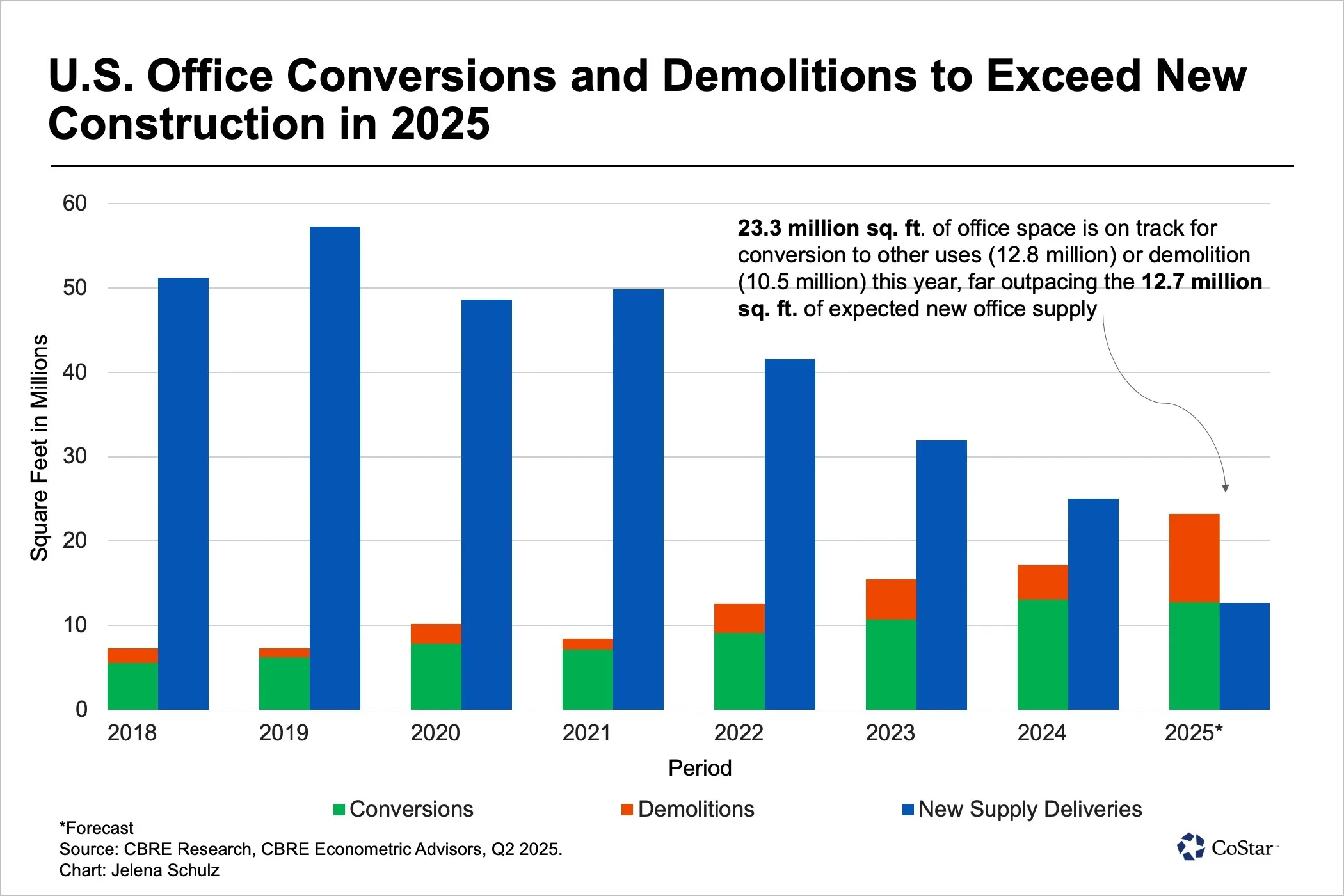

- Developers plan to remove 23.3M SF of office space in 2025—through 12.8M in conversions and 10.5M in demolitions—compared to only 12.7M SF of new supply.

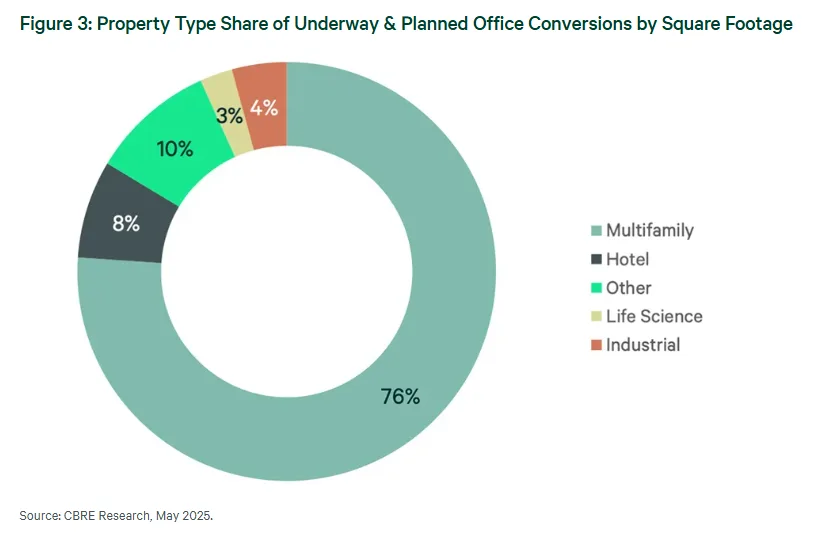

- Conversions are primarily targeting multifamily use, which makes up more than 70% of the active pipeline.

- Manhattan, Washington, D.C., and Cleveland lead the US in conversion volume, thanks to local programs and high vacancy rates.

- Rising construction costs, regulatory hurdles, and building limitations will slow long-term conversion potential.

Office Supply Shrinks for the First Time in Decades

According to CoStar, office conversions are reshaping the US real estate landscape in 2025. For the first time since at least 2000, more office space will be removed through conversion or demolition than added through new construction. CBRE reports that developers will take 23.3 M SF of office space off the market this year—12.8M through office conversions and 10.5M via demolitions. By contrast, they expect to deliver just 12.7M SF of new office space.

This shift could help lower the national office vacancy rate, which remains near a record-high 19%.

Multifamily Conversions Dominate Pipeline

Conversions, especially to multifamily units, continue to gain traction. These projects account for 12.8M SF this year. Since 2016, developers have delivered 33,000 apartment and condo units through office conversions. They expect to add another 43,500 units if current plans move forward.

Multifamily demand remains strong. Since 2020, average rents have climbed 21.3%, while office rents rose just 1.4%. Moreover, multifamily vacancy remains low at 4.8%, compared to 19% for office. These fundamentals make housing a more attractive use for obsolete office buildings.

Demolitions Target Buildings That Can’t Convert

Not every office building can support a new use. Many towers built in the 1970s and ’80s have floorplates too large for apartments. These structures make up over half of all demolitions but only 35% of conversions.

When reuse isn’t feasible, developers often choose demolition—especially in dense markets with limited available land. In these cases, cities can help by adjusting zoning codes and encouraging mixed-use redevelopment.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Major Cities Push Redevelopment

New York and Washington, D.C. lead the country in total conversion SF, with 10.3M and 9.2M, respectively. Local programs like NYC’s “City of Yes” zoning reform and D.C.’s “Office to Anything” initiative have encouraged this momentum.

Cleveland also stands out. It has the highest share of office inventory—8.4%—planned for conversion. Decades of experience with adaptive reuse have helped the city stay ahead of national trends. Limited land and low office rents continue to push developers toward reuse.

Dallas Signals the Future of Urban Office

The Dallas-Fort Worth region ranks fifth in the US with 4.4M SF in its conversion pipeline. Developers are actively transforming outdated office towers into luxury apartments, hotels, and mixed-use spaces. One example is The Sinclair, a 49-story tower that added 293 high-end apartment units and over 400,000 SF of office space after a $300M renovation.

As downtowns evolve into live-work-play districts, these conversions help cities remain vibrant and competitive.

Challenges Still Limit Widespread Adoption

Despite strong momentum, conversions face serious barriers. High interest rates, tariffs, labor shortages, and rising material costs slow many projects. Additionally, not every building qualifies for reuse. Older buildings with outdated layouts or poor locations often remain vacant or are torn down.

Jessica Morin, CBRE’s head of office research, noted that while conversions won’t solve the national housing shortage, they offer real local benefits. At the same time, they remove excess office inventory and support higher property values.

Why It Matters

Conversions and demolitions are reshaping the US office landscape. By removing obsolete buildings, developers are helping rebalance supply, revitalize city centers, and meet changing tenant and resident demands. Expect more cities to follow this trend, especially as they seek to reduce vacancies and repurpose underused space.