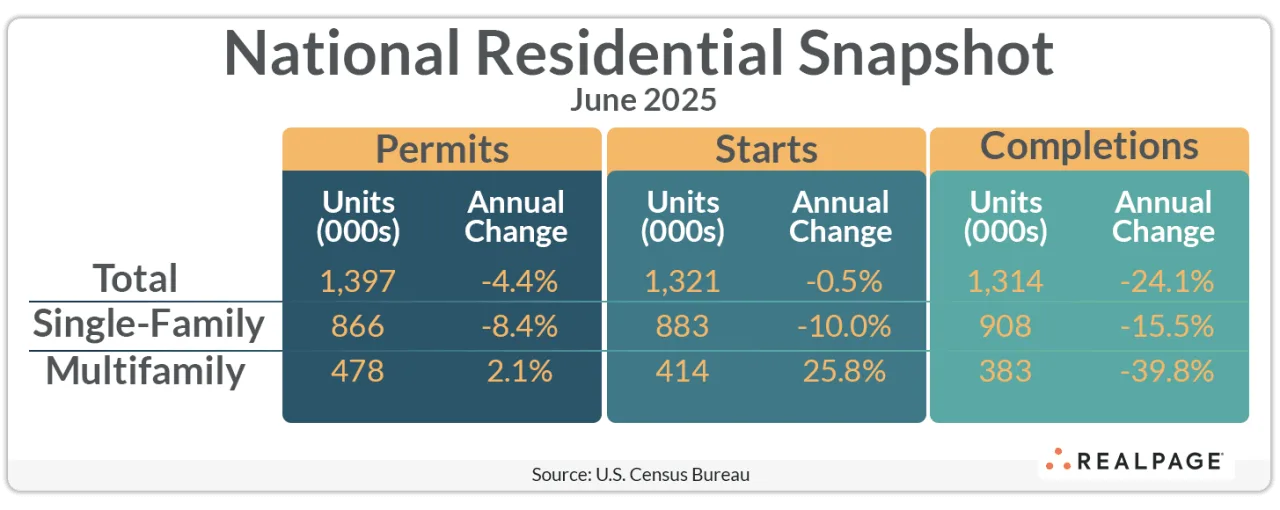

- Multifamily starts jumped 30.6% in June to 414,000 units (seasonally adjusted), up 25.8% from last year.rn

- Permits rose 8.1% from May to 478,000 units but are up only 2.1% year-over-year.rn

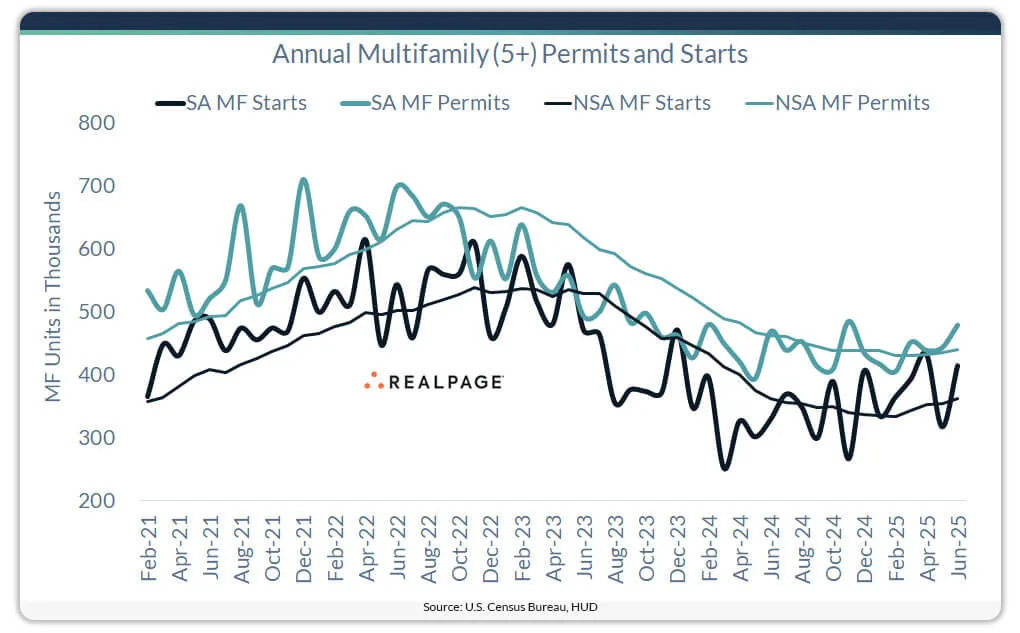

- Unadjusted data shows starts trending up, while permits remain mostly flat.rn

- The South and Northeast regions saw strong growth, but starts fell sharply in the Midwest.rnrnrn

Multifamily Starts Rebound in June

According to RealPage, multifamily housing starts surged in June after a sharp drop in May. The seasonally adjusted annual rate (SAAR) rose 30.6% to 414,000 units. Compared to last year, that’s a 25.8% increase.

The SAAR is based on a small sample of monthly data and is known for big swings. hud surveys about 900 places with permit activity, a small share of the nearly 20,000 permit-issuing locations across the US.

Permitting Still Trails Construction

While starts climbed, multifamily permitting rose more slowly. June’s SAAR for permits increased 8.1% from May to 478,000 units. That’s only a 2.1% gain from last June.

Looking at the raw (unadjusted) numbers, the 12-month total for starts has been rising for four months. In contrast, permits have stayed near 430,000 units during that time, with only a slight increase in June.

Permits are a leading indicator. If they stay flat while starts rise, the growth in construction may not last.

A Closer Look at What’s Being Built

The recent rise in multifamily permits may not reflect conventional apartments alone. It could include more affordable housing, senior living, student units, and for-sale products like condos and townhomes.

This mix matters for investors and developers focused on market-rate rentals.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Single-Family Activity Keeps Falling

The single-family sector remains weak. Permits dropped 3.7% in June to 866,000 units SAAR. That’s the lowest level since March 2023. Starts fell too—down 4.6% from May and 10% year-over-year to 883,000 units.

Higher mortgage rates and economic uncertainty are limiting demand.

Regional Snapshot

Multifamily Starts by Region (SAAR, YoY):

- Northeast: Up 145.8% to 110,000 units.

- South: Up 28.7% to 185,000 units.

- West: Down 0.9% to 85,000 units.

- Midwest: Down 37.9% to 34,000 units.

Multifamily Permits by Region (SAAR, YoY):

- South: Up 4.5% to 250,000 units.

- Midwest: Up 10.5% to 82,000 units.

- West: Down 1.1% to 108,000 units.

- Northeast: Down 15.8% to 39,000 units.

The South and Northeast led June’s gains in starts. But permitting fell in the Northeast and West, raising questions about future growth.

Construction Pipeline Shrinks

The number of multifamily units under construction dropped to 720,000 units. That’s down 0.6% from May and 19.6% from last year. Completions fell even more—down 21% month-over-month and nearly 40% year-over-year to 383,000 units.

Single-family completions also declined. They fell 12.5% from May and 15.5% from last year to 908,000 units.

Why It Matters

Multifamily construction may be starting to recover, but it’s too soon to call it a trend. Starts are up, but permitting is not rising at the same pace. A lasting rebound will depend on stronger permit activity and more clarity in the types of housing being approved.

What’s Next

If permitting picks up in the second half of 2025, more growth in multifamily construction could follow. For now, signs point to a possible bottoming out—not a full recovery.