- Miami office leasing hit 502K SF in Q3 2025, pushing year-to-date activity to 99% of 2024’s total, per CBRE.

- While leasing is up, rent growth has slowed due to a lack of new premium supply and elevated pricing, especially in Brickell.

- Direct vacancy sits at 14.9% citywide, but some submarkets, like Coconut Grove and Aventura, remain highly constrained.

- With no major new office deliveries expected until 2030, brokers anticipate sustained demand and elevated rents into 2026.

Momentum Rebounds

Miami’s office leasing market had a rocky start to the year, driven by macroeconomic jitters, reports Bisnow. Tariff-related uncertainty added to the slowdown. However, the market bounced back sharply in the third quarter. Leasing volume jumped to 502K SF, more than 200K SF higher than Q2, and nearly identical to all of 2024’s activity, according to CBRE.

“This summer wasn’t the time to take a vacation,” said CBRE’s Randy Carballo.

Leasing Picks Up Pace

Early-year deals that were delayed by political and economic turbulence finally closed in the third quarter as companies gained more confidence. Blanca Commercial Real Estate reported total leasing activity—including renewals—at 951K SF for Q3, up 23% above the five-year average.

Still, absorption remains modest: Net absorption was just 11K SF in Q2, down from 22K SF in Q1, as high rents in premier submarkets led some tenants to relocate.

Rents Steady, But Still High

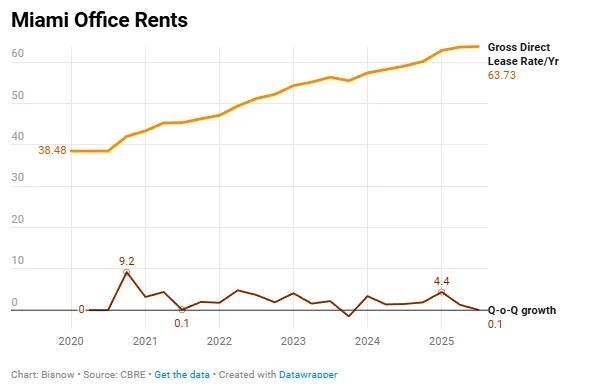

Miami’s overall asking rent increased just 0.1% from Q2 to $63.73 per SF but remains nearly 7% higher than a year ago. Brickell leads the market with average asking rents nearing $93 PSF. This has pushed demand toward more affordable areas. Tenants are increasingly looking at Coral Gables, Doral, and the airport submarket for better value.

Despite the deceleration, Miami is still among the nation’s priciest office markets—rents have surged 66% over the past five years.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Limited Space, Limited Supply

Direct vacancy sits at 14.9% citywide, but it’s significantly lower in key pockets:

- Brickell: 13.4%

- Aventura: 7.9%

- Coconut Grove: just 3.1% of its 1.2M SF is vacant

With only 772K SF currently under construction and no significant new deliveries expected until 2030, tight supply is expected to keep prices elevated.

“I don’t think we’re seeing another 66% rent hike in the next five years,” Carballo noted, “but I do think there’s still room to grow.”

Big Leases, Local Moves

The quarter’s largest deal was Stearns Weaver Miller’s 97K SF lease at Museum Tower in Downtown Miami. ADP signed the second-largest lease, taking 78K SF at the Miami Waterford Business District.

Corporate relocations continue, too—Playboy signed a 26K SF lease to move its headquarters to Rivani Miami Beach. However, much of the momentum was driven by local companies shifting to more affordable areas.

Submarket leasing share in Q3:

- Airport/Doral: 28%

- Downtown Miami: 27%

- Brickell: 13%

Looking Ahead

Even as a government shutdown adds economic risk, brokers are optimistic Q4 will keep pace with Q3’s strong activity.

“A very odd time,” said Blanca’s Danet Linares. “The fundamentals are shot. I don’t know what’s happening, but people just seem to be playing along and continuing.”