- US population grew by just 0.5% last year, intensifying concerns for national multifamily demand.

- Immigration contributed to at least 80% of population gains in 20 states over the last five years.

- Rent growth slowed, with some markets like Miami and Phoenix experiencing rent declines.

- Major cities with ongoing housing shortages may feel less immediate impact.

Stagnant Population and Multifamily Impact

Bisnow reports that the national multifamily sector is confronting new headwinds after the US population grew by a modest 0.5% last year. This slowdown, primarily driven by a sharp decline in international migration and record-low fertility rates, is forcing property owners and developers to reassess demand projections—especially in immigrant-reliant markets.

US Census Bureau data shows only 1.8M in population growth over the last year, half the previous year’s figure. With tighter immigration policies and fewer arrivals, multifamily markets that benefitted from international migration are facing fresh uncertainty.

Construction Wave and Rent Trends

Over 500,000 new apartments were delivered nationally in early 2025, marking a significant supply increase. However, RealPage reports that inventory growth lost momentum for the first time in 15 years. National average rent for a one-bedroom was $1,625 in January, just 0.4% above the previous year, indicating a cooling from the pandemic-era boom.

Miami, Phoenix, and Austin—all strongholds for national multifamily construction—are now seeing rent declines or stagnation as new supply coincides with dampened demand. In Phoenix, rents are nearly 10% below historical trends, and Miami’s asking rents fell about 6% in 2025.

Regional Differences Reshape Outlook

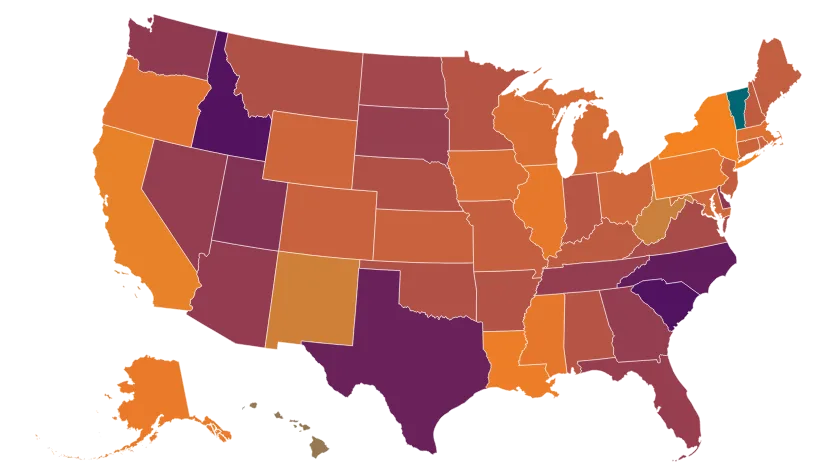

Immigration remains the primary growth engine for many US states—accounting for 80% of net migration in at least 20 states over five years. Areas with historically low or negative population growth rely on immigrants to stabilize housing. However, current federal immigration and deportation policies threaten this stabilizing force, especially after more than 500,000 deportations in the past year. Tighter scrutiny around housing eligibility based on immigration status is also compounding the issue, putting additional strain on multifamily developers navigating HUD policy shifts.

National multifamily developer sentiment is shifting: some Sun Belt states like Texas still post healthy growth but at a slower pace, while Florida slipped in the rankings as remote work wanes and corporate relocation patterns change.

Outlook for Major Cities

Despite stalled national multifamily growth, large urban centers continue to contend with chronic housing shortages and high rents. New York and Chicago top the Waller, Weeks and Johnson Rental Index, with rents exceeding historical norms. Significant pent-up demand and overcrowding in these cities suggest the impact of slower growth may unfold more gradually than in lower-growth or oversupplied regions.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes