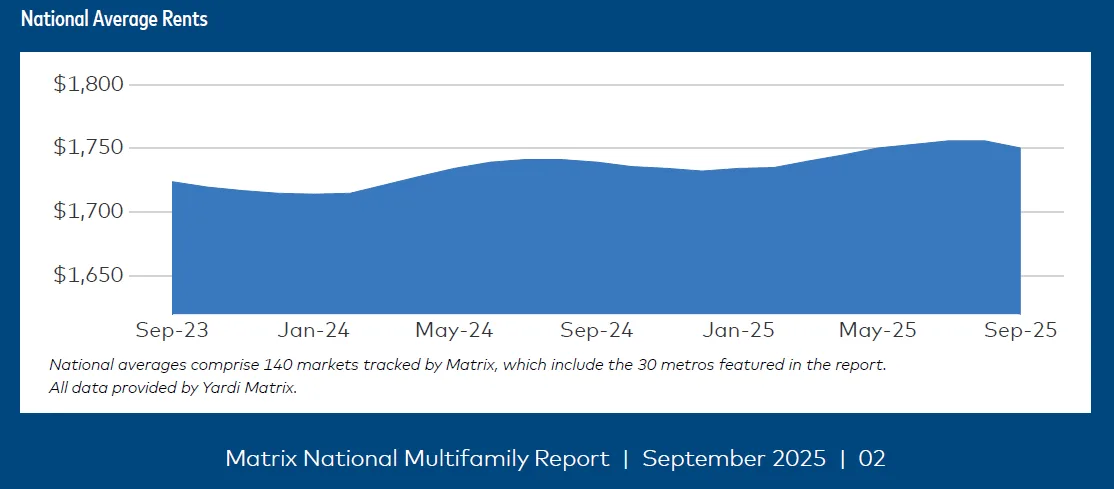

- US average multifamily rent fell by $6 to $1,750, the largest September drop since 2009 and the worst monthly decline since late 2022.

- A glut of new supply, particularly in high-growth Sun Belt markets, is intensifying leasing competition and pushing rents down.

- While demand is softening, renting continues to outpace homeownership due to affordability issues in the for-sale market.

A Cooling Market

US multifamily advertised rents saw a notable $6 drop in September—down to $1,750—signaling potential softening after years of record-setting rent levels.

According to Yardi Matrix, this marks the sharpest September rent decline since 2009 and the worst monthly performance since November 2022.

The pullback is being driven by an influx of supply and waning economic momentum. Over 525,000 units are currently in lease-up nationally, with metros like Dallas, Phoenix, Austin, and Charlotte facing the greatest pressure due to high concentrations of new product.

Rent Leaders and Laggards

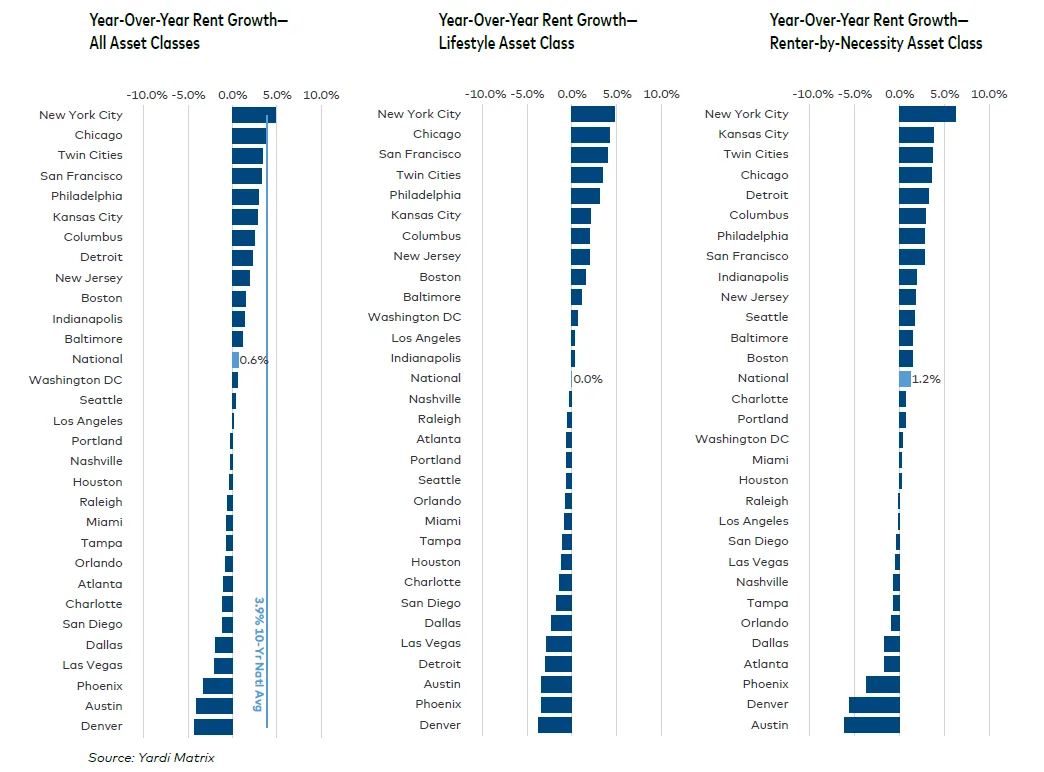

While national rent growth slowed to just 0.6% year-over-year, a handful of markets bucked the trend. New York (4.8%), Chicago (3.9%), and the Twin Cities (3.4%) posted the strongest annual rent gains. In contrast, high-supply markets saw the sharpest declines: Denver (-4.3%), Austin (-4.0%), and Phoenix (-3.3%).

The Single-Family Build-to-Rent (BTR) segment also faltered, with average rents falling $15 to $2,194, the worst performance since 2015. Annual growth in the segment is now flat, with national BTR occupancy holding at 95.1%.

Economic Drag and Demographic Shifts

Labor market softening is adding to the multifamily sector’s challenges. Unemployment ticked up to 4.3% in August with job creation slowing significantly. Consumer confidence is slipping, and more households report expectations of income declines, potentially hampering household formation.

Long-term demographic shifts could further reshape demand. A Harvard study projects household growth to slow to 840,000 per year, down from 1.5M in the previous decade. However, the good news for multifamily is that a greater share of new households are expected to rent instead of buy.

Why It Matters

With affordability pushing more people into rentals, multifamily remains structurally supported. According to Harvard, roughly 2M renter households are expected to form over 2024 and 2025—nearly double the long-term average.

However, the current supply-demand imbalance is weighing on rents. Developers in high-supply metros are increasingly turning to concessions and price cuts to fill units. Until the lease-up backlog is absorbed, rent growth is likely to remain under pressure.

What’s Next

The Federal Reserve’s recent rate cut—its first in nine months—may offer some relief by improving financing conditions and potentially boosting consumer confidence. Meanwhile, tight for-sale market conditions could continue to bolster multifamily demand in the medium term.

As the sector enters the final quarter of 2025, eyes are on whether a seasonal rebound materializes or if September’s rent dip is the first sign of a broader slowdown.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes