- Manhattan’s struggling office market is driving a wave of profitable office-to-residential conversions, unlocking vital new housing supply.rn

- To qualify for tax incentives, 25% of apartments in these projects must be rent-stabilized—making them potentially subject to Mamdani’s proposed rent freeze.rn

- If implemented, the policy could undermine investor appetite and deal economics, threatening a rare win-win solution to NYC’s dual office glut and housing crunch.rn

Office Conversions Finally Add Up

With roughly 16% of NYC office space sitting empty—versus just 1.4% of apartments—developers are increasingly converting outdated towers into much-needed housing, reports WSJ. High construction costs slowed conversions, but steep office discounts—some selling at 30 cents on the dollar—are reviving developer interest.

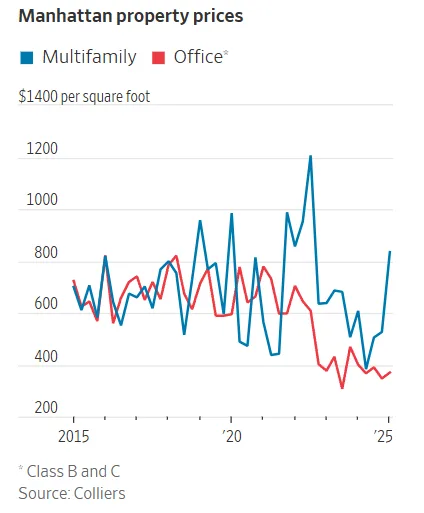

Residential conversions cut rentable space by 25%, so office values must drop 50% below apartment values to make sense. In early 2025, that discount hit 56%, according to Colliers.

Policy Shift Could Cool Investor Enthusiasm

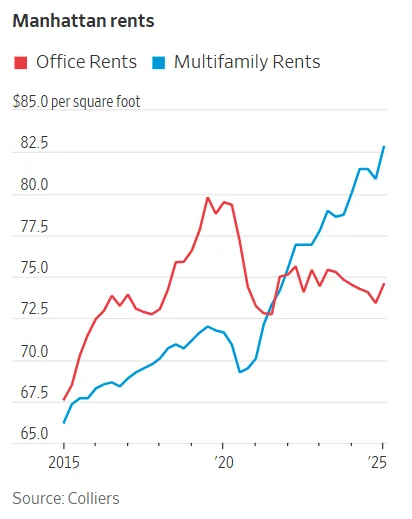

Developers use tax breaks that require 25% of units to be rent-stabilized under current office conversion incentives. If Mamdani’s rent freeze passes, those units could see no rent growth for decades, hurting long-term project returns. This risk may deter private equity and family office investors who view conversions as strong income plays during high inflation.

And while the mayoral race remains months away, the risk of stricter rent regulation is already prompting some developers to consider delaying or downsizing conversion plans—or to lobby for policy carve-outs.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

A City Primed For Conversions

New York’s building stock is unusually well-suited to this trend. Nearly 20% of its office buildings are ideal candidates, thanks to their locations near transit and their aging infrastructure. Unlike new builds, which can take three years or more, conversions average just 18 months—making them a fast-track fix for the housing shortage.

At 25 Water Street, developers removed the entire facade and reconfigured interiors to bring light into new residential units. RXR Realty’s 5 Times Square project faces similar challenges with floorplate layouts and optimizing the mix of apartment unit types.

The Bottom Line

Office conversions are emerging as one of the few scalable ways to add housing in New York without ground-up development. If 25% of units face rent freezes, the financial case for office-to-residential conversions could fall apart.

That risks derailing a rare alignment between investor interests and the city’s urgent need for more housing supply.

Developers are pausing or lobbying as they wait for clarity on City Hall’s future rent stabilization policies.

The outcome of the 2025 mayoral race could reshape Manhattan’s skyline and stall momentum in the housing conversion boom.