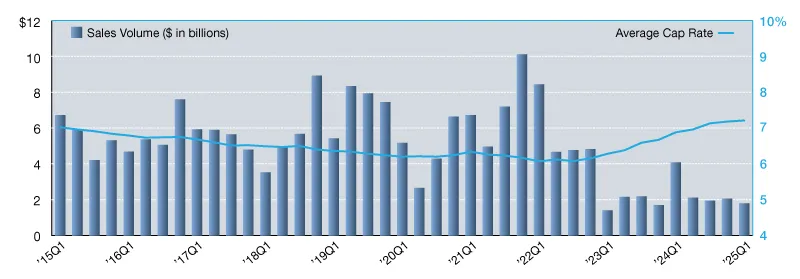

- Net lease office sales volume fell 56.2% year-over-year to $1.8B in Q1 2025.

- Cap rates rose for the tenth straight quarter, averaging 7.21%, but increases have slowed.

- Institutional buyers led acquisitions with 43% share, while REITs remained inactive.

- Investor sentiment remains cautious due to rising vacancies and 2025 loan maturities.

Market Recap

The single-tenant office market continued to contract in Q1 2025, with transaction volume dropping to $1.8B, reports Commercial Search. This marked a 13% slide from Q4 2024 and a sharp 56.2% fall year-over-year. The downturn stems largely from ongoing tenant retrenchment, high vacancy levels, and tepid leasing momentum.

Cap rates in the sector ticked up again, reaching an average of 7.21%—the tenth consecutive quarter of increases. However, the rise in cap rates has decelerated, with just a 3-basis-point uptick in Q1 compared to a cumulative 30-basis-point jump over the prior three quarters. This suggests that the most volatile pricing shifts may be in the rearview.

Who’s Buying?

Institutional capital made a notable comeback in early 2025, accounting for 43% of acquisitions. This defied 2024 expectations that these players would scale back office exposure. Deals ranged from small healthcare offices to larger corporate campus sale leasebacks.

Private buyers also remained active, representing 31% of market share. REITs, on the other hand, were entirely absent, reflecting a more cautious stance amid longer-term uncertainty in the office sector.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Investor Sentiment And Sector Outlook

Sentiment remains challenged by ongoing tenant downsizing, difficulty backfilling space, and misaligned lease structures. Many assets continue to underperform, and 2025’s wave of maturing debt is adding further pressure on landlords.

Looking ahead, any recovery in the net lease office sector will likely hinge on creative repositioning, leasing stabilization, and improved financing conditions. Until then, muted investment activity is expected to persist through the near term.