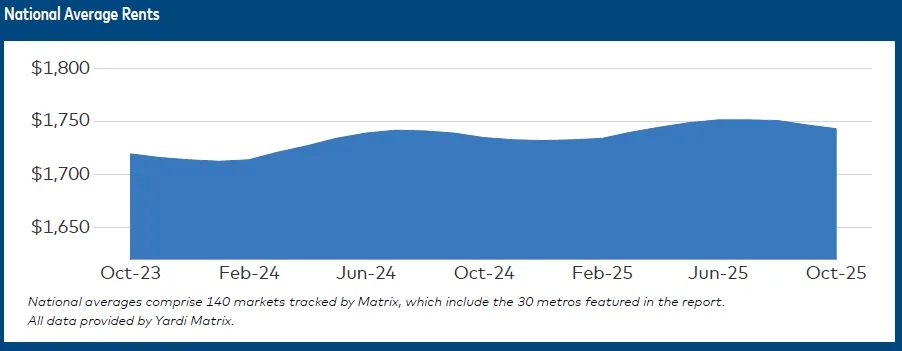

- US multifamily rents fell $4 in October to $1,743, with year-over-year rent growth flat at 0.5%.

- Declining absorption, persistent inflation, and labor market weakness point to a cooling multifamily sector.

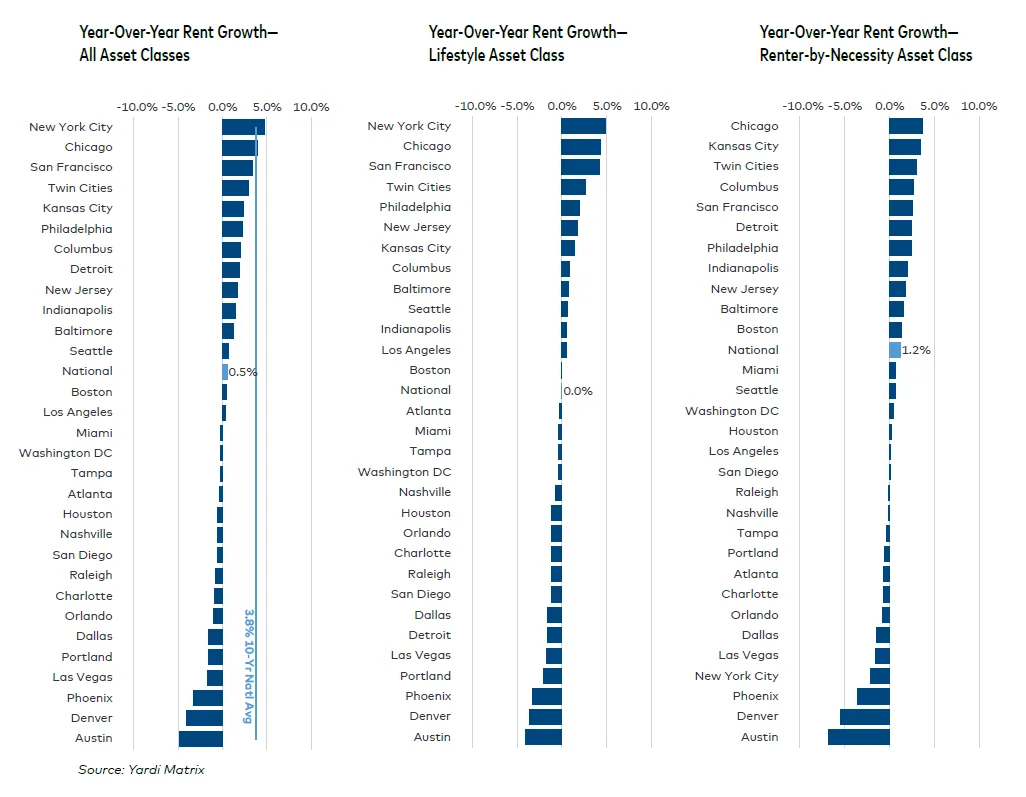

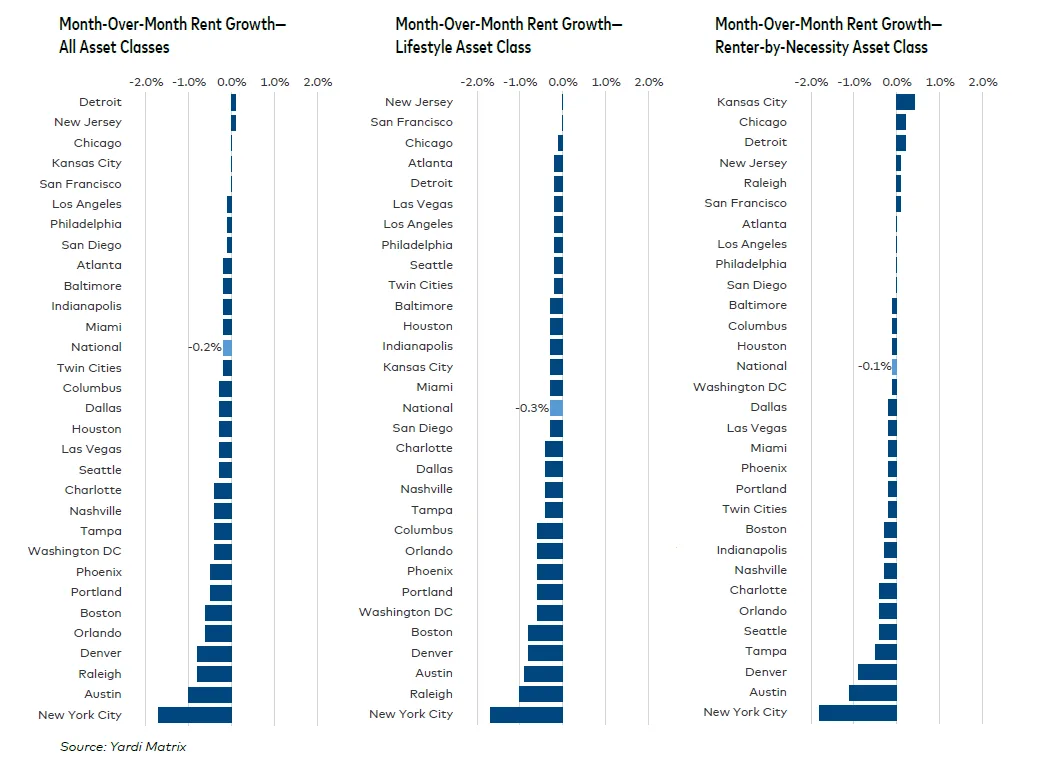

- High-supply Sun Belt and Western metros saw the steepest rent drops, while Midwest and gateway markets led in rent growth.

A Market In Transition

October marked the third straight month of rent declines, with national average rent down to $1,743, reports Yardi Matrix. Rent growth held steady at 0.5% year-over-year. The figure reflects broader economic headwinds, including weak consumer sentiment, a cooling labor market, and persistent inflation. With financial pressure mounting, some renters are opting to double up or move back in with family.

Demand Cracks Emerge

Apartment absorption dropped in Q3 to 110K units, well below the 185K-unit average seen in the first half of 2025. The Midwest led the deceleration, with the Southeast and Southwest close behind. Operators in oversupplied markets like Austin, Charlotte, and Orlando are ramping up concessions. Some now offer one or two months of free rent—even on renewals—to maintain occupancy.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Where Rents Are Growing (And Shrinking)

Despite national softness, rent growth remained strong in several major metros. New York (4.7%), Chicago (3.9%), and San Francisco (3.4%) led the way. At the other end of the spectrum, high-supply Sun Belt and Western markets are feeling the pinch: Austin (-4.8%), Denver (-4.1%), and Phoenix (-3.3%) all posted steep annual declines. In total, rents fell in 25 of Matrix’s top 30 metros on a month-over-month basis, with New York, Austin, and Raleigh leading the drop.

Occupancy Is Stable, For Now

The national occupancy rate ticked down slightly to 94.7% in September but remains 0.1% higher than a year earlier. Some high-supply metros, including Austin and Denver, held occupancy flat year-over-year, while Atlanta, Charlotte, and Phoenix posted modest gains due to stronger absorption.

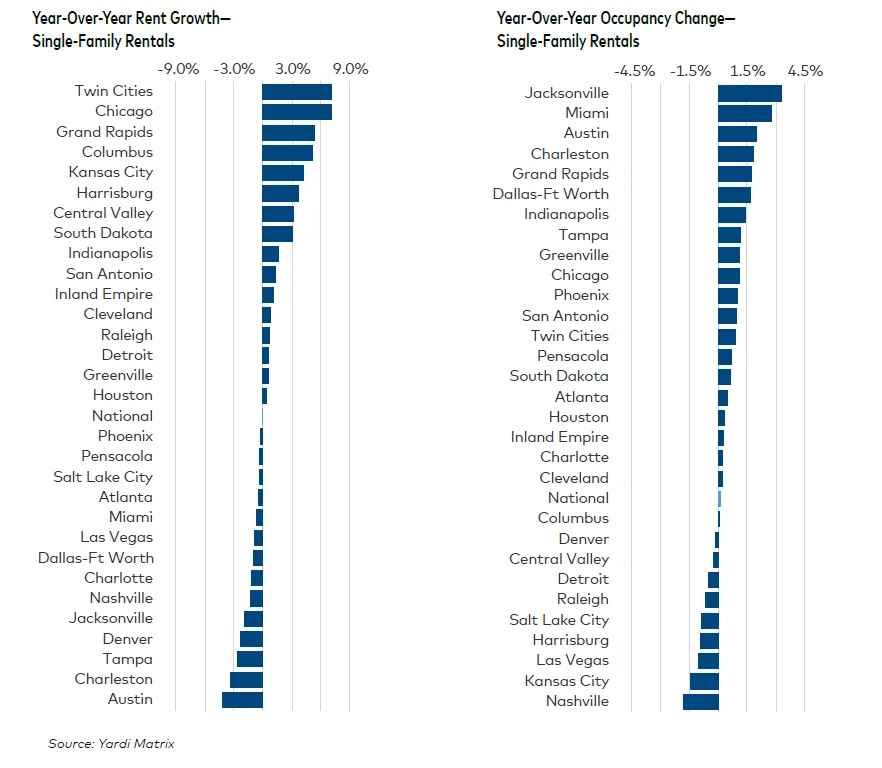

Build-To-Rent Pressure Grows

Single-family build-to-rent (BTR) rents fell $6 in October to $2,195, now flat on a year-over-year basis. The Midwest led BTR growth, with Chicago and the Twin Cities both posting 7.0% annual increases. However, Sun Belt markets struggled—Austin (-4.2%), Jacksonville (-1.9%), and Nashville (-1.3%)—as weak for-sale housing demand and competition from accidental landlords dragged on rents. National SFR occupancy remained solid at 95.1%, boosted by stability in renter-by-necessity assets.

The Outlook

The slowdown in rent growth and absorption underscores a broader economic shift. Mixed signals—from weak job creation and cautious consumer behavior to AI-driven productivity gains and deregulation—suggest a transitional economy. Yardi Matrix expects multifamily performance to remain soft through the end of 2025, though well-located assets in low-supply markets may outperform. As economist Mark Zandi noted recently, while the economy is under pressure, a recession remains unlikely.

Why It Matters

As developers retreat and concessions rise, multifamily investors and operators are entering a new phase defined by caution, selectivity, and adaptation. Market fundamentals remain intact, but pricing power is clearly slipping—especially in oversupplied growth metros.