- Starts are down nearly 50% from 2021, allowing demand to catch up.

- High home prices and mortgage rates keep many households in the rental market.

- National rents have declined slightly, but recovery is expected in 2026.

- Some owners are struggling to refinance, creating attractive deals for investors.

Market Finds Its Footing

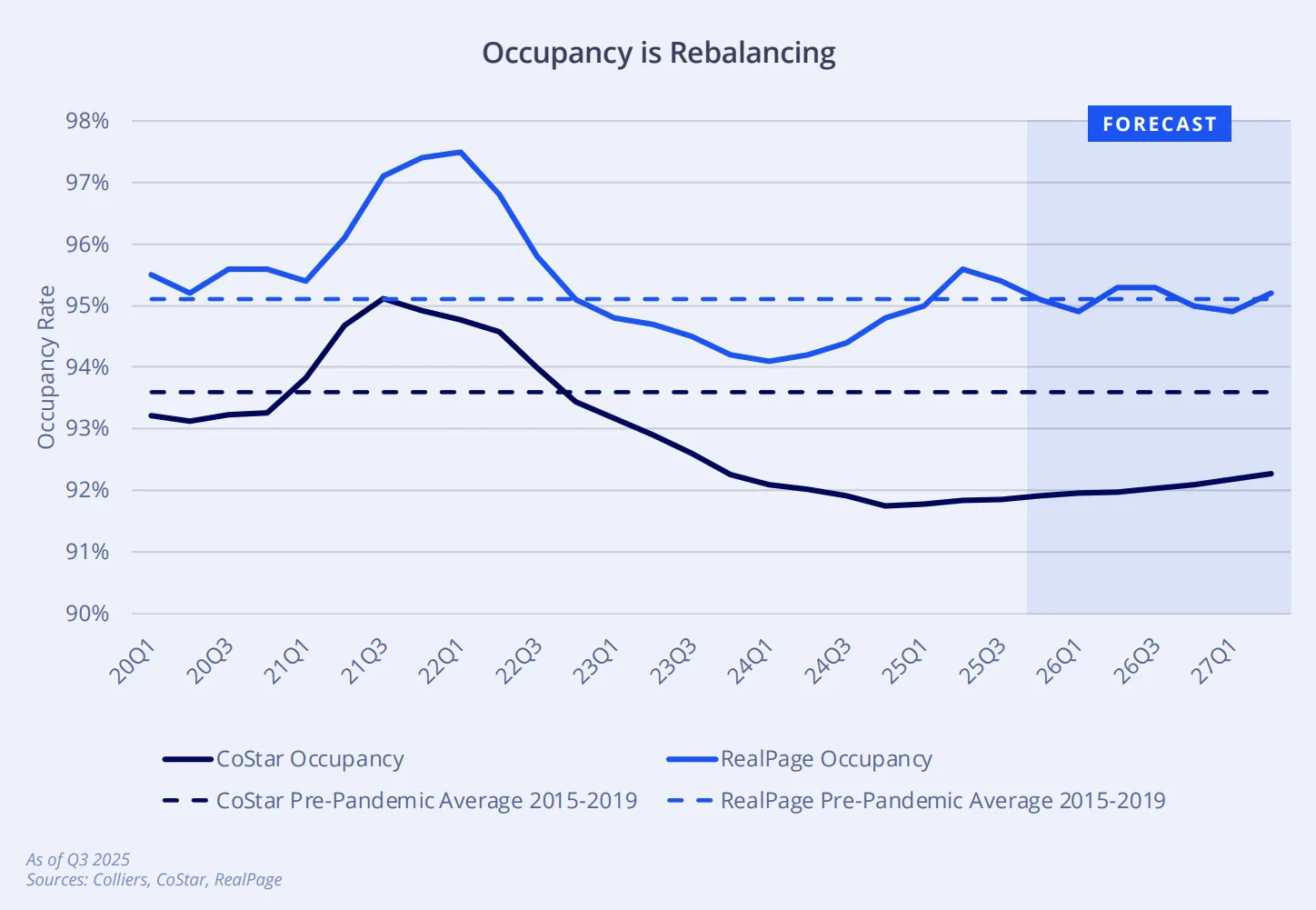

According to Colliers, the US multifamily sector is shifting toward stability. Although rents dropped 0.3% nationally in Q3 2025, occupancy held firm at 95.1%. Leasing slowed over the summer, but demand remains steady. High mortgage rates and expensive homes continue to price buyers out of ownership, keeping pressure on the rental market.

