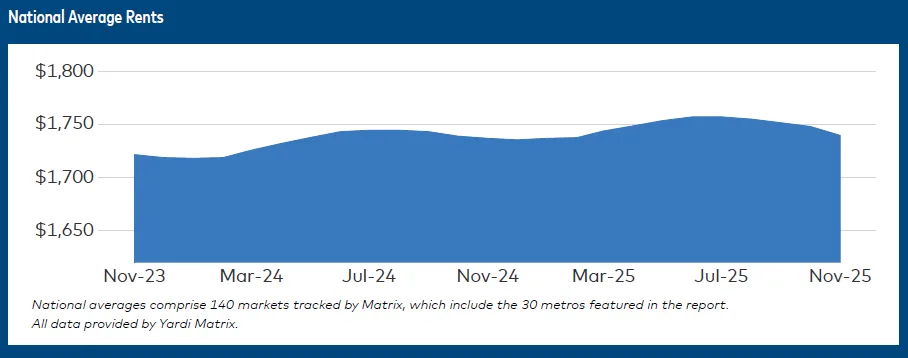

- National average rents fell $8 in November to $1,740, with year-over-year growth slowing to 0.2%, the weakest since early 2021.

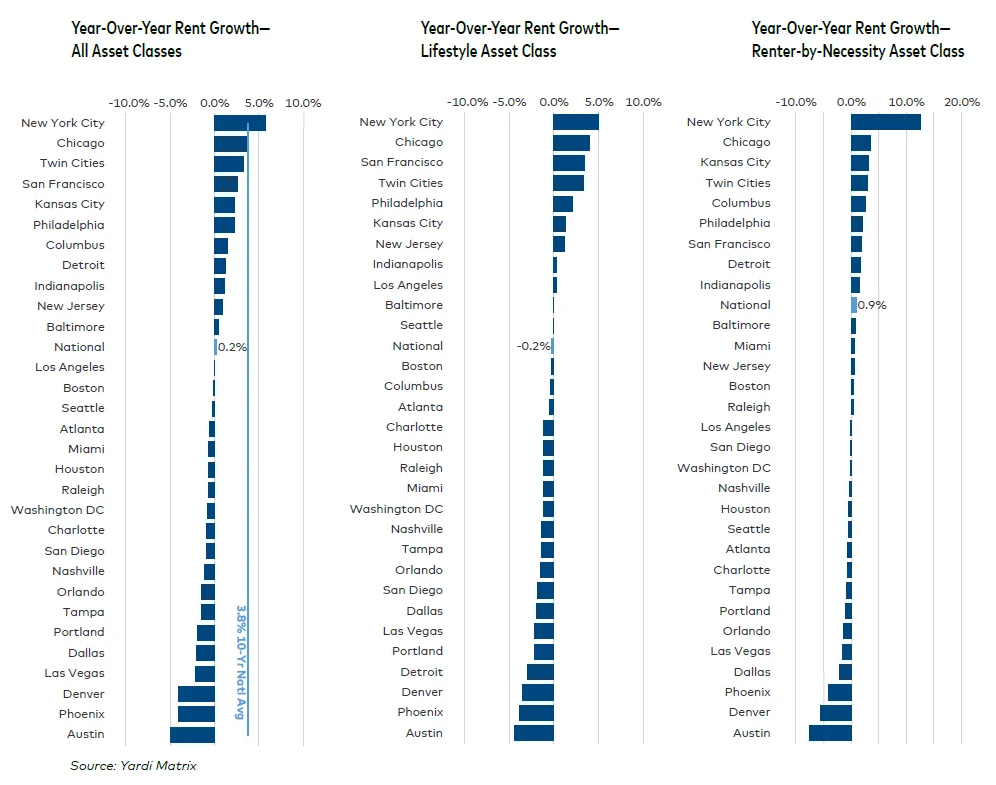

- Negative rent growth is now widespread, impacting 90% of top 30 metros, including recent strongholds like San Jose, San Francisco, and New Jersey.

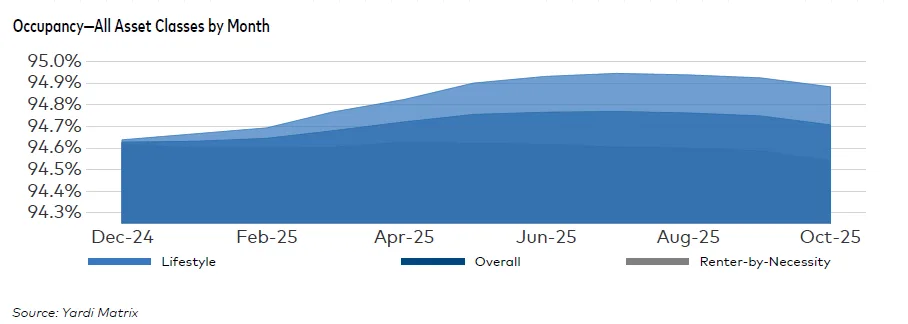

- Occupancy rates remain stable at 94.7%, but softening demand and high deliveries are expected to keep pressure on rents heading into 2026.

