- National capital markets recorded $255B in core CRE sales in 2025, with momentum building each quarter.

- Multifamily led with $115B in transactions, accounting for 45% of total core-sector volume.

- Industrial, office, and retail sectors also posted gains, each led by a mix of institutional and private investors.

- Interest rate cuts and moderating US bond yields supported renewed investor activity.

Market Momentum Builds Nationwide

According to Bisnow, national capital markets rebounded in 2025, as US commercial real estate sales surged past $255B across multifamily, industrial, office, and retail sectors. Investors—buoyed by rate cuts and stabilized bond yields—catalyzed activity despite economic headwinds and policy uncertainty. Core asset classes saw higher sales with each quarter, reversing the stagnation of prior years.

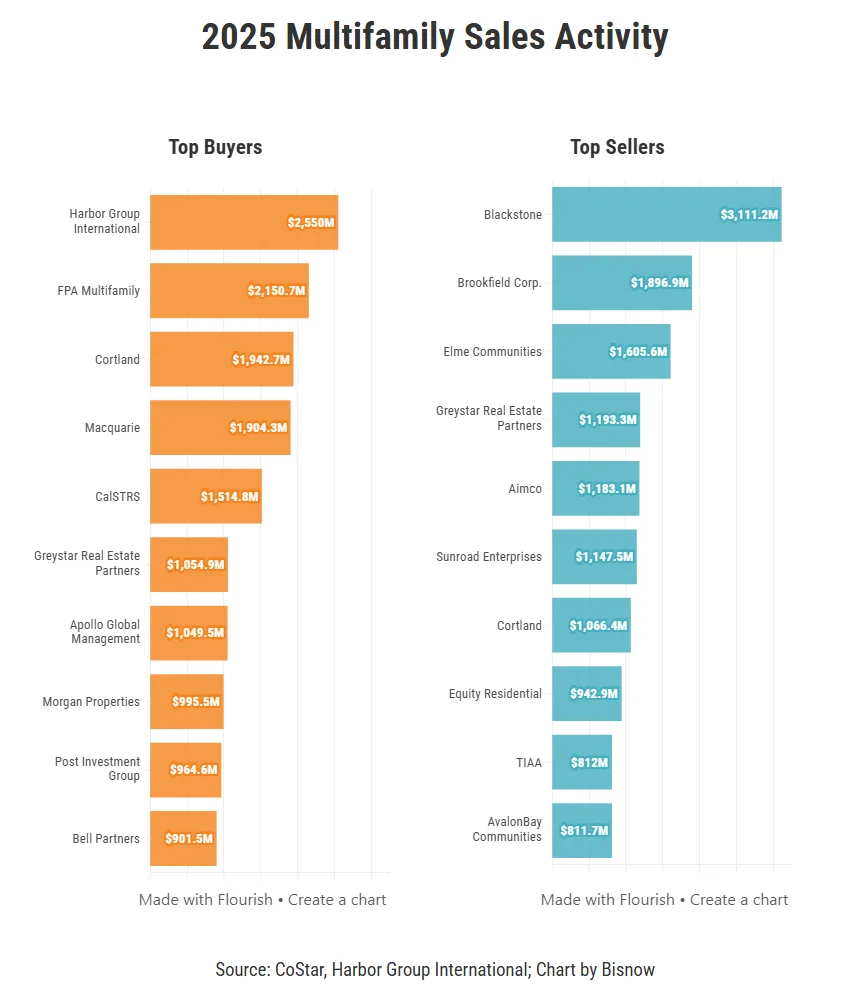

Multifamily Remains Investor Favorite

Multifamily captured the largest share of national capital markets volume in 2025, reaching $115B—approximately 45% of sector investment. Top buyers included Harbor Group International, FPA Multifamily, and Cortland, with transactions ranging from large portfolio deals in New England and the Sun Belt to Elme Communities’ substantial asset sale. This builds on strong mid-year and Q4 momentum, when multifamily and office were already outperforming other asset classes across several US regions. The strong appetite reflects investor confidence amid challenging homebuying conditions and robust rent growth outlooks.

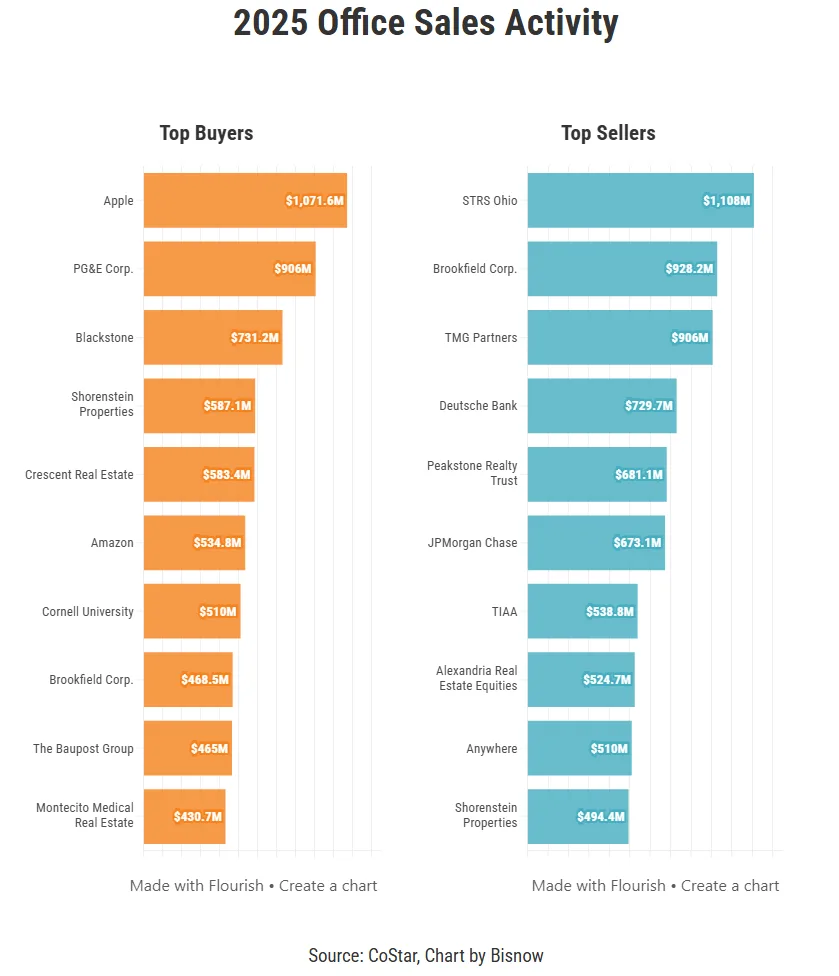

Industrial and Office Attract Private Equity

Industrial sales followed, totaling $61.9B. EQT AB led industrial acquisitions with $2.7B, followed by Ares Management and Morgan Stanley. Blackstone was the sector’s largest seller, unloading $4.6B in assets. In office, $47.2B changed hands, driven by end-user buys, including Apple’s multi-building Silicon Valley purchases and PG&E’s Oakland headquarters acquisition. Owner-users seized on discounted pricing and abundant vacancy, a dynamic rooted in the pandemic’s lingering effects.

Resiliency in Retail Transactions

Retail vacancy hit historic lows as $5.4B was spent by top buyers. RCG Ventures led retail acquisitions with a $1.8B portfolio purchase, while Simon Property Group acquired the Brickell City Centre mall. Strategic Value Partners was the most active seller, closing over $1.4B in retail dispositions. Investors continue to favor net lease and grocery-anchored retail centers for their stable returns, a trend expected into 2026.

What’s Next

The national capital markets landscape benefited from favorable debt conditions in 2025. With investors focused on near-term yields and long-term fundamentals, further activity is expected as capital seeks opportunity in a shifting market environment.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes