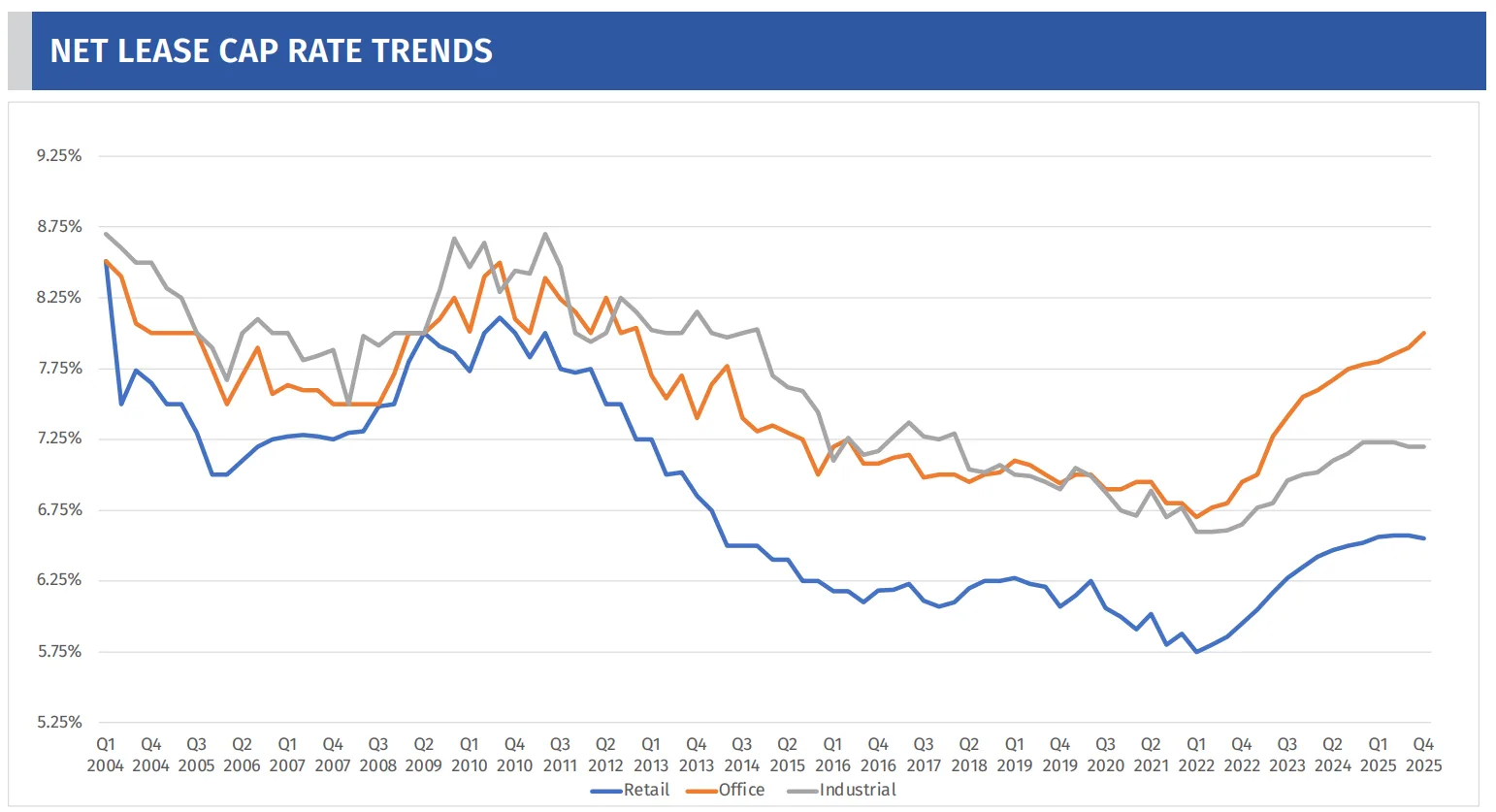

- Cap rates rose just one basis point in Q4 2025, continuing a three-quarter trend of stability.

- Investors are focusing more on lease duration, tenant credit, and asset type than interest rate changes.

- Bid-ask spreads narrowed, supporting stronger deal flow.

- Retail outperformed, while office cap rates continued to climb amid uncertainty.

A Market Settling into Place

According to Globe St, after two years of steady repricing, the net lease sector entered the final quarter of 2025 with cap rates in a near holding pattern. The overall national asking cap rate rose just one basis point to 6.81%, following similarly muted changes in Q2 and Q3. Even after the Federal Reserve’s December rate cut—its third of the year—cap rates were largely unaffected, a sign that the market has shifted its attention away from monetary policy and toward property-specific fundamentals.

This recalibration is evident across transactions and asset classes. While borrowing costs are still elevated by historical standards, the market appears to have absorbed much of the impact. Investors are now navigating within a narrower band, pricing risk based on factors like lease term, credit quality, and sector outlook.

Sector Performance Shows Diverging Sentiment

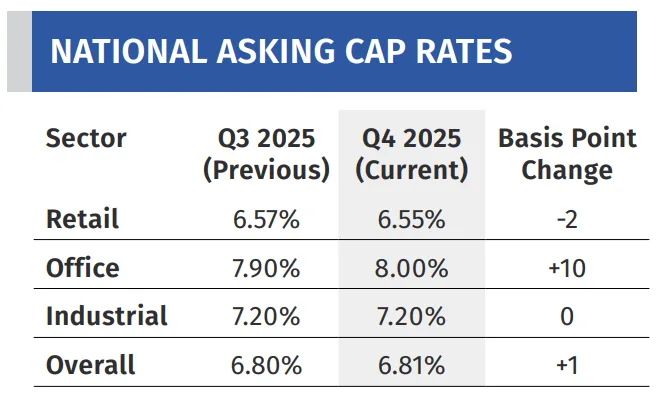

While the overall market stayed steady, cap rate movement varied by property type. Retail posted modest compression, dropping to 6.55% as investor demand remained healthy. Industrial held flat at 7.20%, suggesting a pause after significant repricing earlier in the cycle. Investor appetite in the industrial segment has remained relatively strong despite elevated yields, reflecting confidence in the asset class’s long-term fundamentals. Office saw the most upward movement, climbing to 8.00% amid ongoing skepticism over long-term tenant demand and a noticeable increase in available inventory.

This divergence reflects investors’ growing emphasis on use-case resilience and perceived risk. Office, in particular, continues to face headwinds as users rethink long-term occupancy strategies.

Buyers and Sellers Are Finally Meeting

One of the clearest signs of market stability is the tightening of bid-ask spreads. Across all major property types, the gap between asking and closed cap rates narrowed, indicating greater alignment on pricing. As expectations converge, transactions are picking up—especially for assets with strong credit and longer-term leases.

Investors are no longer sitting on the sidelines waiting for more rate cuts. Instead, many are finding ways to price deals based on today’s realities, not tomorrow’s hypotheticals.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Lease Term Remains the Biggest Driver

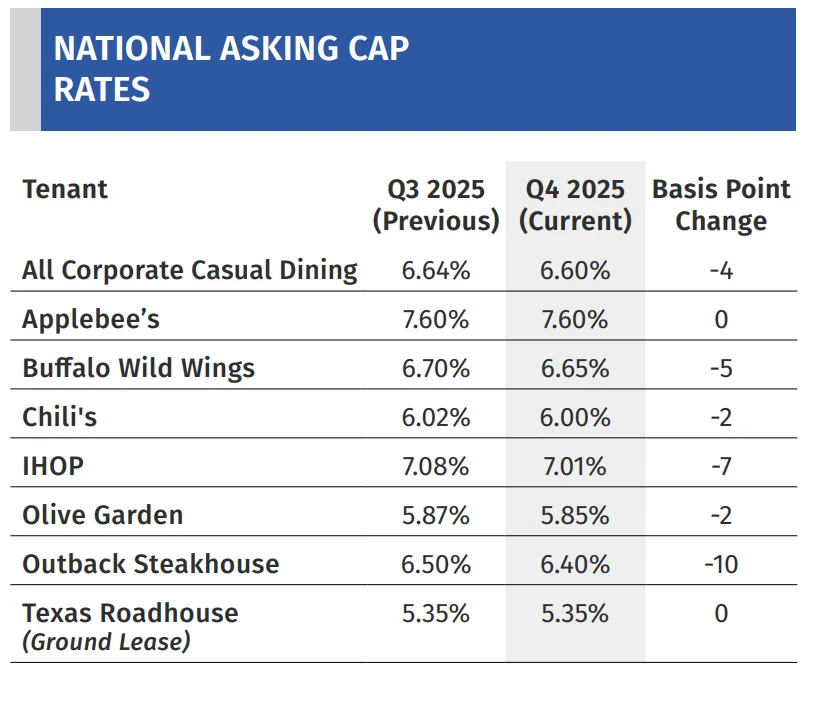

Across nearly every net lease segment, lease duration continues to play an outsized role in valuation. Assets with 15 or more years on the lease are still commanding the most aggressive pricing, while those with fewer than five years are seeing yields push well into the 8–9% range.

This pattern is especially clear in sectors like drugstores, dollar stores, and auto-related retail, where the cap rate swing between long- and short-term leases often exceeds 200 basis points. It’s a consistent reminder that in this environment, time equals value.

Looking Ahead to 2026

As 2026 begins, the market appears more balanced than it has in years. While further rate cuts may provide support, investors shouldn’t expect cap rates to follow in lockstep. The disconnection between short-term rate moves and cap rate shifts is now well established.

Instead, pricing will likely continue to reflect micro-level factors. And with supply at a decade high, investors—particularly private buyers—will have ample opportunity to pick their spots, so long as they price the risk correctly.