Development Slows, Supporting Recovery

Fewer new projects are starting. Construction costs, labor issues, and limited financing have cut new starts nearly in half since early 2021. More than 500,000 units are still under construction, with most activity in large cities like New York, Dallas, and Phoenix. Sun Belt markets such as Austin and Charlotte lead in new builds as a share of their total supply. This slowdown should ease pressure on rents and help bring balance back to the market.

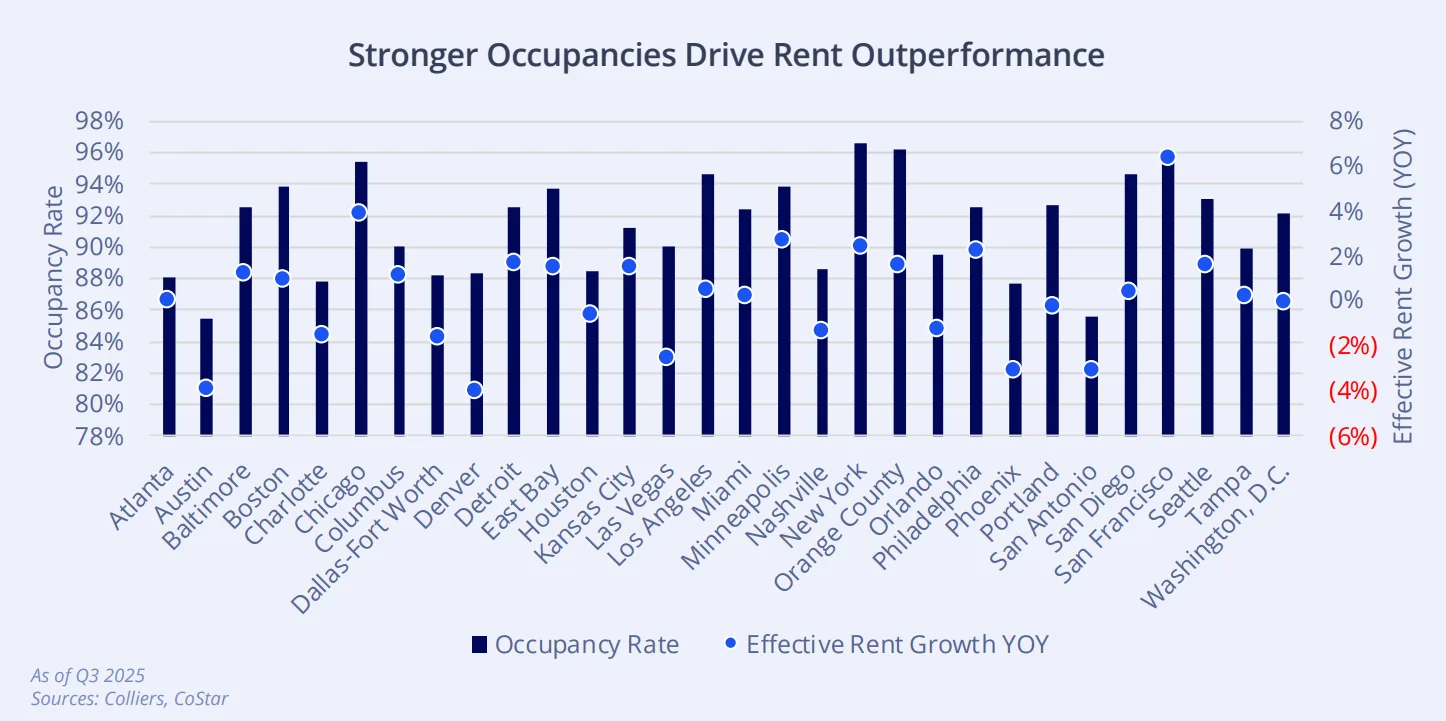

Rent Trends Vary Widely by Market

Rent growth has cooled. Nationwide, rents dropped about 1% over the past year, according to Green Street. However, the trend isn’t uniform. San Francisco, Chicago, and New York saw rent gains, while Austin, Denver, and Phoenix reported declines. Markets with fewer new units are seeing stronger growth. Analysts expect rents to bounce back by late 2026 as the current wave of supply gets absorbed.

Strong Demand Keeps Occupancy High

Despite slower leasing, demand continues to outpace normal levels. Many renters are staying put, unable to afford today’s home prices. This trend keeps occupancy stable, even in high-supply areas. Some renters are shifting into single-family rentals, but the overall impact on multifamily remains limited.

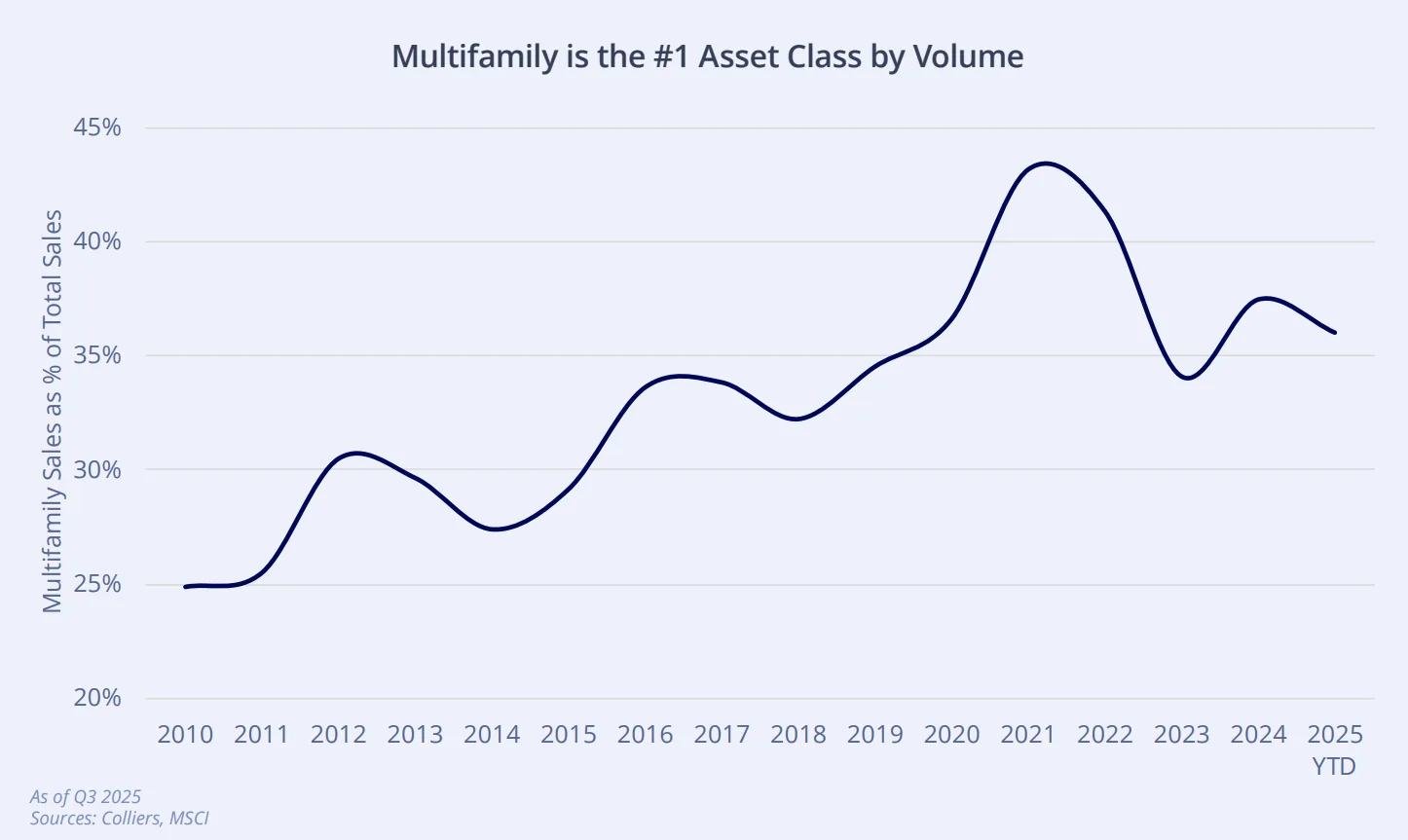

Capital Markets Stay Engaged

Investors are returning to the market. Multifamily continues to lead all asset classes by transaction volume. Cap rates hover around 5.2%, and competition remains strong. Debt is available from banks, agencies, life companies, and CMBS lenders. Many buyers are targeting assets below replacement cost or in markets with long-term growth potential.

Distress on the Rise—Slowly

Some properties bought at market peaks are now struggling to refinance. Special servicers are stepping in more often, especially with transitional assets. Most lenders are avoiding foreclosures for now, but more opportunities may emerge as billions in loans mature. Investors with capital are watching closely for deals.

Looking Ahead

Multifamily is positioned for a rebound. Slowing supply and solid demand are setting the stage for stronger rent growth in 2026. Markets with less construction, strong job growth, and lower homeownership rates should outperform. Meanwhile, investors are already moving capital back into the space, encouraged by clearer trends and better pricing.

“Investors are lining up to be in position for what should be stronger market performance in 2026 and beyond.”

— David Goodhue, Head of US Multifamily Capital Markets, Colliers.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes