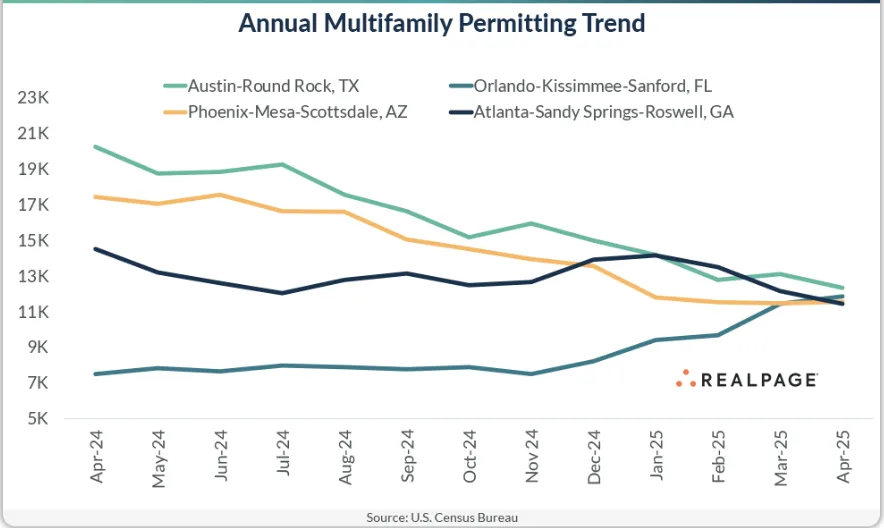

- Four major metros—Austin, Orlando, Phoenix, and Atlanta—clustered around 11,400 to 12,300 multifamily units permitted in the year-ending April, despite widely varying trends in 2023.

- Orlando was the only one of the four to see growth year-over-year, while Austin posted the sharpest decline, down nearly 8K units.

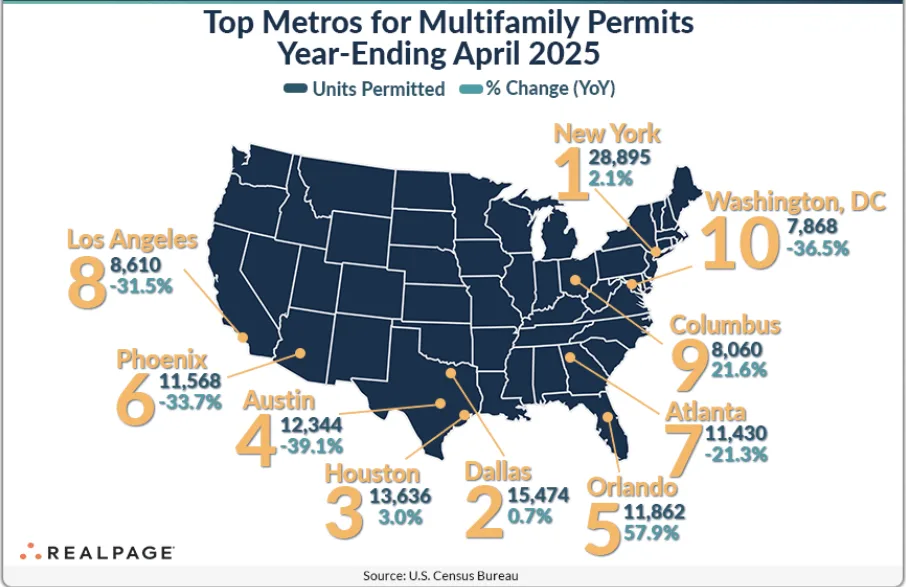

- Nationwide, New York remains the leader in permitting, while cities like Columbus, Chicago, and Anaheim saw notable year-over-year gains.

- Texas continues to dominate the list of top permitting localities, accounting for six of the top 20 permit-issuing places.

Converging Trends Among Key Markets

In a rare alignment, Austin, Orlando, Phoenix, and Atlanta—markets that had been on divergent permitting paths—each posted annual multifamily permit totals between 11,400 and 12,300 units, reports RealPage. This data comes from the latest US Census Bureau report for the year-ending April.

Orlando was the standout, increasing its annual permit total by 4,351 units compared to April 2023. Meanwhile, Austin’s total plunged by 7,910 units, Phoenix fell by 5,891 units, and Atlanta declined by 3,088 units over the same period.

Broader Market Movements

Los Angeles and Washington, DC also saw significant declines in annual permitting, each dropping by roughly 4K to 4,500 units. In contrast, New York, Dallas, and Houston posted modest gains.

Columbus, OH was a notable gainer with an increase of 1,431 units—up nearly 22% to 8,060 units permitted for the year-ending April.

New York continues to lead the nation in multifamily permitting, followed by Dallas, Houston, and Austin. Orlando, Phoenix, and Atlanta followed, with Los Angeles, Columbus, and DC rounding out the top 10.

Sun Belt Slowdown

Miami dropped out of the top 10, falling to #16 after permitting 3,186 fewer multifamily units year-over-year. Tampa also declined by over 3K multifamily units. Together, the two Florida metros recorded around 6,800 multifamily units permitted for the year—far below their prior pace.

Other metros with steep declines in multifamily permits included Denver (-2,866), Minneapolis-St. Paul (-2,748), Jacksonville (-2,690), Greensboro/Winston-Salem (-2,426), Salt Lake City (-2,268), and Seattle (-2,083). Fourteen other metros each declined by over 1K multifamily units.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Markets On The Rise

In addition to Orlando and Columbus, markets showing strong permitting growth included:

- Chicago: +2,240 units

- Anaheim: +1,721 units

- Fayetteville-Springdale-Rogers, AR: +1,710 units

- Omaha: +1,319 units

- Des Moines: +1,224 units

- Augusta, GA: +1,220 units

- Milwaukee: +1,190 units

Top Permit-Issuing Places

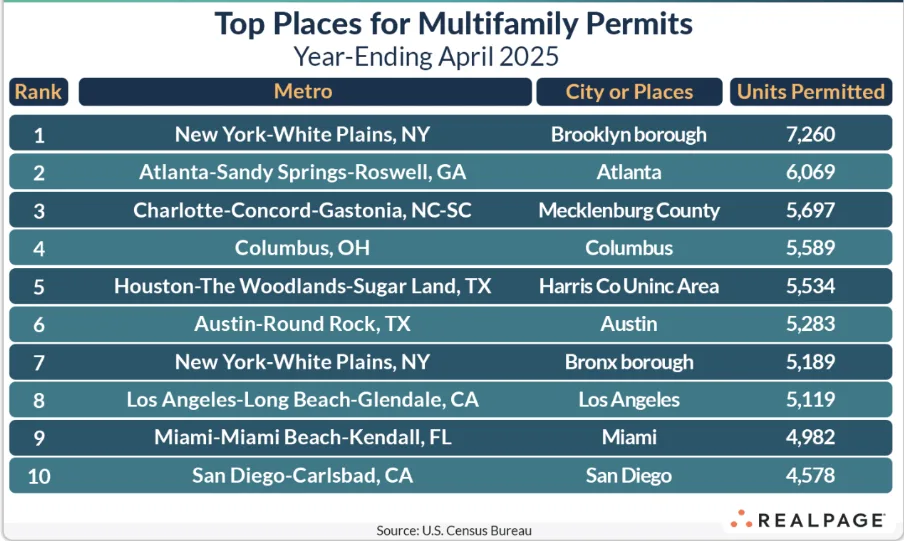

At the submarket level, Brooklyn, Atlanta, and Mecklenburg County (Charlotte) held the top three spots for multifamily permitting activity. Columbus, OH jumped to #4, followed by Unincorporated Harris County (Houston) at #5 and the city of Austin at #6—despite a broader metro slowdown.

Other notable localities included:

- The Bronx (#7)

- Los Angeles (#8)

- Miami (#9, down from #5 in March)

- San Diego (#10, displacing Unincorporated Travis County)

Texas remains the most active state at the local level, with six jurisdictions in the top 20. New York, California, Florida, and North Carolina each had two.

Why It Matters

The convergence in multifamily permitting signals shifting dynamics in development pipelines, particularly in high-growth Sun Belt metros where economic and supply-side pressures may be moderating new starts. While some markets pull back, others—especially in the Midwest and select secondary metros—are gaining momentum, pointing to a redistribution of multifamily development activity.

Expect further reshuffling ahead as interest rates, construction costs, and local market fundamentals continue to evolve.