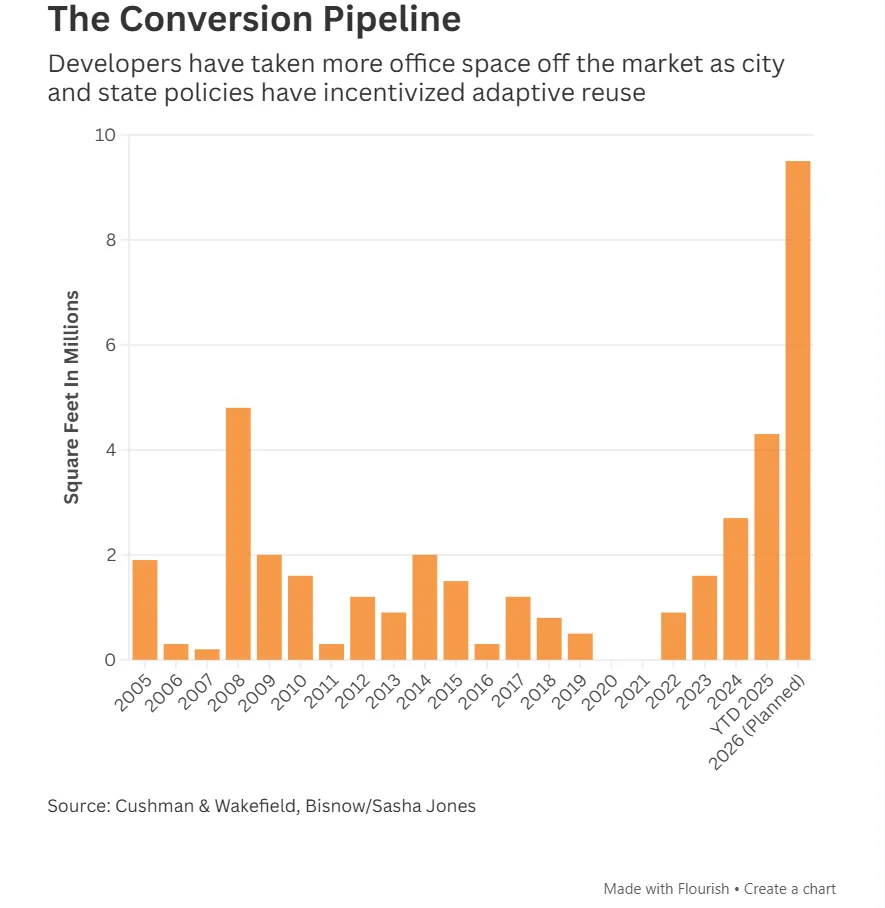

- NYC developers are on track to start 9.5M SF of office-to-residential conversions in 2026, more than double this year’s 4.3M SF and nearly twice the city’s last peak in 2008.

- New tax incentives, streamlined zoning laws, and falling office property values have created the ideal environment for adaptive reuse, leading major players like TF Cornerstone and Northwind Group to reenter or expand in the market.

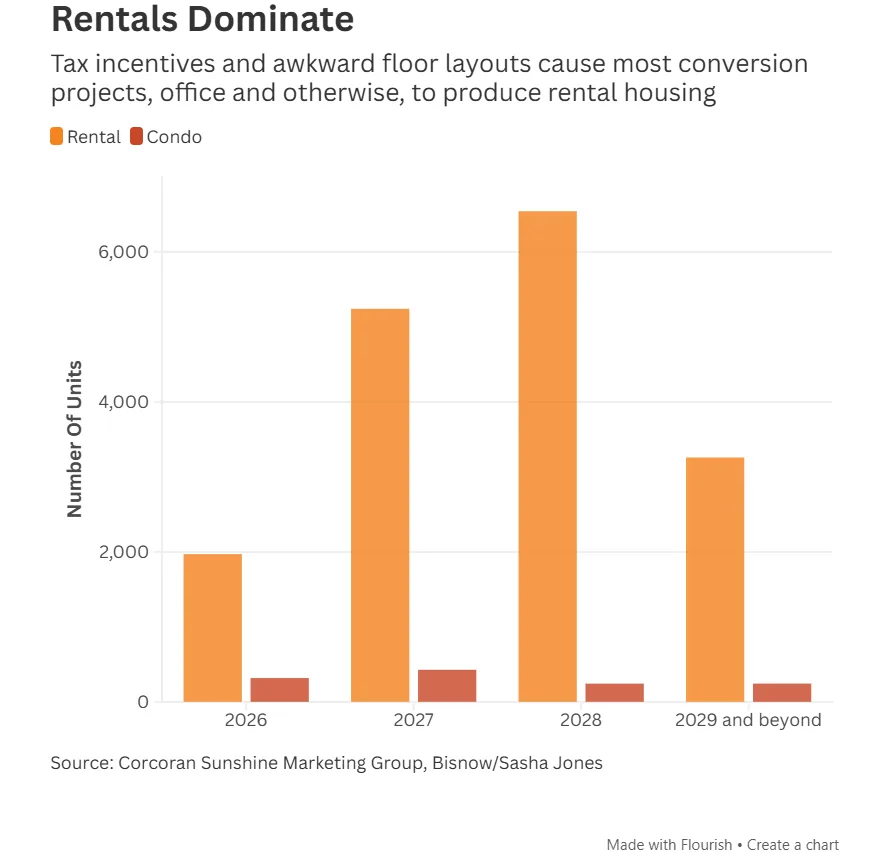

- Rental units dominate the conversion pipeline, driven by the 467-m tax break and design constraints, with 6,500+ new rental units expected by 2028 compared to just a few hundred condos.

The Big Shift

After years of slow movement, 2025 marked a turning point for adaptive reuse in New York City, reports Bisnow. Developers launched construction on 4.3M SF of residential conversions—up nearly 60% from 2024. And next year, that number is set to more than double, with 9.5M SF in the pipeline, according to Cushman & Wakefield.

TF Cornerstone’s Jeremy Shell called it an “alignment of stars” driven by policy shifts, tax breaks, and falling office demand.

Policy & Economic Forces Aligned

Several key reforms have made conversions more viable:

- Office Conversion Accelerator (2023): Helped developers streamline approvals across city agencies.

- 467-m Tax Incentive (2024): Offers escalating tax breaks for rental projects that begin by mid-2026, 2028, or 2031—with the largest benefits for those that move fastest.

- City of Yes Zoning Reform: Expanded eligibility for conversions to office buildings constructed up to 1990 and relaxed unit layout rules.

Simultaneously, falling property values—driven by the flight to newer office buildings—have made acquisitions more attractive.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

TF Cornerstone Returns To Manhattan Conversions

TF Cornerstone, once big in Manhattan reuse, returned to conversions this year after nearly 20 years away from such projects. In August, the firm secured a $159M ground lease for the 32-story Tower 57, a nearly vacant Midtown office tower. It plans to transform the 430K SF building into 350 mixed-income apartments.

The firm also announced a $1B joint venture with Dune Real Estate to target conversions nationwide.

Design Challenges Lead To Rental-Heavy Pipeline

Conversions often come with unusual layouts due to floor plate constraints. That’s one reason most projects are rentals—renters are more flexible than condo buyers, and the 467-m incentive only applies to rental units.

According to Corcoran Sunshine:

- In 2026, 2K rentals and 317 condos are expected from conversions.

- By 2028, 6,540 rentals and 242 condos are projected.

Developers are making conversions work by cutting light wells, repurposing deep floor plates for amenities, and adding new floors. 25 Water Street delivered 1,320 luxury units this year, marking the largest office-to-residential conversion in the US to date.

Outlook: Growth May Plateau After 2026

While the current pipeline is strong, some industry experts expect the pace of conversions to taper after 2026:

- The value of the 467-m incentive drops for projects that don’t start by mid-2026.

- High-end office leasing is rebounding, reducing the availability of viable Class-A assets for conversion.

- Class-A buildings have been harder to convert, and future projects may skew smaller, especially in areas like Midtown South.

Still, firms like Northwind Group remain committed. The lender has financed eight NYC conversion projects, including the former Pfizer HQ on East 42nd Street, which is now slated for 1,600+ units.

Why It Matters

Conversions offer a path to alleviate NYC’s housing shortage while repurposing outdated office stock. With developers and lenders moving quickly to take advantage of temporary incentives and favorable conditions, 2026 is shaping up to be a high-water mark for adaptive reuse in the city. But with the window for the most generous incentives closing, this may be a short-lived boom.