- Despite growing concerns over commercial real estate, at least eight US regional banks reported improved CRE loan performance in Q3 2025, with lower non-performing loan rates year-over-year.

- Office loans remain a major concern, with delinquencies reaching nearly 12% and vacancy rates climbing beyond levels seen during the global financial crisis.

- Some regional banks are trimming office loan exposure while cautiously re-entering CRE lending—office loan originations rose 181% year-over-year in Q3, showing the sector’s complex dual nature.

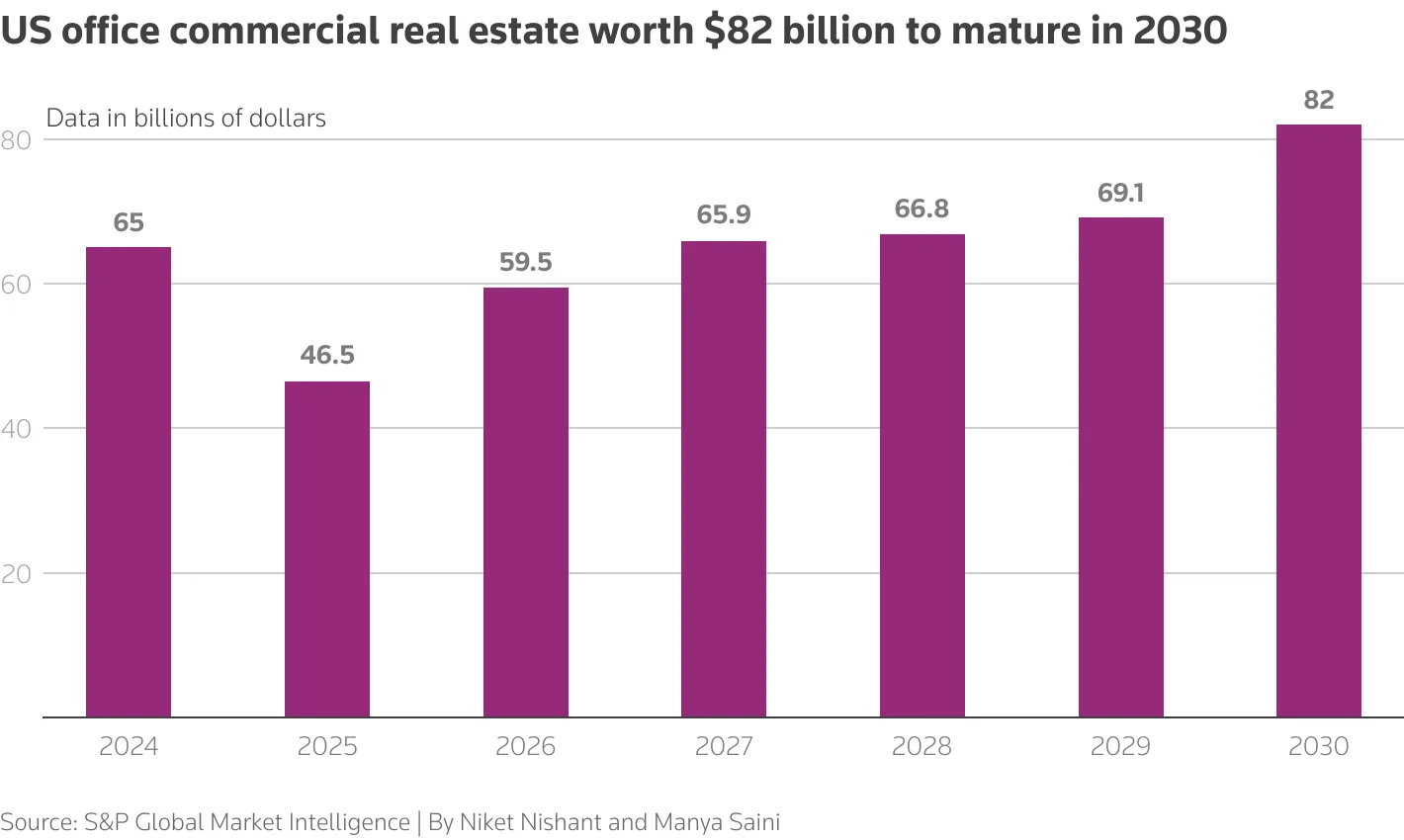

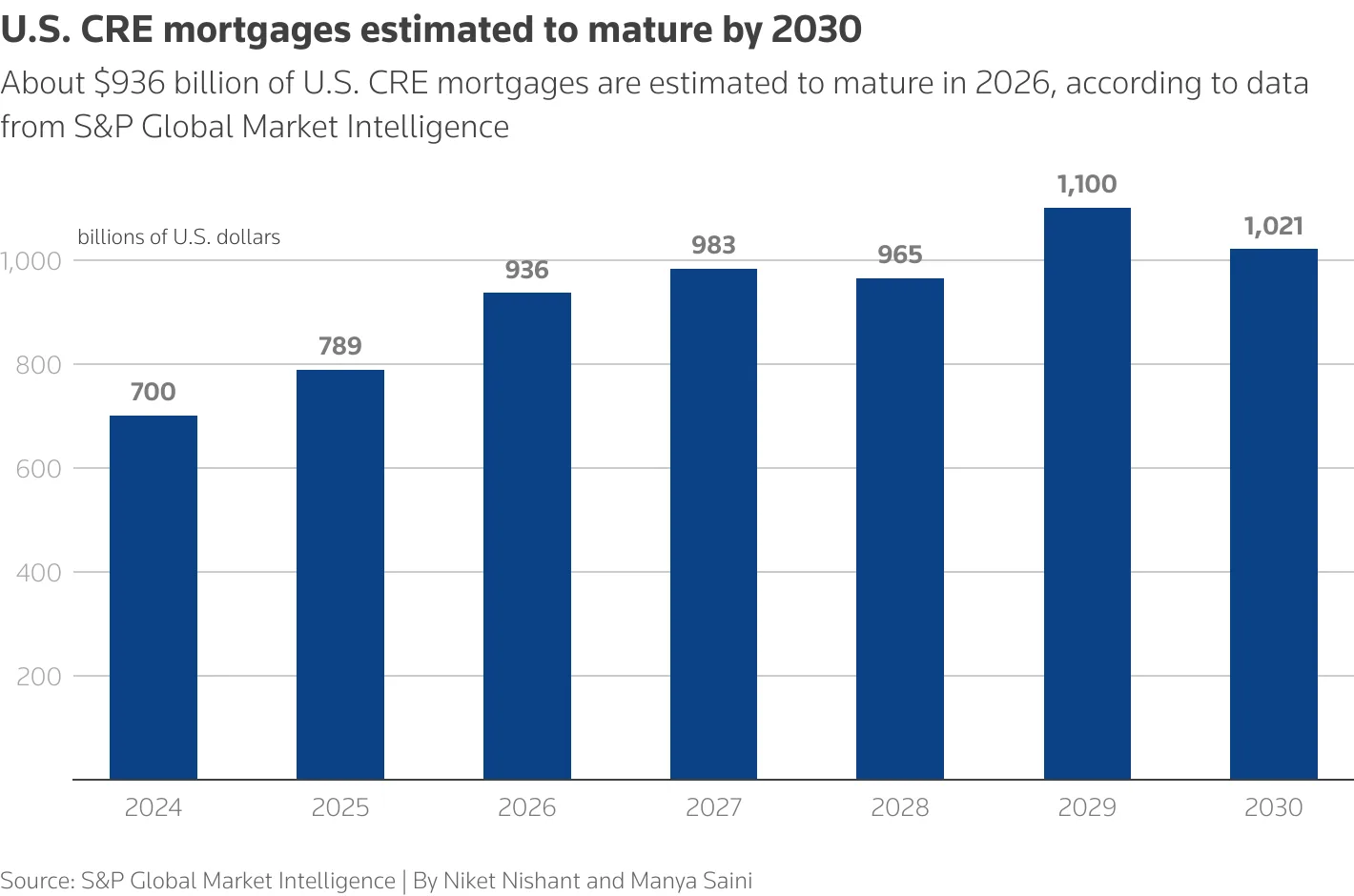

- Analysts expect loan-loss provisions to rise in 2026, with pressure mounting as nearly $1 trillion in CRE loans mature in 2026—one-fifth of which are office-related.

A Resilient Front

Regional and mid-sized US banks are showing unexpected strength in managing their commercial real estate portfolios. A Reuters review of Q3 2025 earnings reports from eight institutions found falling rates of non-performing CRE loans compared to the previous year—an encouraging sign after months of industry anxiety.

Notably, banks like Flagstar, M&T, Citizens Financial, and Regions Financial reported improved credit performance or continued de-risking of their office loan books. For example, Flagstar Bank—still recovering from its predecessor’s CRE-related turmoil—cut its office loan loss allowance by 142 basis points last quarter.

Office Space: Still the Weak Link

Despite broader CRE stability, the office sector remains an industry-wide burden. Office vacancy rates have surpassed post-financial crisis levels, and 11.76% of office loans are now delinquent, according to Trepp. Thomas Mason of S&P Global said the office market has not fully adjusted to structural shifts in work habits: “We definitely haven’t worked through all of the office issues.”

