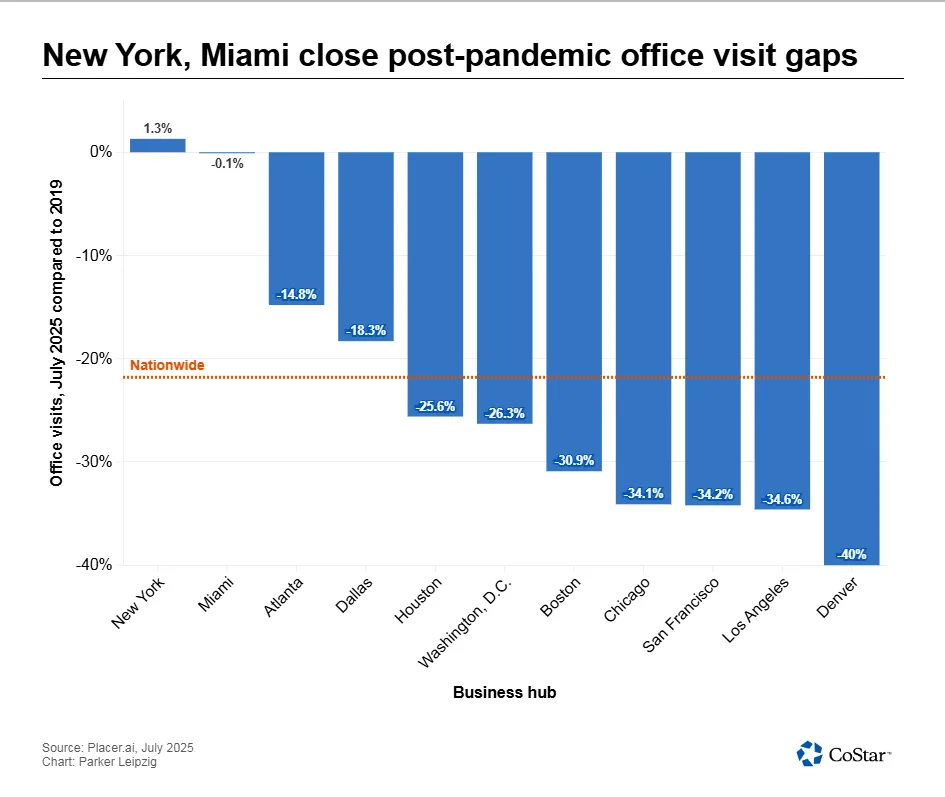

- New York office foot traffic in July 2025 was 1.3% higher than July 2019, marking the first major US city to exceed pre-pandemic levels since Placer.ai began tracking in 2020.

- Miami ranked second, with activity just 0.1% shy of 2019 levels, while other large cities such as Chicago, San Francisco, and Los Angeles saw declines of more than a third.

- Nationwide, office visits remain 21.8% below 2019 levels, but the gap is the smallest since the pandemic began, as Fortune 100 companies increasingly mandate full-time in-office work.

New York has officially closed—and slightly surpassed—its pandemic-era return-to-office gap, reports CoStar. July foot traffic in the city’s office buildings was 1.3% above the same month in 2019, according to Placer.ai. The research, which tracks anonymized visits to roughly 1K US commercial office properties, marks the first time any major city reached this milestone since 2020.

A First Among Big Cities

New York’s gain stands out among major office markets. Miami came close at just 0.1% below pre-pandemic levels. Cities like Atlanta and Dallas still lag by about 15% and 18%, respectively. Chicago, San Francisco, Los Angeles, and Denver trail by more than 33%.

The Details

Placer.ai attributes New York’s rebound in part to the city’s strong financial services sector. Stricter in-office mandates from employers like JPMorgan Chase, Citadel, Goldman Sachs, Amazon, and AT&T have also played a role. Nationwide, office foot traffic in July was down 21.8% from 2019, a notable improvement from earlier in the recovery.

Workplace Policy Shift

In the second quarter of 2025, 54% of Fortune 100 companies required full-time in-office work—up sharply from 5% in mid-2023—according to JLL. On average, employees were in the office 3.9 days per week, compared to 2.6 days in 2023. More firms are also monitoring attendance and enforcing compliance, CBRE found.

Leasing Momentum

The surge in attendance parallels strong leasing activity. Manhattan recorded 16.1M SF of new leases in the first half of 2025. This exceeded the annual first-half totals from 2016 to 2019, when leasing averaged about 15M SF. Vornado CEO Steven Roth recently described Manhattan as “the strongest real estate market in the country, and the strongest by far.”

Why It Matters

New York’s milestone signals a potential tipping point in the nationwide return-to-office trend. While hybrid work remains common, employers’ stricter policies appear to be boosting in-person attendance and, in some markets, strengthening leasing fundamentals.