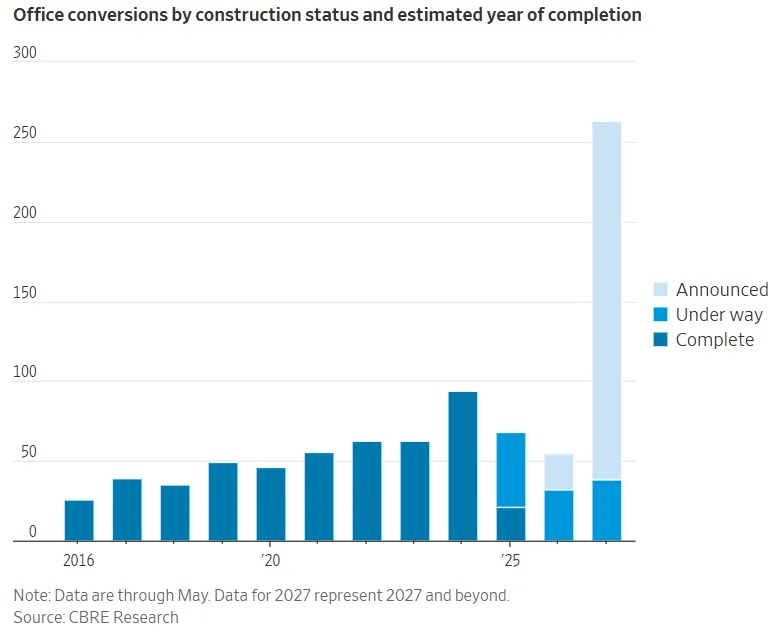

- US office supply is projected to contract in 2025 for the first time in over two decades due to increased demolitions and residential conversions.rn

- Lower office building prices and new government incentives are accelerating conversions, breathing new life into underused urban areas.

- Despite the reduced supply, vacancy rates remain high, though signs of recovery are emerging in leasing activity and investor interest.rn

The Tide Is Turning

After years of grappling with an oversupply of office buildings, the US real estate sector is seeing a long-awaited shif, reports WSJ. According to CBRE, office inventory is on track to decline in 2025—marking the first annual contraction in a quarter-century. The change is driven by a combination of building demolitions, fewer new developments, and an uptick in conversions to residential use.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why Now?

Falling office values, more flexible zoning regulations, and generous government incentives are making conversions more financially viable. Office space that once sat vacant is being reimagined as much-needed housing. In New York City, up to 40M SF of office space could be converted in the next decade—double earlier projections.

Projects like RXR’s conversion of 5 Times Square into 1,250 apartments (with 313 affordable units) are leading the trend. That project benefitted from a 90% tax abatement and building acquisition costs that were 40% below pre-pandemic values.

A Slow But Meaningful Shift

Nationwide, the office market is on track to lose 23.2M SF of space this year, while only 12.7M SF of new office inventory is expected to come online—just a quarter of 2019 levels.

Although this won’t eliminate the glut overnight, it represents a significant correction. Many expect this trend to revitalize struggling business districts by bringing in residents and retail.

Challenges Remain

Despite the contraction, office vacancy rates remain stubbornly high at 19%. Many landlords still face delinquent mortgages and can’t afford the costly upgrades today’s tenants demand.

Yet there are signs of optimism. Leasing activity is rebounding, and more tenants are looking to expand. In Q2, 40% of prospective tenants were in growth mode, up from 33% in earlier quarters.

Investors Re-engage

Institutional investors are starting to come off the sidelines. Blackstone recently bought a 46% stake in a Midtown Manhattan office tower valued at $1.4B—its first major US office play since 2022. The firm cited limited new supply and stable demand as key reasons for the bet.

Looking Ahead

While a full-scale recovery is still out of reach, the current shift represents the first meaningful rebalancing of the US office market in a generation. If conversions continue at this pace, and demand gradually returns, the office sector may find a new, leaner equilibrium in the years ahead.