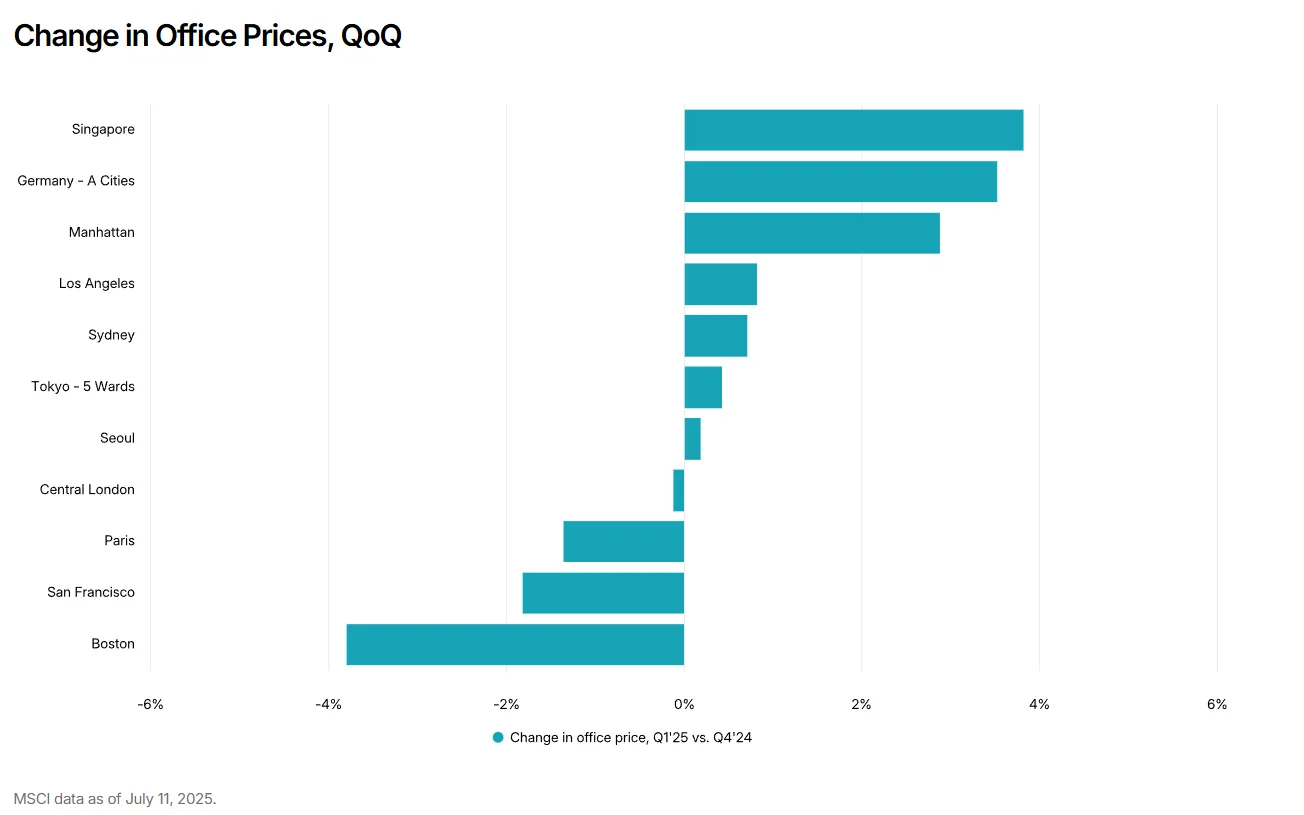

- The global office sector is beginning to show signs of stabilization after years of decline, but the recovery remains fragmented and asset-specific.

- Major investors like Blackstone and Norges Bank Investment Management are returning to the market, targeting high-quality assets in global gateway cities.

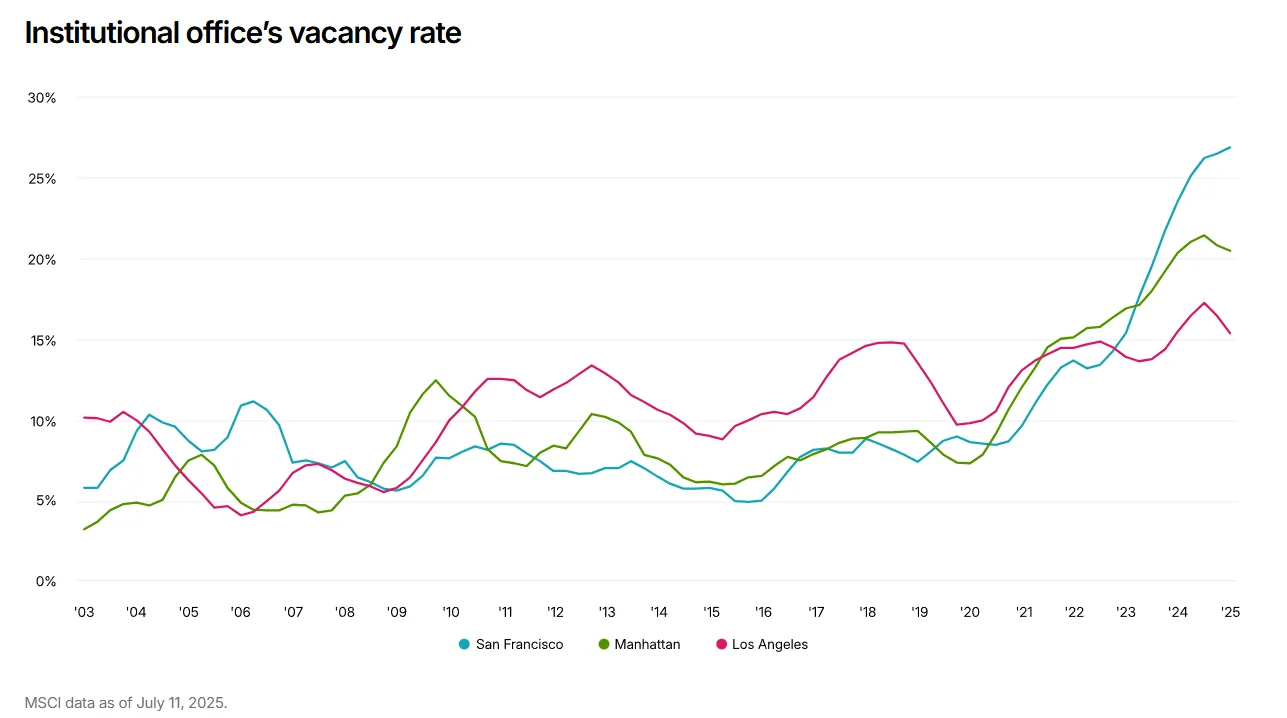

- Outdated and underperforming office buildings face significant challenges, with many at risk of becoming stranded assets unless upgraded or repurposed.

A Long-Awaited Turning Point

Office markets globally have faced a prolonged correction since the pandemic disrupted work patterns and occupancy levels, reports MSCI. Now, early 2025 data indicates the sector may be stabilizing—albeit unevenly. Leading institutional investors are cautiously reentering the market, suggesting confidence in a selective rebound.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

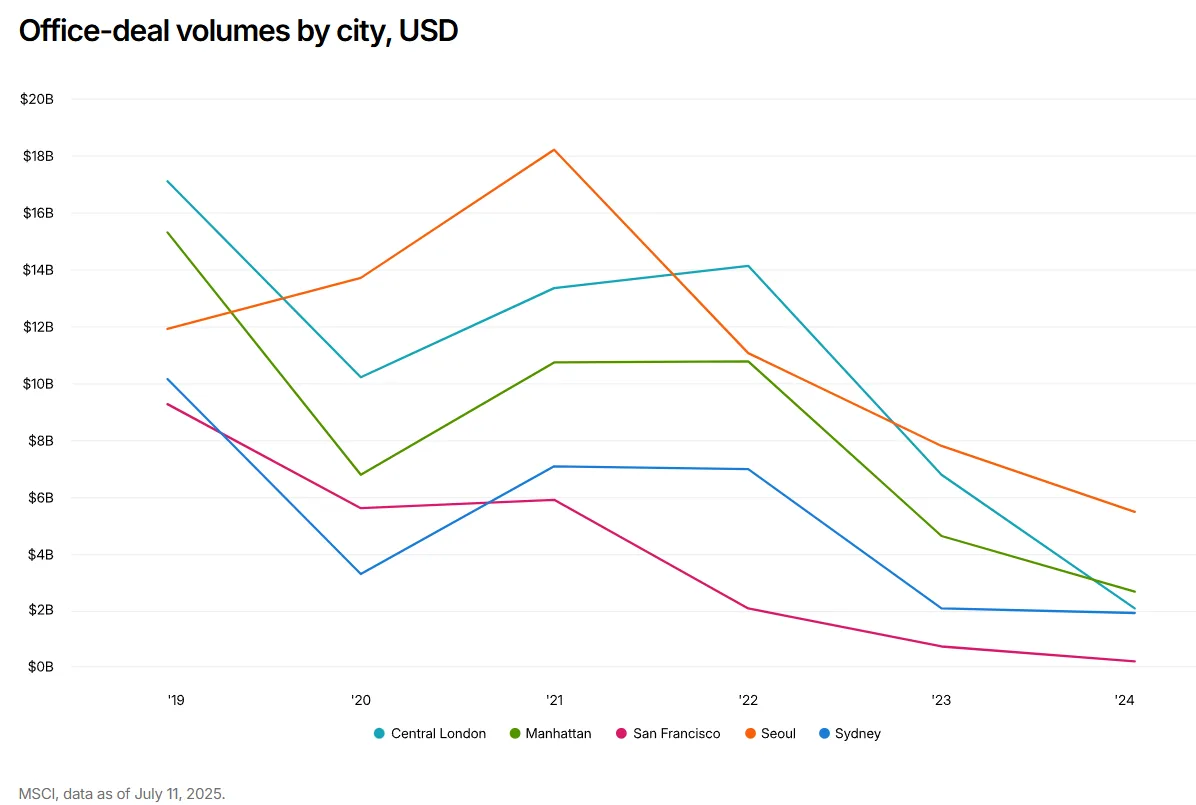

Capital Coming Back—Selectively

Blackstone has deployed nearly $4B in global office deals this year, including a $2.6B acquisition in Tokyo and assets in New York and Washington, DC. Norges Bank has also made substantial investments, acquiring offices in Boston, San Francisco, and Paris. These moves are focused on prime assets in resilient urban centers, signaling a bifurcated recovery.

Tenants Are Returning—But Not Everywhere

Office usage is rebounding in places like London and Manhattan, where Q4 2024 leasing volumes exceeded long-term averages. Asia-Pacific cities are nearing pre-COVID norms. However, North American and European markets still see elevated vacancy rates. Corporate mandates from Amazon and JPMorgan are helping drive occupancy, though hybrid work models remain dominant.

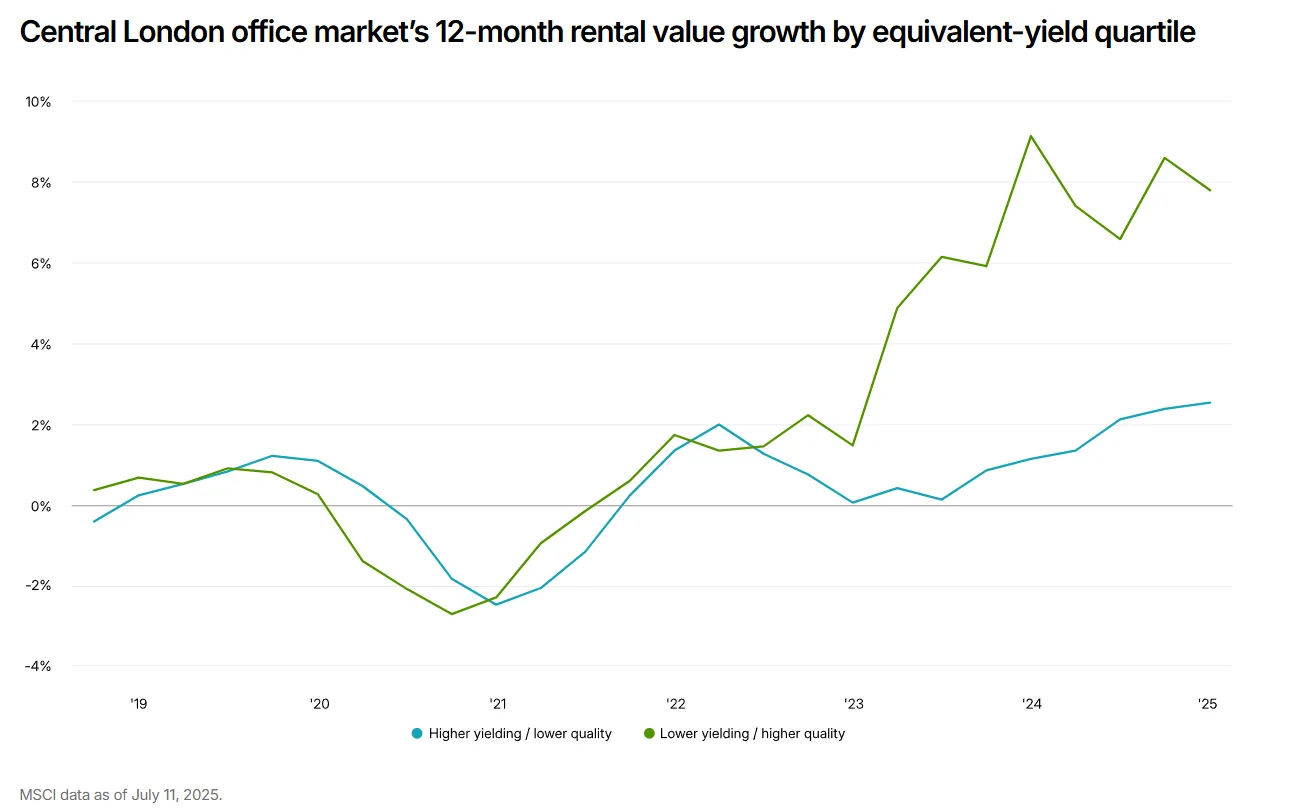

The Asset Divide Widens

Tenants are actively leasing offices that offer strong ESG credentials and flexible, employee-friendly designs. Investors and occupiers are increasingly treating aging or poorly located buildings as liabilities. They’re steering clear of commodity office space, often opting to redevelop or convert these properties for alternative uses.

Development And Redevelopment Bets Rise

With prime assets scarce, investors are moving up the risk curve. In London, IJM Corp. acquired 25 Finsbury Circus for $91M, planning a $190M renovation. In San Francisco, DivcoWest and Blackstone are redeveloping 199 Fremont into a tech-focused workplace, betting on future tenant demand.

Why It Matters

Office isn’t obsolete—but it’s not what it used to be. Asset selection, not just sector exposure, will define outperformance in the next cycle. Investors who adapt to shifting tenant expectations and ESG demands will benefit, while others risk holding stranded assets.

What’s Next

Expect more capital targeting top-tier, sustainable assets and redevelopment opportunities. Poorly located or obsolete buildings will face pressure to convert or exit the market altogether. In an era of slower growth and higher rates, precision—not scale—will be key to navigating the office sector’s evolving playbook.