Rents Decline Amid Cooling Demand

US multifamily advertised rents dropped again in November, reports Yardi Matrix. It marked the fourth straight monthly decline as the average rent fell to $1,740. That’s down $17 from the summer peak, per Yardi Matrix. Year-over-year growth has dwindled to just 0.2%, a stark contrast to the pandemic-era surge.

Supply-demand Imbalance Worsens

The sluggish rent performance reflects deeper structural concerns. Metros with strong historical absorption—such as Austin (-5.0%), Phoenix, Denver (both -4.1%), and Dallas (-2.0%)—are now grappling with overbuilding and waning demand. These markets are dealing with elevated vacancies despite solid absorption levels, suggesting a widening mismatch between deliveries and leasing activity.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Even Top Performers Are Slipping

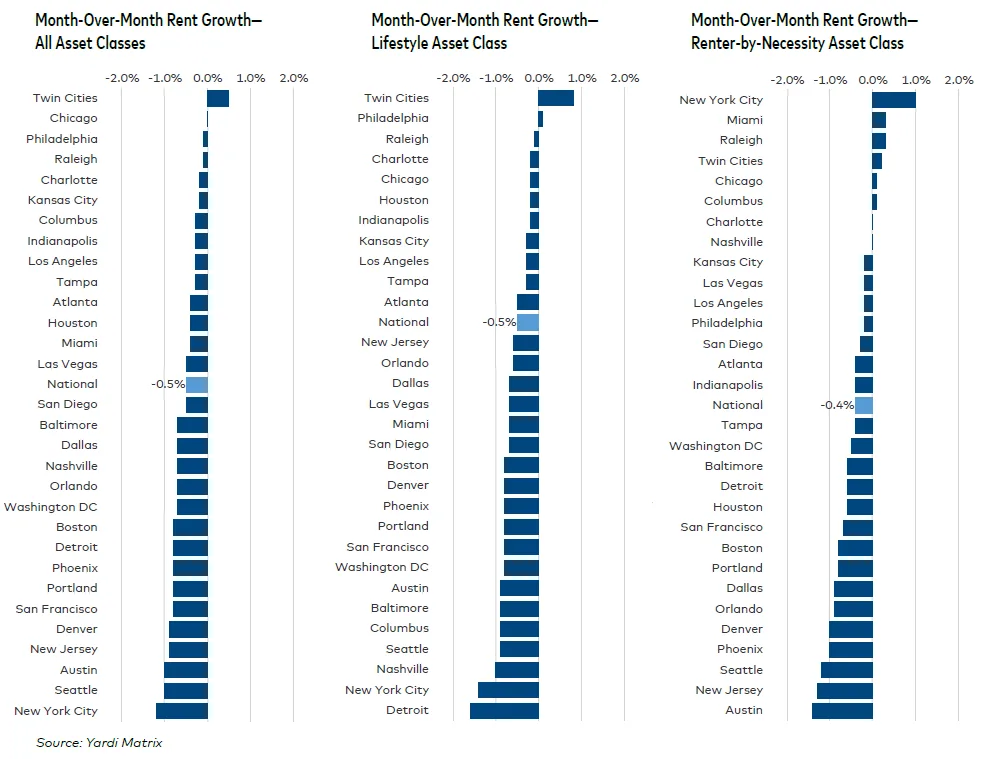

The rent weakness is no longer isolated to high-supply Sun Belt markets. November brought rent declines to New Jersey, San Francisco, San Jose, and Columbus—markets that had posted above-average rent growth in recent years. The Twin Cities was the only major metro to post positive monthly rent growth.

Lifestyle VS. Renter-By-Necessity Divergence

Lifestyle properties continue to drive the downturn, falling 0.5% month-over-month, while the Renter-by-Necessity segment slipped a milder 0.4%. For example, in New York, RBN rents rose 1.0%, but Lifestyle rents dropped 1.4%, dragging overall performance negative.

Occupancy Remains Resilient… For Now

Despite declining rents, national occupancy held steady at 94.7% in October. Some markets, including Atlanta (+0.9%), San Francisco, and Phoenix (+0.4%), even posted gains. But others like Indianapolis (-0.5%), Washington DC, and Miami (-0.2%) saw small declines without clear causes.

Why It Matters

This sustained rent dip signals that developers and investors may need to brace for a more prolonged soft patch. With year-end absorption slowing, consumer confidence weakening, and immigration policies tightening, demand-side headwinds are taking their toll. Meanwhile, a robust pipeline of deliveries continues to flood the market, making rent growth recovery uncertain.

What’s Next?

Rent growth is projected to remain modest or negative in many metros for the rest of 2025. Markets like Austin, Phoenix, and Denver, with 2025 completion rates exceeding 5% of total stock, face the greatest downside risk.

Still, historically resilient metros like New York (5.7% YoY) and Chicago (3.8%) continue to post strong growth, thanks to tighter supply and urban demand.