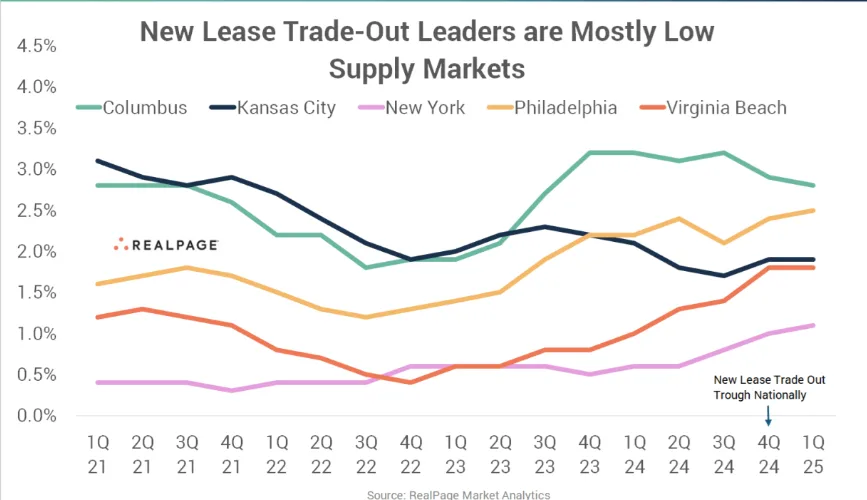

- Anaheim, Columbus, Kansas City, New York, Philadelphia, and Virginia Beach are the only major markets to sustain positive new lease trade-out rates since 2023.

- These markets saw their lowest new lease growth in late 2024 but still avoided rent cuts while national averages dropped by as much as 4.4%.

- Slower supply growth in most of these markets has supported pricing power for operators, with Columbus as a notable exception due to an ongoing supply wave.

Resilient In A Downturn

New lease trade-out—the year-over-year change in rent for newly signed leases—has been under considerable pressure nationally due to a surge in multifamily supply. By late 2024, US operators were slashing rents at the steepest rate in years, with new lease prices falling by as much as 4.4%, reports RealPage.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

A Small Circle Of Strength

Despite the broader trend, six major markets never dipped into negative territory: Anaheim, Columbus, Kansas City, New York, Philadelphia, and Virginia Beach. These metros saw modest to flat rent and lease pricing changes even as many others, like Austin and Denver, experienced double-digit rent cuts.

- Anaheim led the group, bottoming out at a still-positive 1.4% trade-out.

- Columbus, Kansas City, and New York saw slight growth between 0.5% and 1%.

- Philadelphia and Virginia Beach posted essentially flat pricing, which still ranked among the best nationally.

Why It Happened

One common thread among these outperformers: relatively limited new supply. While the US saw average inventory growth of 3% in 2024, these markets posted significantly lower new construction activity—giving property owners more pricing power and helping sustain rent growth even as other metros experienced declines.

The exception is Columbus, where a steady flow of new supply is expected to peak in late 2025. Yet even there, rent performance has remained stable so far, with demand largely keeping pace with new deliveries.

Looking Ahead

These markets highlight the stabilizing role of constrained supply during volatile periods. While much of the nation adjusts to a cooling rental market, metros with tempered development pipelines may continue to enjoy rent pricing resilience—at least in the near term.