- The technology and higher education sectors are leading the charge in D.C.’s new-to-market office leasing activity, contributing to a projected 474K SF of occupancy gains.

- Companies like ServiceNow, SpaceX, CoreWeave, and OpenAI expanded or entered the D.C. market in 2025, seeking proximity to federal policymakers and defense-related opportunities.

- Out-of-town universities such as the University of Michigan and UNC Chapel Hill are establishing satellite offices, contributing to the city’s leasing momentum.

- These smaller but frequent deals are adding meaningful absorption and setting the stage for long-term expansion across both sectors.

A Resilient Recovery

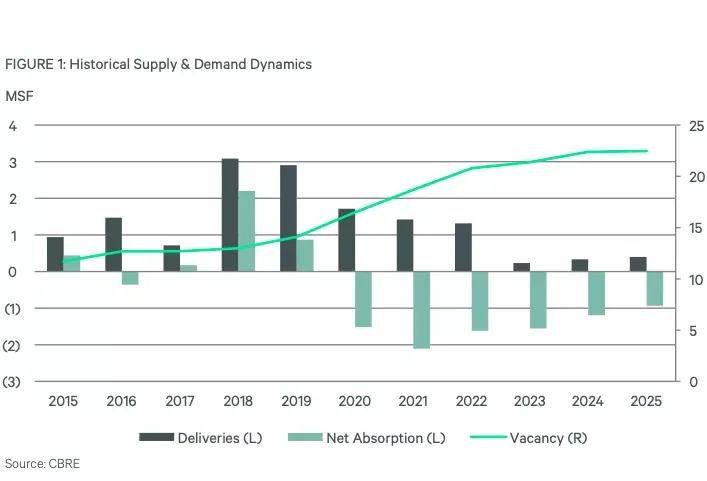

After a rocky 2025 marked by political unrest and federal budget cuts, Washington, D.C.’s office market is showing signs of stability—and growth. According to Bisnow, the city is expected to add nearly half a million SF in occupancy gains in 2026, largely thanks to an influx of new-to-market tenants.

Vacancy rates have leveled off just above 20%, and leasing losses shrank compared to the previous year—positive signs for a market that’s been slow to attract fresh entrants.

Tech Enters the Capitol

Much of the new demand is coming from Silicon Valley players looking to bolster their presence near Capitol Hill. ServiceNow, CoreWeave, and OpenAI all signed new leases in 2025, ranging from 11K to over 22K SF, primarily to house government relations and policy teams.

SpaceX expanded its footprint, and Nvidia is reportedly searching for up to 30K SF of space in the city, underscoring a growing interest from AI and defense tech firms to be closer to federal stakeholders.

“There’s a real focus on nimble innovation in the defense sector,” said JLL’s Tammy Shoham, pointing to an expected rise in tech-led expansions through 2026.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Higher Education Finds a Home

Universities are also playing a key role in the city’s office revival. The University of Michigan and UNC Chapel Hill recently signed leases for roughly 11K SF each, adding to the more than 70 non-local universities with a presence in the District.

These institutions use their D.C. offices to host federal programs, support student internships, and maintain a lobbying presence.

“It does seem like every couple of months you hear about another school wanting to plant a flag here,” CBRE’s Emily Eppolito said.

Why It Matters

While individual leases may be modest in size, the combined impact of tech and education tenants is helping turn the tide in D.C.’s office market. Developers and brokers note that these sectors tend to grow with time, turning small footholds into larger, long-term commitments.

Shifts in university leasing behavior mirror broader national trends tied to changing enrollment patterns and institutional strategies, adding further significance to their presence in the D.C. market.

“It’s not always going to be a 50K SF lease,” said Lincoln Property Co.’s Tim Whitebread. “But you add five or 10 of them together, and you’ve got meaningful absorption.”

What’s Next

With early momentum in 2026 and a strong pipeline of interest from tech and higher education, D.C.’s office market is entering a new phase. As Shoham put it, “The fact that those are the two sectors that are growing so much has the potential to be exponential in a way that other sectors have not been.”

Expect further growth from both industries—especially as tech companies continue to scale their policy operations and universities seek a stronger foothold in the nation’s capital.