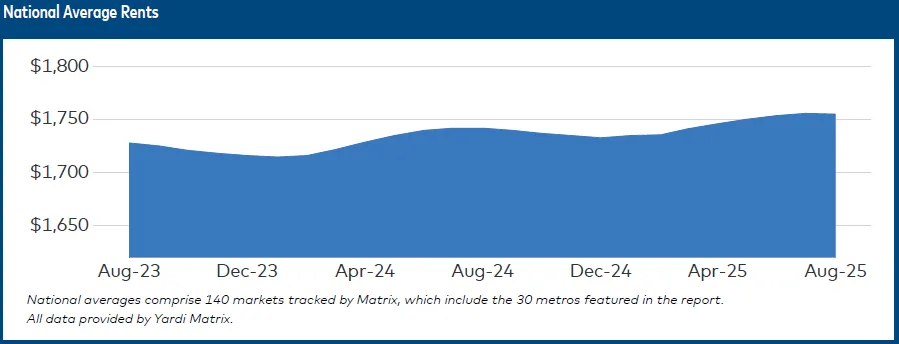

- US average multifamily rent dropped by $1 in August to $1,755, with annual rent growth slowing to 0.7%, reflecting limited momentum as the year progresses.

- Elevated new deliveries have intensified competition, but new construction is now declining due to high costs and tighter financing.

- Federal rate cuts expected in the coming months could revive deal flow and financing activity, though major impacts may remain limited.

Seasonal Slide In Rents

Multifamily rents in the US inched down $1 in August, settling at an average of $1,755, reports Yardi Matrix. The modest decline is in line with typical seasonal patterns, but also reflects broader economic caution and fading momentum in rent growth. Year-over-year rent growth cooled to 0.7%, down from recent highs and signaling slower market conditions ahead.

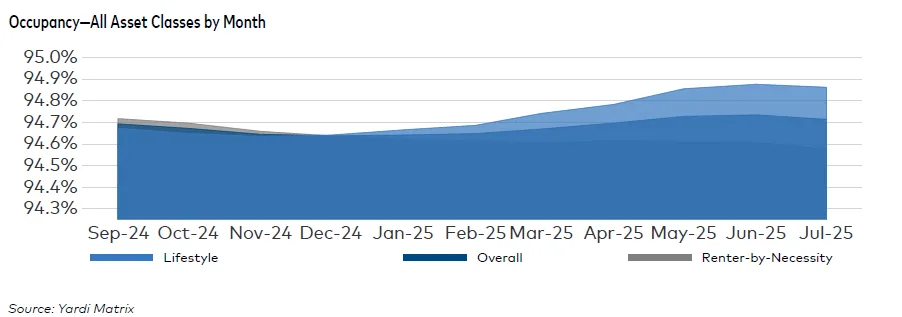

Despite the softening, national occupancy remains steady at 94.7%, unchanged from the prior year, underscoring ongoing demand—even as affordability tightens.

Supply Still Outpacing Demand

A key drag on rent growth is oversupply. Many metros are just past their peak construction activity, but new deliveries continue to flood the market in areas like Austin, Charlotte, and Orlando. At the same time, new apartment starts are falling sharply, hit by soaring construction costs and tighter lending standards.

Some metros, particularly in the Midwest and Northeast, bucked the trend. Cities like Chicago (4.0%), Columbus (3.3%), and Twin Cities (3.2%) led annual rent gains, while supply-heavy Sun Belt markets like Austin (-4.5%), Denver (-3.8%), and Phoenix (-2.8%) saw rents decline.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Interest Rates Could Nudge The Market

The Federal Reserve is expected to cut interest rates by at least 25 basis points in September, with further reductions possible by year-end. These cuts could spur refinancing and help rescue some underwater deals. They may also slightly ease construction financing costs. However, the report notes they are unlikely to fully revive housing activity or reverse the cooling rent trend.

Many would-be homebuyers are sidelined by high mortgage rates. As a result, they are expected to remain in the rental market longer, helping sustain multifamily demand.

Policy Action Gaining Steam

In response to surging housing costs and stalling supply growth, policymakers are taking action. Over 20 states have adopted new pro-housing laws in 2025, and more than 400 housing-related bills have been introduced nationwide.

Legislation ranges from easing lot size restrictions in Texas to streamlining environmental reviews in California. At the federal level, lawmakers have increased funding for Low-Income Housing Tax Credits to support affordable housing. While positive, these efforts will take years to materialize into actual housing units, especially as developers remain cautious amid a high-cost environment.

What’s Next?

Short-term rent growth is expected to remain muted, with the Midwest and Northeast likely to continue outperforming Sun Belt and Mountain West markets. Nationally, rent increases may not gain traction again until spring 2026—if economic and supply conditions improve.

Meanwhile, the market remains in a holding pattern. Strong occupancy and steady (albeit slowing) demand are keeping the sector resilient. Affordability remains stretched, and new competition continues to enter the market. As a result, operators may need to stay aggressive on leasing and concessions heading into the fall.