- US apartment occupancy rose 140 basis points year-over-year to 95.6% in June.

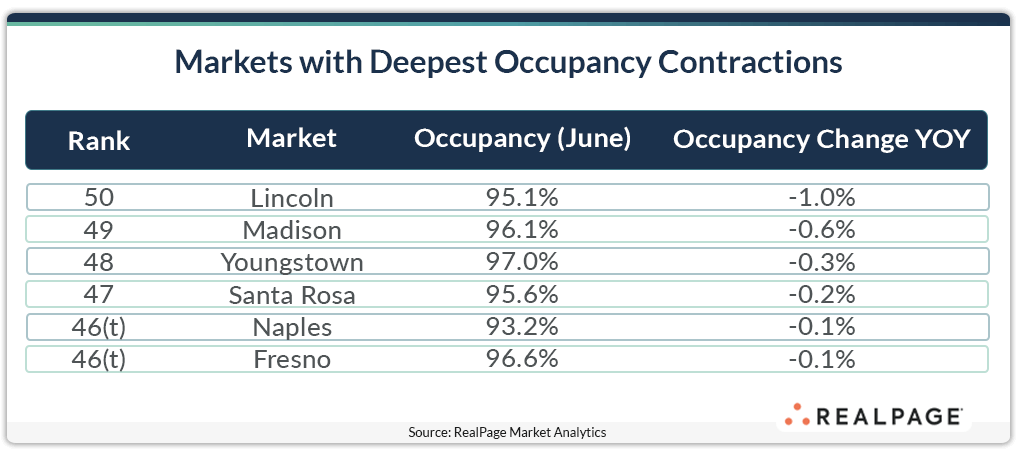

- Only six of the top 150 US apartment markets recorded occupancy declines, with Lincoln, NE seeing the steepest drop at 100 bps.

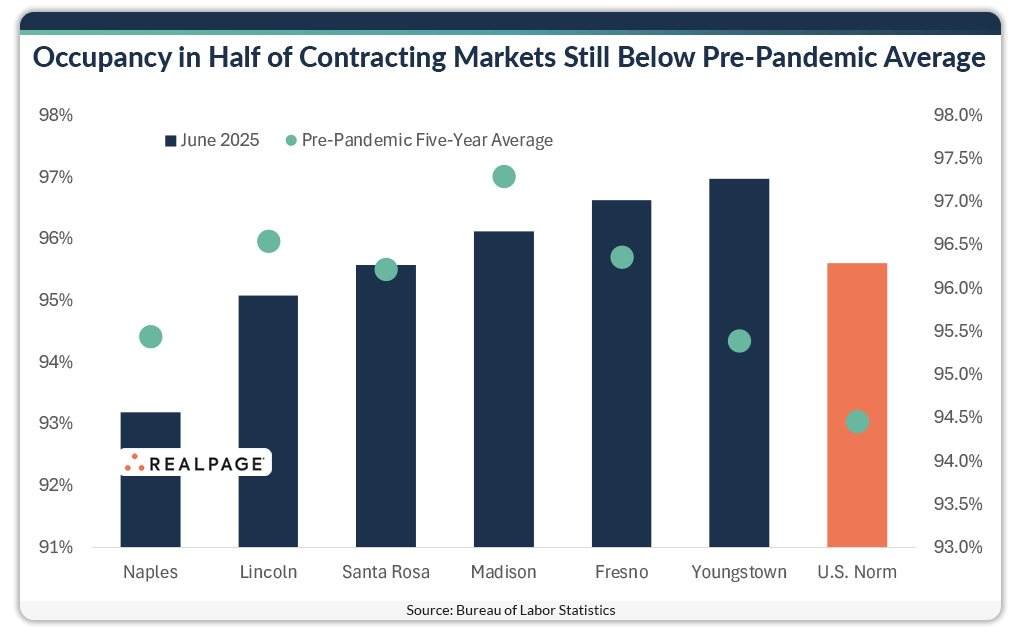

- Half of the markets still experiencing declines are operating below pre-pandemic occupancy averages, primarily due to mismatches between supply and demand.

A Tightening National Market

Leasing activity across the country remained robust through the first half of 2025, reports RealPage. As a result, US apartment occupancy rose to 95.6% in June, up 140 basis points year-over-year. The vast majority of the 150 largest apartment markets are now seeing improvement, but six markets continued to report occupancy contractions, some significantly trailing historical norms.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

The Hardest Hit

Lincoln, NE experienced the most pronounced drop, with occupancy falling 100 bps to 95.1%. That’s 150 bps below its pre-pandemic average (2015–2019) and reflects a mismatch in supply and demand. In the year-ending Q2 2025, developers delivered 1,139 units, while demand registered at just 876 units.

Madison, WI, the second-most affected market, saw occupancy decline by 60 bps to 96.1%. Despite its softening, the city still posts healthy occupancy compared to national norms. A drop in new supply—down 18% year-over-year—helped offset weakening fundamentals, with demand for 1,032 units nearly matching the 1,815 units delivered.

Smaller Markets Feeling The Pinch

Youngstown, OH—a smaller apartment market with just over 25,400 units—saw a mild 30 bps decline, ending June at a still-strong 97% occupancy. That rate exceeded the national average, but marked a slip compared to its more recent five-year trend.

The other three apartment markets—Santa Rosa, CA (-20 bps), Naples, FL (-10 bps), and Fresno, CA (-10 bps)—recorded minimal year-over-year occupancy losses, keeping rates relatively stable despite broader headwinds.

Why It Matters

While occupancy rates are strengthening across the US, a few apartment markets are still playing catch-up, often due to lingering supply-demand imbalances or broader regional challenges. Notably, even among the underperforming metros, most are maintaining occupancy levels above 95%, signaling a generally healthy multifamily market.

What’s Next

With construction levels moderating in several lagging markets and demand trending upward in places like Madison, the outlook for these six metros may stabilize heading into late 2025. Nationally, as leasing momentum continues, further occupancy tightening is likely—though market-specific dynamics will drive individual performance.