Several banks—M&T, Regions, and Citizens Financial among them—are actively reducing exposure to office real estate. Citizens, for instance, reported a modest decline in its office loan balance to $2.5B, maintaining a reserve coverage of 12.4%.

A Surprising Surge in Originations

While banks are trimming office exposure, new lending in the sector is increasing. Data from the Mortgage Bankers Association shows total CRE originations rose 36% year-over-year in Q3, with office originations spiking 181%. This counterintuitive trend reflects ongoing investor appetite and developer needs, despite lingering market uncertainty.

Still, financing terms remain tight. New CRE loans in 2025 are being issued with average rates of 6.24%, up from 4.76% on maturing loans, as Fed rate cuts take time to filter into the market.

The Road Ahead

With $936B in US CRE mortgages set to mature in 2026—up 18.6% from 2025—and maturities peaking at $1.1 trillion in 2029, stress on banks is likely to intensify. S&P Global projects loan-loss provisions could rise to 24% of net revenue in 2026, up from 20.8% this year.

Even beyond office, other property types are starting to show strain. Life sciences real estate, once seen as resilient, is facing higher vacancies and tighter capital as biotech funding dries up.

Why It Matters

The mixed signals in CRE—stabilizing portfolios, soaring originations, and persistent office stress—underscore the complexity facing regional banks. While the worst fears of a CRE-driven banking crisis have not materialized, the office sector remains a long-term challenge, with broader implications for bank risk management and lending strategy.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes