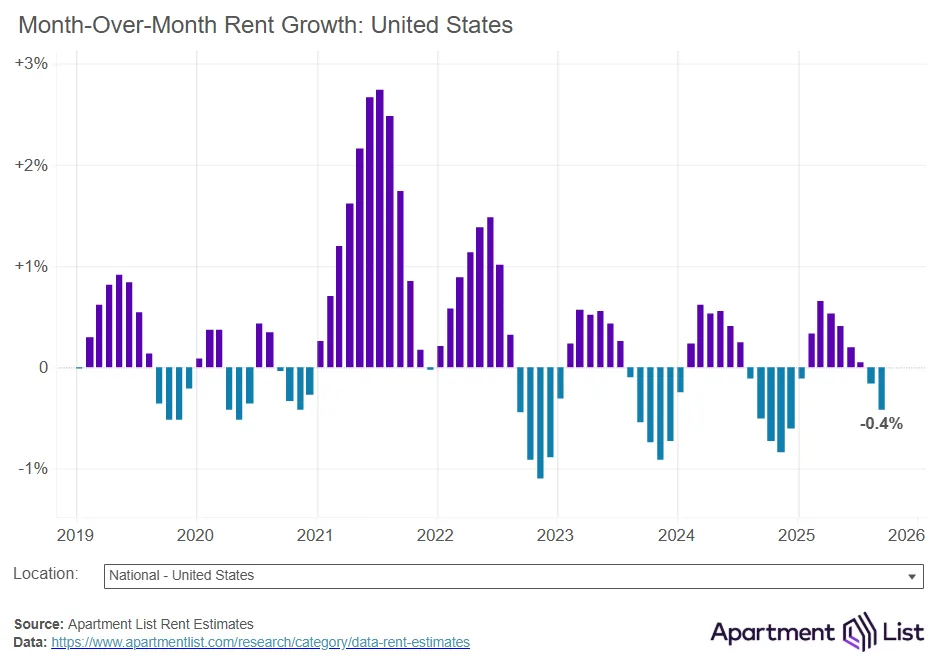

- National rent prices fell 0.4% in September, with the median rent now at $1,394 — down 0.8% from a year ago.

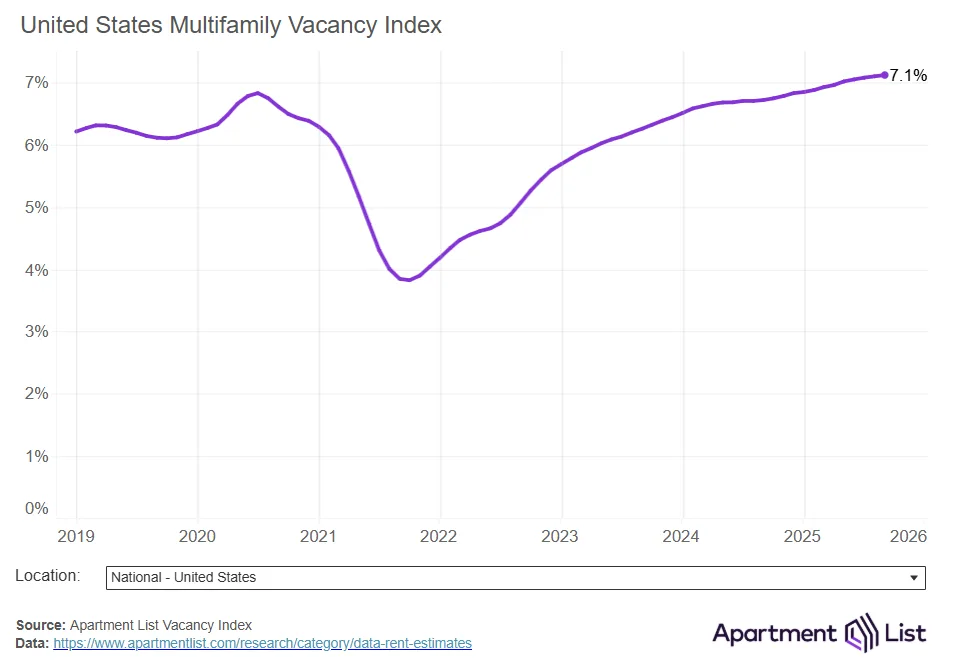

- The US multifamily vacancy rate hit a record 7.1%, fueled by a flood of new apartment deliveries and slowing demand.

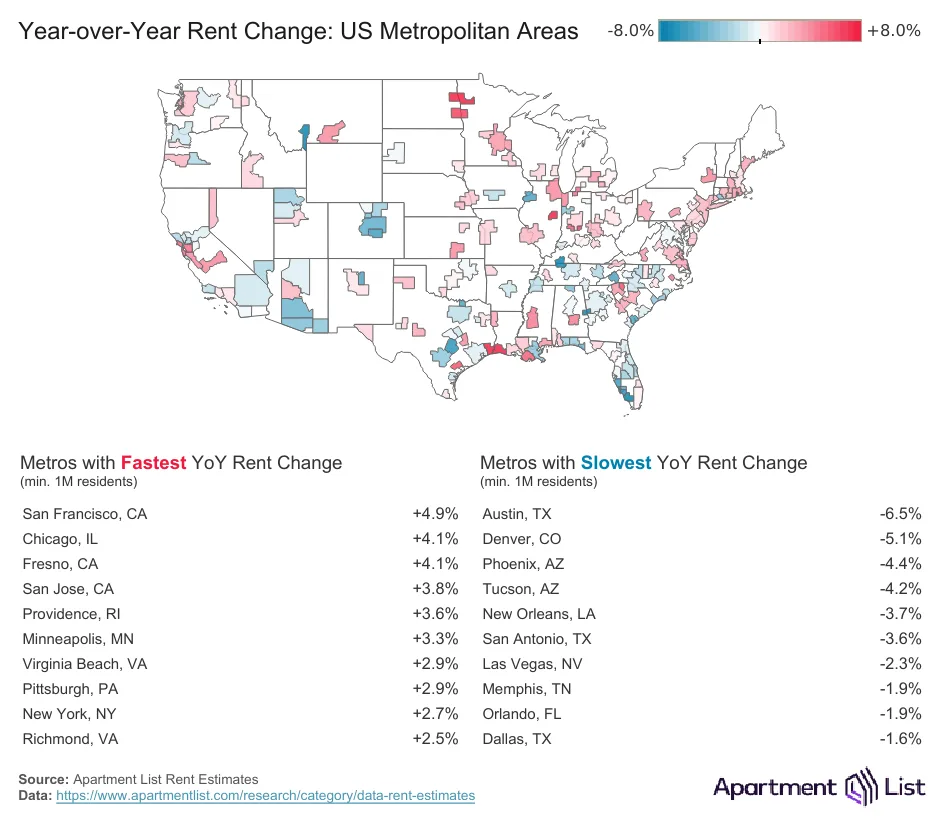

- Austin leads major metros with a 6.5% annual rent drop, while San Francisco saw the fastest rent growth at +4.9% year-over-year.

Rent Growth Stalls as Market Enters Slow Season

National rent prices slipped for the second consecutive month in September, declining 0.4% and bringing the median rent to $1,394, according to Apartment List.

The downturn marks the typical seasonal slowdown, but also reflects deeper market softness. On a year-over-year basis, rents are down 0.8%, a modest improvement from last month’s -0.9% reading — the first upward tick in annual growth since March.

Although prices are down from their August 2022 peak by 3.3% ($48), they remain 22% higher than pre-pandemic levels in January 2021, showing the lasting impact of the 2021–2022 rent surge.

Record Vacancy Rate Highlights Oversupply

The national multifamily vacancy rate climbed to 7.1% in September, the highest level Apartment List has recorded since tracking began in 2017. The increase stems from a construction wave that peaked in 2024, with more than 600,000 new units delivered — the most since 1986. While completions have slowed, a still-strong pipeline (686,000 units under construction) continues to outpace long-run averages.

The surplus of new units has eroded landlords’ pricing power, contributing to stagnant or declining rents across many metros.

Slower Leasing Signals Softer Demand

Units are also taking longer to lease. The national average list-to-lease time rose to 31 days in September, up from 29 days in August and 30 days a year ago. Though down from the January peak of 37 days, this uptick reflects cooling demand as the off-season begins and renters become more selective.

Sun Belt Sees Sharpest Rent Drops, Bay Area Rebounds

Regional rent trends show a split:

- sun belt markets are seeing the steepest declines, led by Austin, where rents have dropped 6.5% year-over-year and are now 19% below their 2022 peak. Other high-supply metros such as Denver, Phoenix, San Antonio, and Orlando are experiencing similar pressures.

- In contrast, San Francisco posted a 4.9% annual rent increase, with prices in the urban core up 12.4% year-over-year. San Jose also made the top five with a 3.8% jump.

- Midwest and East Coast markets like Chicago, Minneapolis, Providence, and Virginia Beach also saw rent growth, but at more modest levels.

Why It Matters

The combination of elevated vacancies, extended leasing times, and regionally varied performance underscores a rental market in transition. Developers in overbuilt metros are now facing weaker fundamentals, while undersupplied urban cores are seeing a rebound in demand.

What’s Next

While rent declines may continue into the final months of 2025, analysts expect stabilization in 2026 as the pipeline slows and demand normalizes. Still, with macroeconomic uncertainty and thousands of units yet to hit the market, a return to tighter conditions could take longer than expected.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes