- BXP CEO Owen Thomas believes the office sector hit its bottom in 2024, as vacancy rates begin to decline and leasing activity picks up, particularly in premier properties.

- The market remains sharply divided between high-end office space—where demand and rents are holding—and lower-tier properties that continue to underperform.

- Despite the rise in office-to-residential conversions, Thomas says many outdated buildings will ultimately need to be demolished rather than repurposed.

A Turnaround—For Some

According to Owen Thomas, CEO of BXP (formerly Boston Properties), the worst of the office market downturn is over, reports CNBC. In an optimistic outlook, Thomas pointed to falling vacancy rates and a resurgence in leasing, especially from financial and tech firms, as signs that the sector bottomed out in 2024.

CBRE data supports this cautious optimism. The overall office vacancy rate dropped 20 basis points in Q3 to 18.8%, marking the first annual decline since the pandemic began.

Flight To Quality

BXP, the largest US office REIT, focuses on premier buildings leased mainly to financial and legal sector tenants. Thomas said these “top 10%” assets are seeing stronger demand and command 55% higher rents, with vacancies as low as 11% in BXP’s markets.

“There’s a clear bifurcation,” he said, between premier buildings and everything else. Many landlords are upgrading lower-tier properties with better amenities and lower rates. Still, the long-term outlook for aging buildings remains dim.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Demolitions, Not Just Conversions

New York has become a model for office-to-residential conversions, supported by high rents and new tax incentives. Thomas stressed that conversions alone won’t fix the oversupply problem.

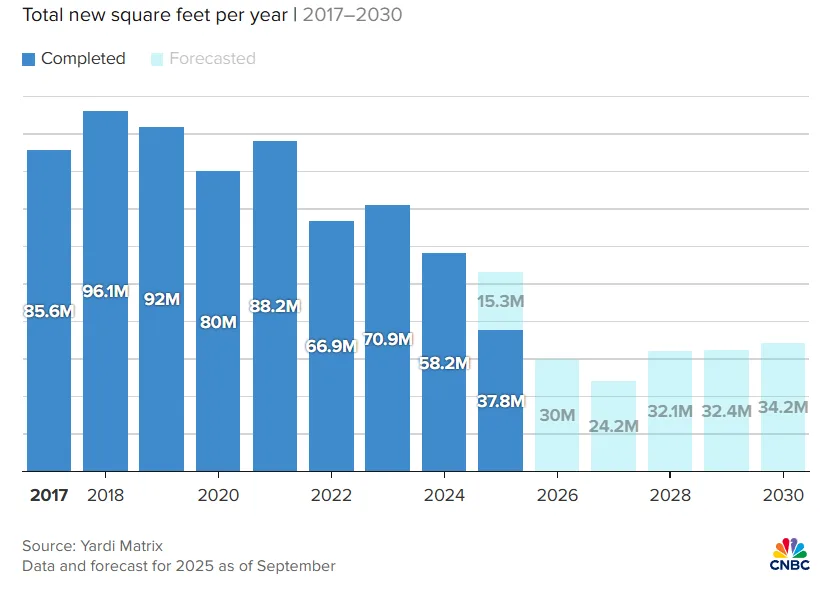

“The office market overall is overbuilt,” he said. “There are going to be buildings that are demolished and made into something else.” BXP itself is involved in some suburban teardown projects and continues to prioritize new development over acquiring distressed assets.

What’s Ahead

BXP is doubling down on ground-up projects, recently launching a $2B development at 343 Madison Avenue in Manhattan. The firm sees better long-term returns in building new rather than acquiring existing properties, even those at discounted prices.

As for local politics, Thomas expressed cautious optimism about New York City’s future under Mayor-elect Zohran Mamdani, particularly regarding housing and public safety.

Why It Matters

Despite growing investor interest and improving fundamentals in top-tier assets, much of the US office inventory remains obsolete. With conversions limited, demolition and redevelopment will increasingly reshape the post-pandemic office market.