- Multifamily rentals account for 33% of US rental stock, overtaking single-family rentals at 31%—a record low for single-family homes.

- Only 13.7% of single-family homes are renter-occupied, the lowest rate since at least 2011.

- Sun Belt and dense, expensive metros continue to see multifamily rental shares rise fastest.

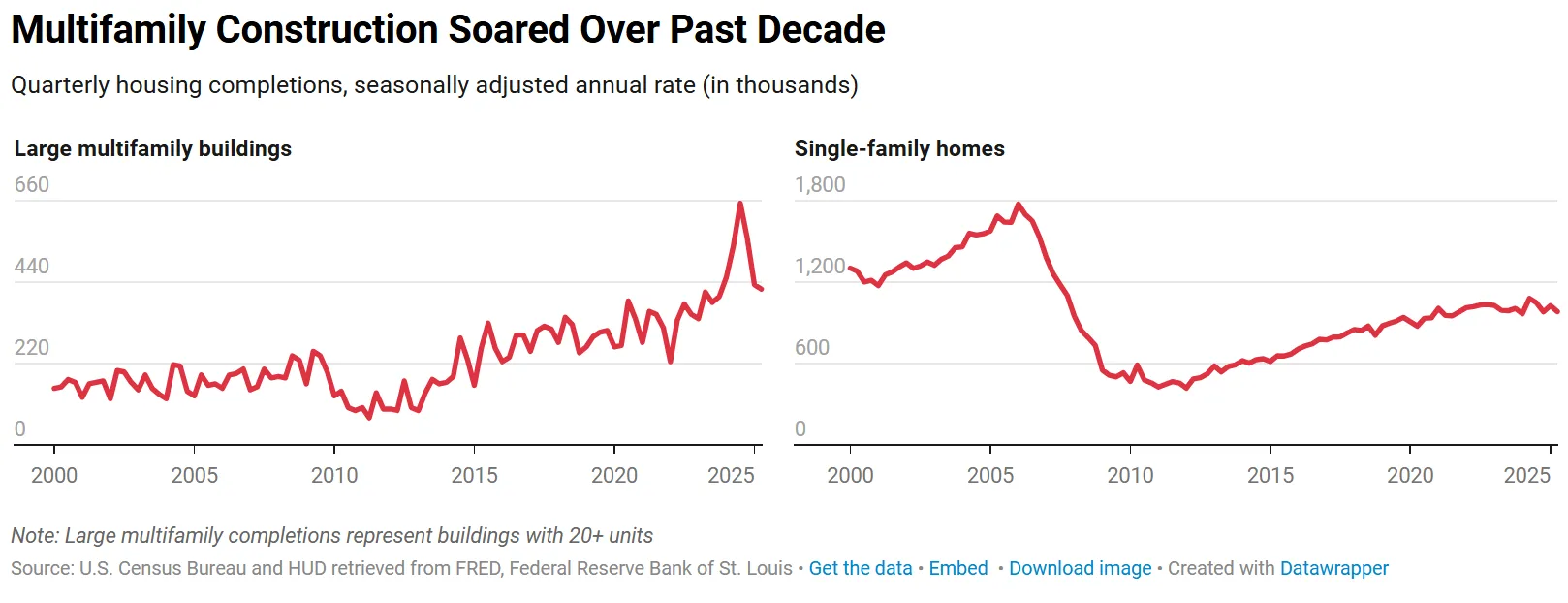

- Multifamily construction hit record levels in 2024 as single-family rental availability diminished.

Multifamily Rentals Dominate US Market

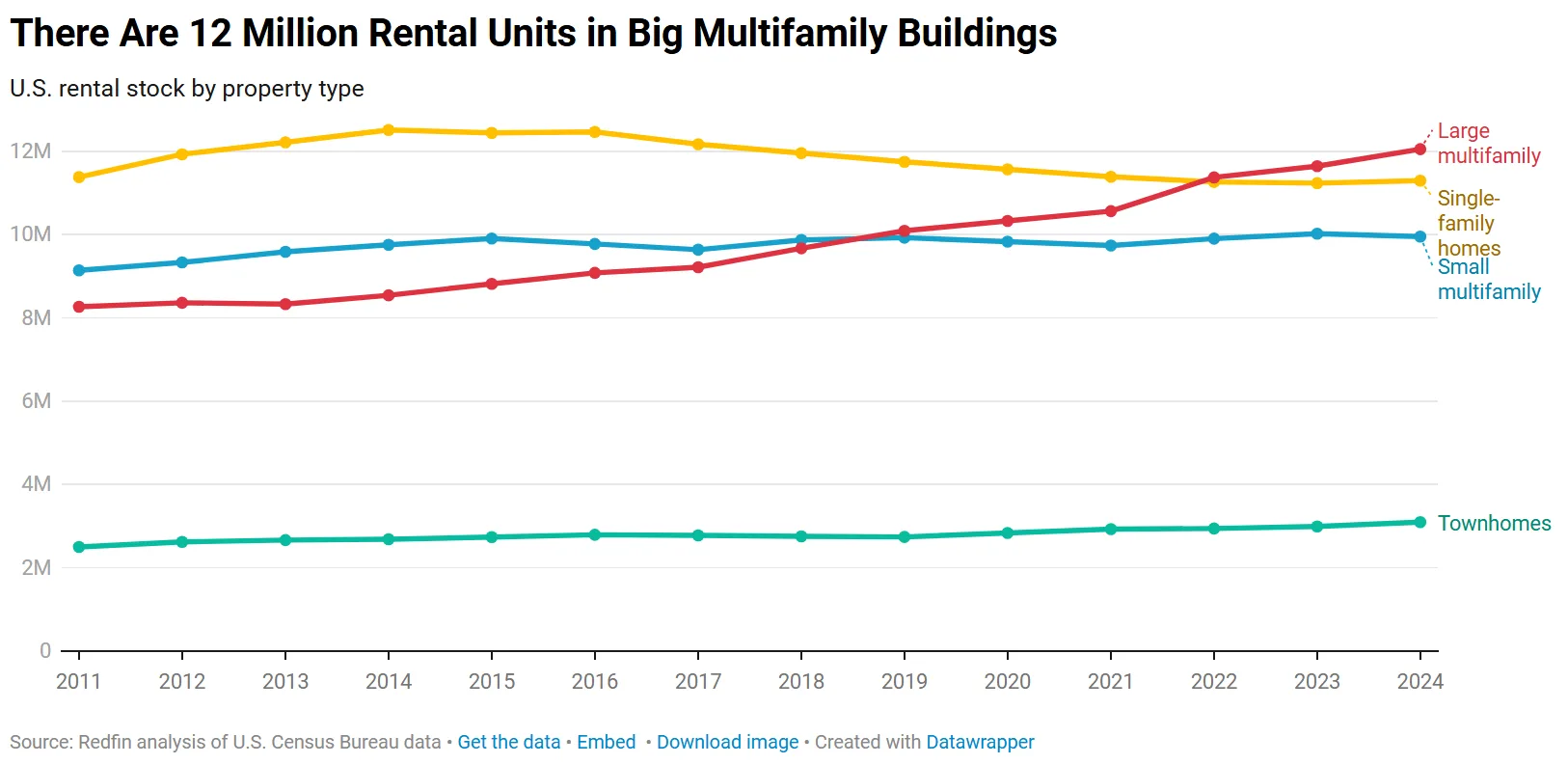

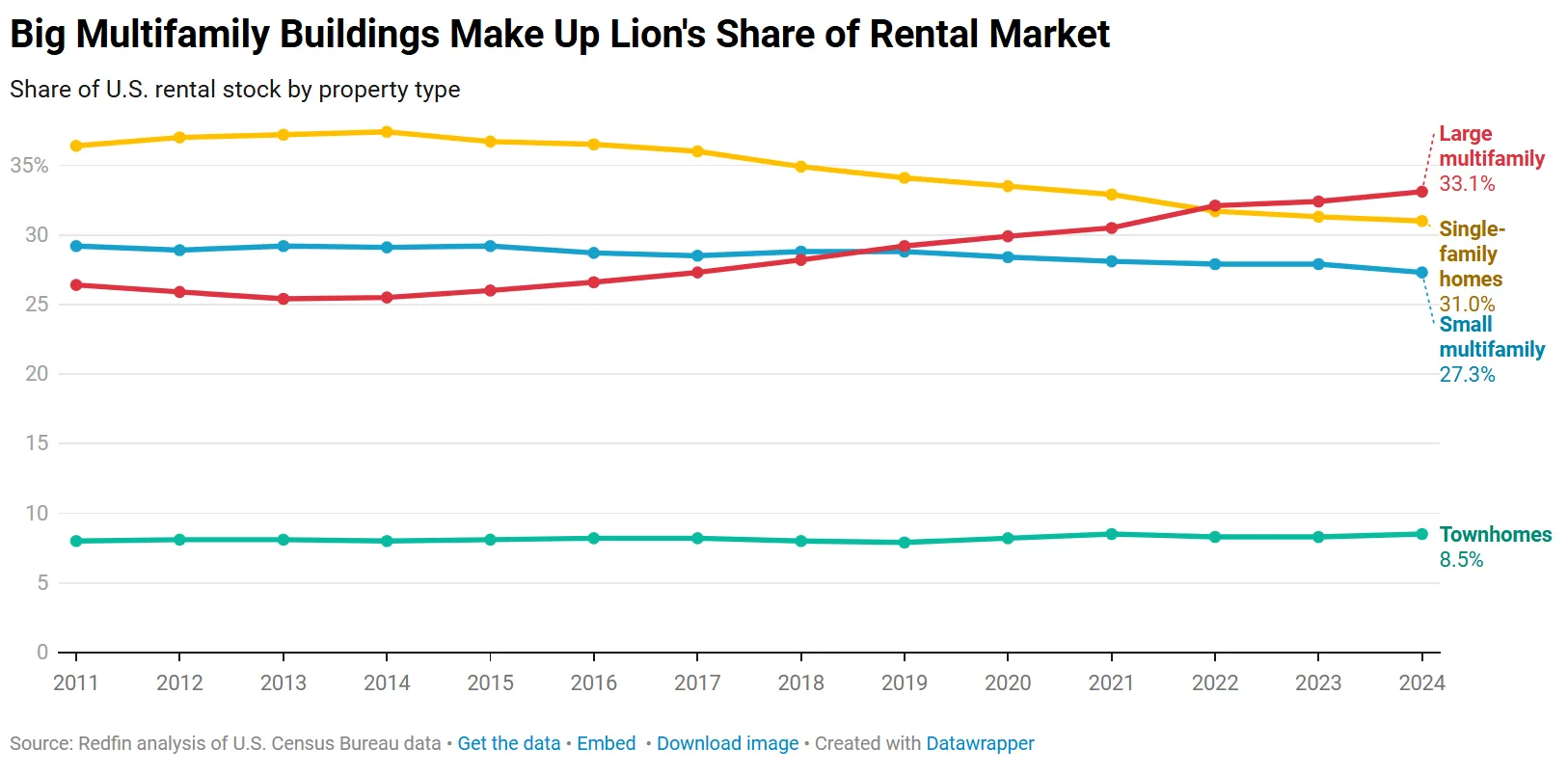

Redfin News reports that the US rental housing market has marked a major shift: for the first time, large multifamily buildings make up the largest share of rental units nationwide. As of 2024, 33.1% of all rentals are in buildings with 20 or more units, surpassing single-family homes, which now represent just 31% of rentals—their lowest level on record.

The decline in single-family rentals is sharp. Since 2021, when single-family homes were most common among rentals, the segment’s share has trended down. Building activity in the multifamily sector has ramped up, contributing to increased rental supply and putting downward pressure on rents in many regions.

Construction Trends Fuel Multifamily Growth

Recent years saw a surge in multifamily construction, particularly during the pandemic. Builders responded to strong rental demand and favorable financing conditions by delivering more large multifamily projects. In contrast, single-family construction, while also increasing, has not kept pace and remains below early-2000s highs. Most new single-family homes go directly to owner-occupants, further shrinking the rental pool.

This surge has led to more options for renters and slower rent growth, according to Redfin analysts. Total multifamily rental units reached a record 12.1M in 2024, compared to 11.3M single-family rentals—the third lowest on record.

Markets and Metro-Level Changes

Multifamily rentals are concentrated in urban, high-cost metros. In New York, multifamily units make up 69.1% of all rentals, the highest among major metros, with similar trends in Minneapolis, Seattle, Miami, and Boston. The lowest shares are in Virginia Beach, Cincinnati, and Detroit.

The Sun Belt stands out for rapid multifamily growth: Dallas led with a 17-percentage-point gain since 2014. Only two metros, Philadelphia and Anaheim, saw single-family rental shares rise. Most metros, especially in the West and South, now rely more on multifamily than ever before.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why It Matters

The multifamily rentals trend impacts investors, builders, and renters alike. For investors, multifamily assets offer scale and stable returns. Renters gain more choices and better negotiating conditions as supply grows. At the same time, single-family rentals continue to command premium rents and attract investor attention, underscoring how both asset types are evolving in parallel as key components of the rental housing landscape.