- Slowing construction and steady renter demand are setting the stage for long-term rent growth, despite muted performance in early 2025.

- While metros like Austin and Phoenix face high vacancies, the Northeast, Midwest, and parts of the West Coast are showing healthy fundamentals.

- With the ownership premium at record highs, many households are locked out of homeownership. That’s driving sustained demand for rentals.

- Capital is cautiously returning as pricing stabilizes and deliveries slow, especially in top-tier locations.

The Big Picture

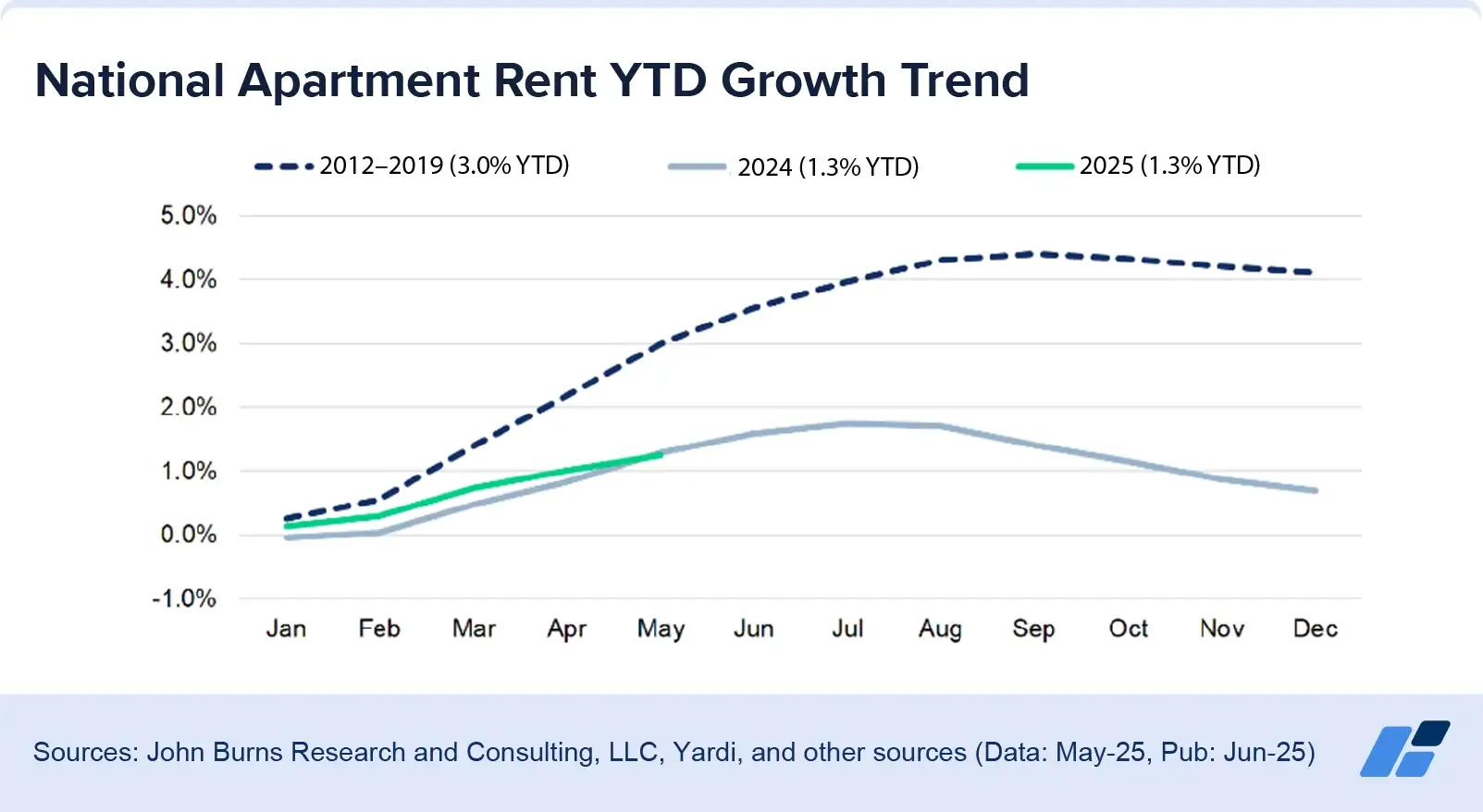

As reported by John Burns Research and Consulting, after a pandemic-driven boom in construction and cheap capital, the multifamily reset is beginning to take shape. The 2025 rent growth is tracking at just 1.3% year-to-date—well below typical spring levels. But this slower pace signals a healthier, more stable cycle.

Regional Divergence Takes Shape

Sunbelt markets like Austin, Denver, and Phoenix are still working through a wave of new supply. But demand remains intact, especially in the long run.

Meanwhile, cities like New York, Boston, Chicago, and Seattle are outperforming. Their tighter construction pipelines and steady demand are supporting stronger fundamentals.

Occupancy nationwide hovers around 94%. Class A buildings in oversupplied markets face higher vacancies and deep concessions. In contrast, Class B and C assets are more stable.

Renting Still Wins

Homeownership remains out of reach for many. Elevated mortgage rates and record ownership premiums are keeping renters in place longer.

After two years of flat rents and rising wages, rent-to-income ratios have returned to normal. That creates room for modest rent increases in 2026.

As long as mortgage rates stay high, renting will remain the more affordable choice in most metros.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Supply Drops, Capital Watches

New construction starts are down to levels last seen in the early 2010s. With deliveries slowing and demand steady, supply overhang should fade by late 2025.

Transactions remain limited due to interest rate uncertainty. But capital is finding its way back.

Institutional investors are focusing on top locations with long-term potential. Private buyers are chasing distressed or all-cash deals.

What’s Next

The next rental cycle is already underway—ushering in a multifamily reset defined by quieter growth but stronger fundamentals.

Today’s success will come from operational focus and steady demand—not chasing fast growth. For well-capitalized investors, this could be the time to re-enter the market.

Why It Matters

This isn’t a downturn—it’s a reset. Slowing supply, solid demand, and a growing renter base are laying the groundwork for the next growth phase.

With ownership still out of reach for many, the rental market is positioned to regain pricing power in the coming years.