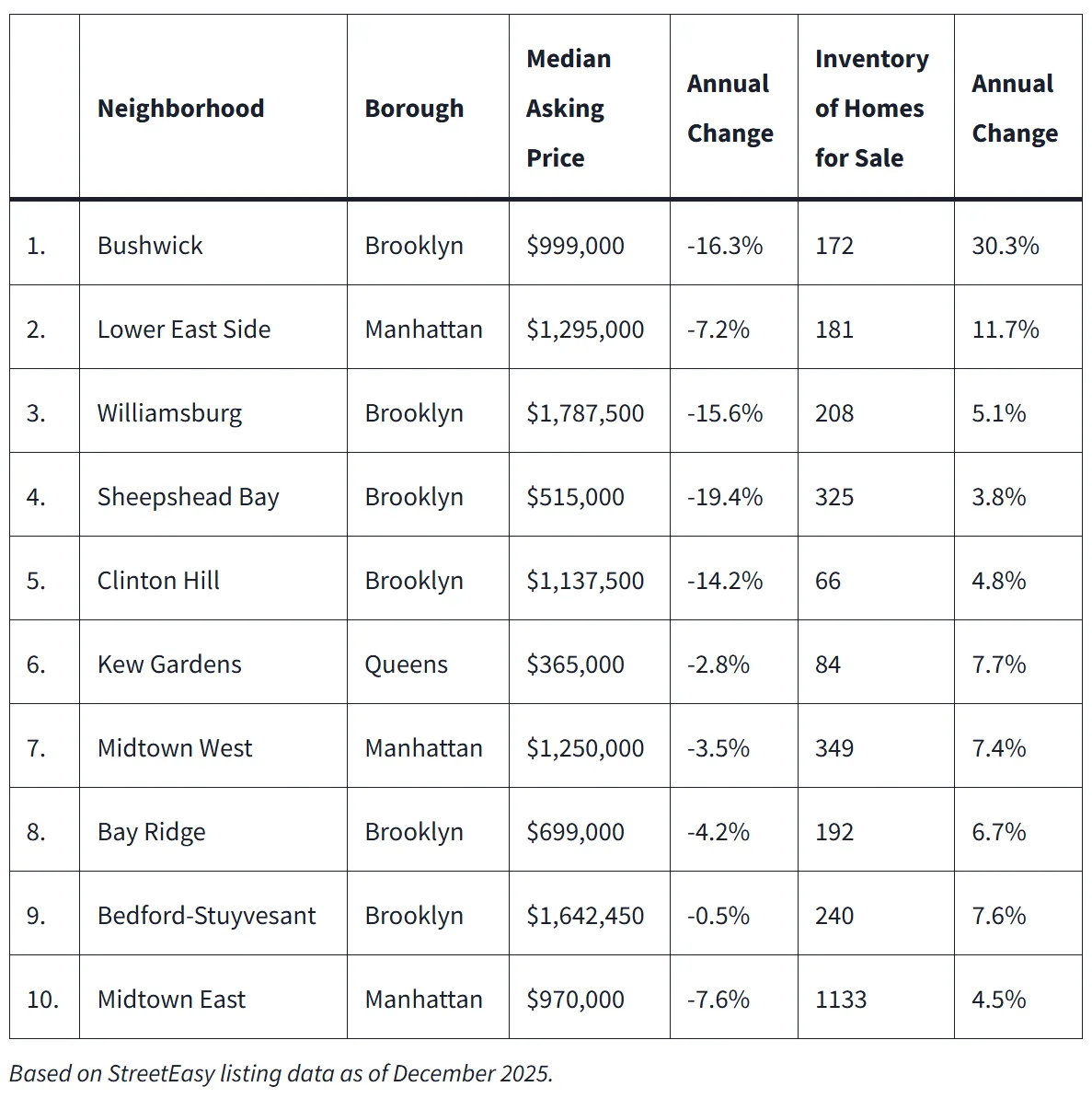

- Buyer-favorable conditions emerge in multiple NYC neighborhoods as inventory expands and asking prices fall.

- Bushwick leads StreetEasy’s 2026 list with a 30.3% inventory increase and a 16.3% price drop.

- Affordability gains are notable in both outer boroughs and Manhattan, with Sheepshead Bay seeing prices fall by 19.4%.

- Rising supply in well-known areas like Williamsburg, Lower East Side, and Midtown is tipping the balance toward buyers in 2026.

NYC Buyers See More Options

StreetEasy’s latest data pinpoints a shift in New York City’s sales market heading into 2026. As supply outpaces demand in key neighborhoods, buyers are gaining leverage not seen in recent years. The trend is broad-based, with both Brooklyn and Manhattan offering expanded inventories and softer prices.

Top Neighborhood Insights

- Bushwick (Brooklyn): Median asking price: $999,000, down 16.3%. Inventory up 30.3%, bringing more options and leverage to buyers.

- Lower East Side (Manhattan): Median asking price dropped 7.2% to $1.3M with inventory climbing 11.7%.

- Williamsburg (Brooklyn): Prices fell 15.6% to $1.79M while inventory rose 5.1%, easing competition for buyers.

- Sheepshead Bay (Brooklyn): Saw the sharpest price drop, down 19.4% to $515K, with inventory up slightly.

- Clinton Hill, Kew Gardens, Midtown West, Bay Ridge, Bedford-Stuyvesant, and Midtown East all posted higher inventory and lower annual median asking prices, improving opportunities for buyers across price points.

Get Smarter About What Matters in New York

Subscribe to our free newsletter covering the biggest commercial real estate stories across the five boroughs — delivered in just 5 minutes.

Why It Matters

NYC neighborhoods experiencing both lower median asking prices and higher for-sale inventory indicate momentum for buyers in the market. Motivated sellers are adjusting expectations, especially in areas like Bushwick and Williamsburgh, signaling a window for value-driven acquisitions.

Diverse locations from downtown Manhattan (Lower East Side, Midtown West, Midtown East) to Brooklyn and Queens (Sheepshead Bay, Bay Ridge, Kew Gardens) offer avenues for different buyer budgets and lifestyle needs. Inventory growth means buyers can negotiate more aggressively and assess a broader selection. Recent increases in retail supply across NYC are also reshaping neighborhood dynamics, adding another layer of appeal for buyers evaluating long-term value.

What’s Next

As these NYC neighborhoods continue to see more listings and competitive asking prices, buyer leverage may persist through 2026 depending on macroeconomic trends and mortgage rates. StreetEasy’s analysis suggests market watching remains essential for those aiming to enter or expand their position in New York City real estate.