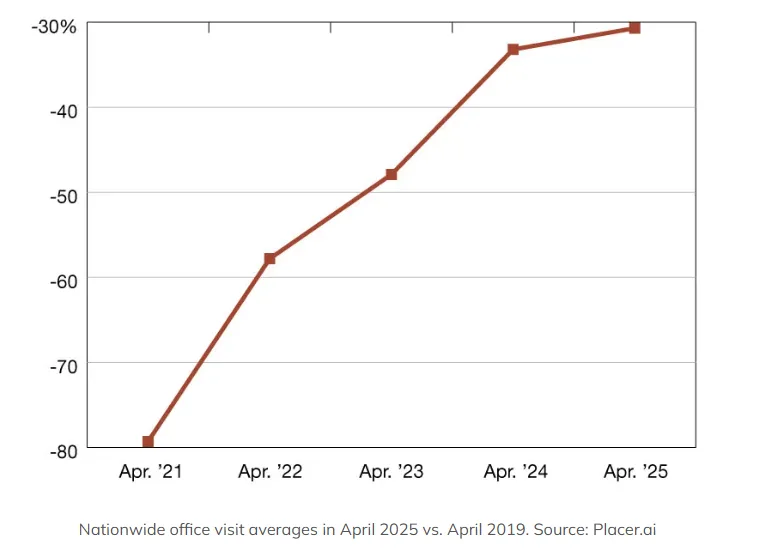

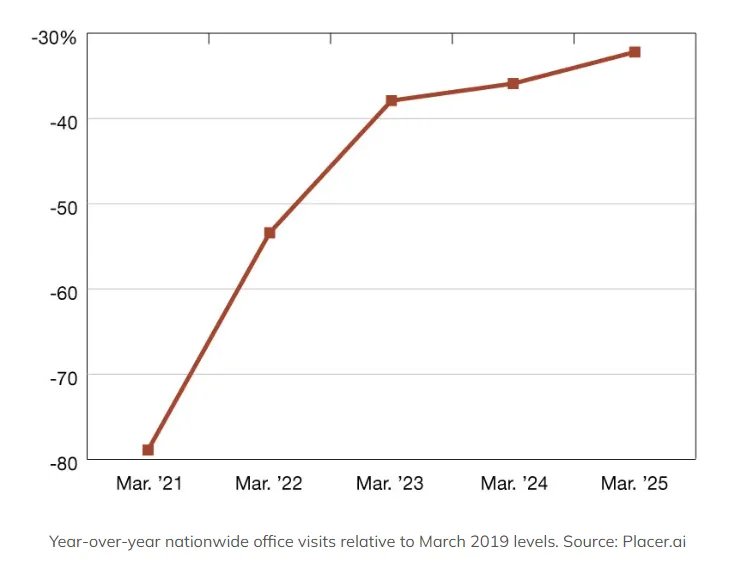

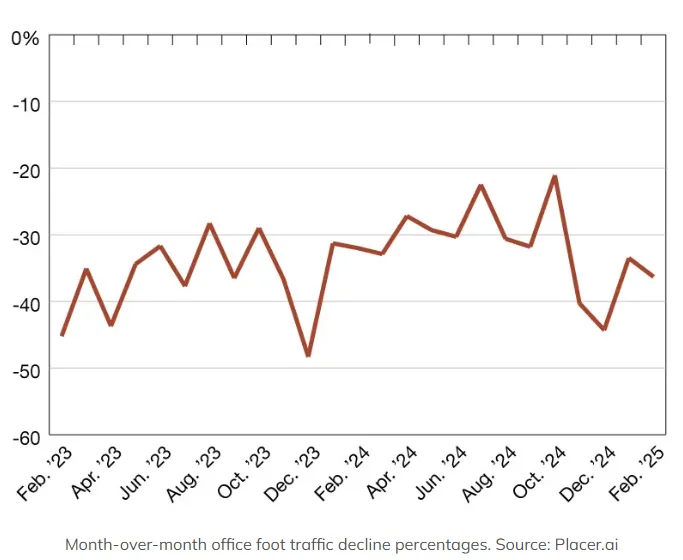

The Placer.ai Nationwide Office Index shows April 2025 as the third-strongest month for office recovery and attendance since the pandemic began, trailing only October and July 2024, reports Commercial Search. Visits were just 30.7% below April 2019 levels—an encouraging jump from April 2024. Notably, this improvement came despite Easter falling in April this year (vs. March in 2024), a holiday that typically reduces office visits due to extended weekends.

New York Leads The Recovery

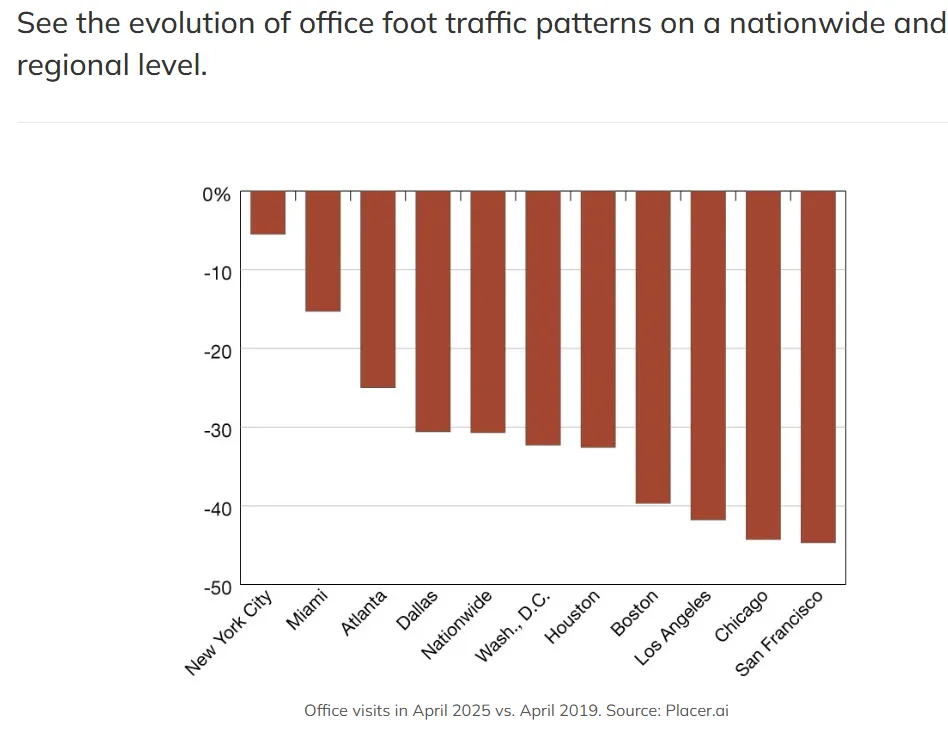

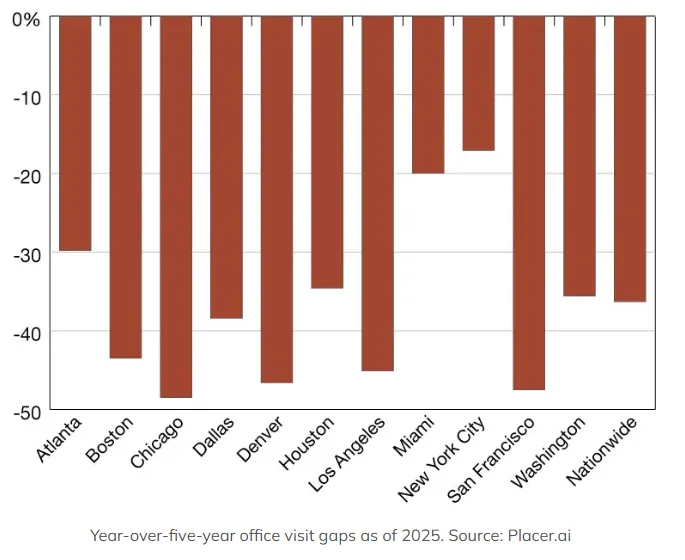

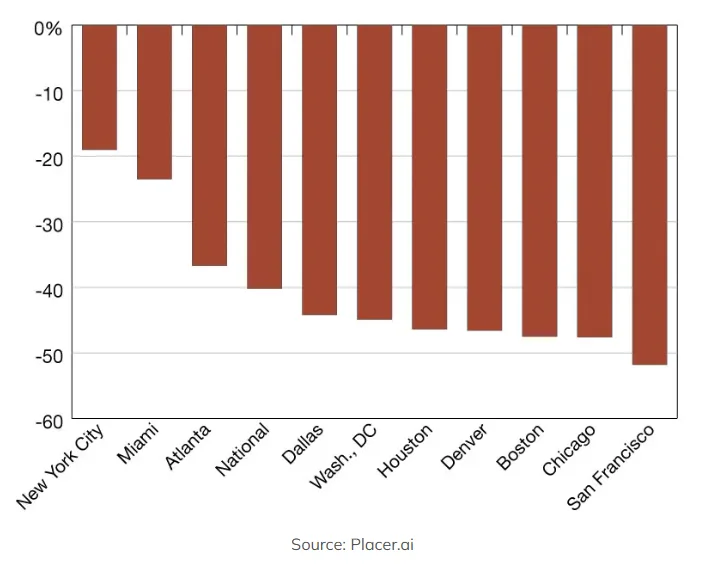

Zooming in on major business hubs reveals New York City maintaining its frontrunner status in the return-to-office (RTO) race. Office visits were just 5.5% below 2019 levels, signaling a near-full recovery. Miami wasn’t far behind, with visits trailing April 2019 by just 15.3%. Dallas and Atlanta also outperformed the national average, while Chicago and San Francisco remained laggards.

Midweek Is The New Peak

Office visitation patterns reflect a clear hybrid trend. Nationwide, midweek days saw the strongest recovery. In NYC, Tuesdays and Wednesdays were actually busier than during the same period in 2019, while Thursdays nearly matched pre-pandemic traffic. Fridays and Mondays continue to lag. Miami saw similar midweek peaks—but its Fridays fared better than New York’s, reflecting local work culture dynamics.

San Francisco Rebounds On Tech RTO Push

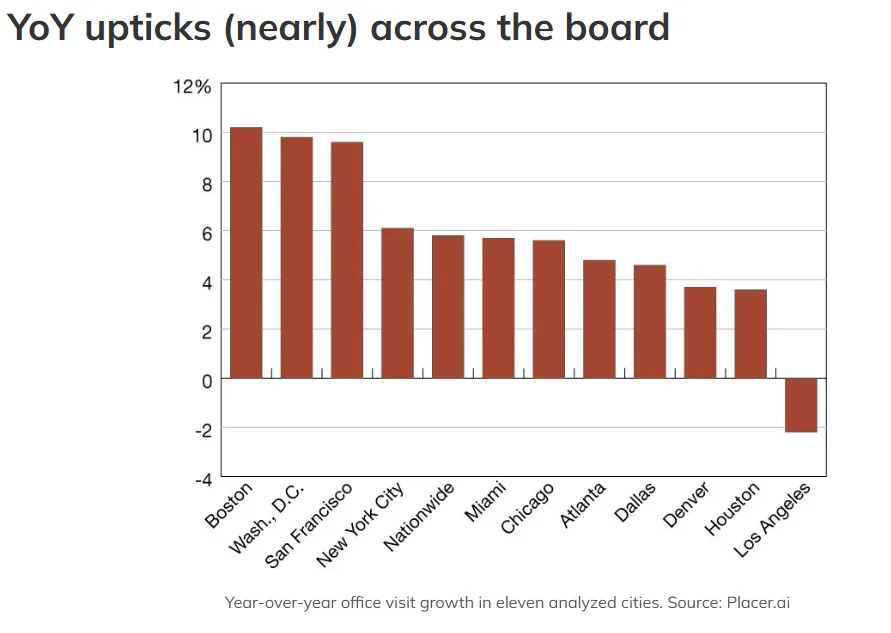

Despite trailing in overall office recovery, San Francisco recorded the highest year-over-year growth in April, signaling that RTO mandates across the tech sector may finally be moving the needle. Boston followed closely with a 7.4% annual increase. Other metros generally saw year-over-year improvements, with the exception of Los Angeles and Houston, which posted modest declines.

What It Means

After a sluggish start to 2025, the office market appears to be regaining momentum. The combination of stricter mandates—from JPMorgan’s five-day policy to government-led RTO efforts—and improved weather conditions likely fueled the March–April office recovery. And as cities like NYC and Miami approach full office recovery, new data suggests that flexible work patterns are here to stay—but so is the slow, steady climb back to the office.

What’s Next

If April’s numbers are any indication, the RTO momentum could continue to build heading into the summer months. With hybrid workdays becoming more structured and mandates increasing, May and June may offer the clearest picture yet of what post-pandemic office life really looks like.