- Chicago leads the nation in effective rent growth, jumping 8.1% year-over-year, with cities like Lexington, Omaha, and Cincinnati also surpassing 6% annual gains.

- Occupancy rates have climbed above 97% in several metros, including Northern New Jersey, New York, and West Michigan—signaling strong renter retention alongside rising rents.

- Despite a wave of new supply, key metros such as Dallas–Fort Worth, Austin, and South Florida continue to see strong absorption, proving that demand is keeping pace with deliveries.

Rent Growth Leaders Emerge

Chicago sits at the top of the multifamily rent growth leaderboard with a significant year-over-year increase. As of Q2 2025, effective rent reached $2,187, up 8.1%, as reported by Berkadia. Following closely are Lexington (7.3%), Omaha (7.0%), and Cincinnati (6.3%), reflecting a broader trend where Midwest and emerging markets outperform coastal cities. Other notable mentions include Madison, Cleveland, and Wichita, all posting year-over-year rent hikes exceeding 5%.

High Rent, High Retention

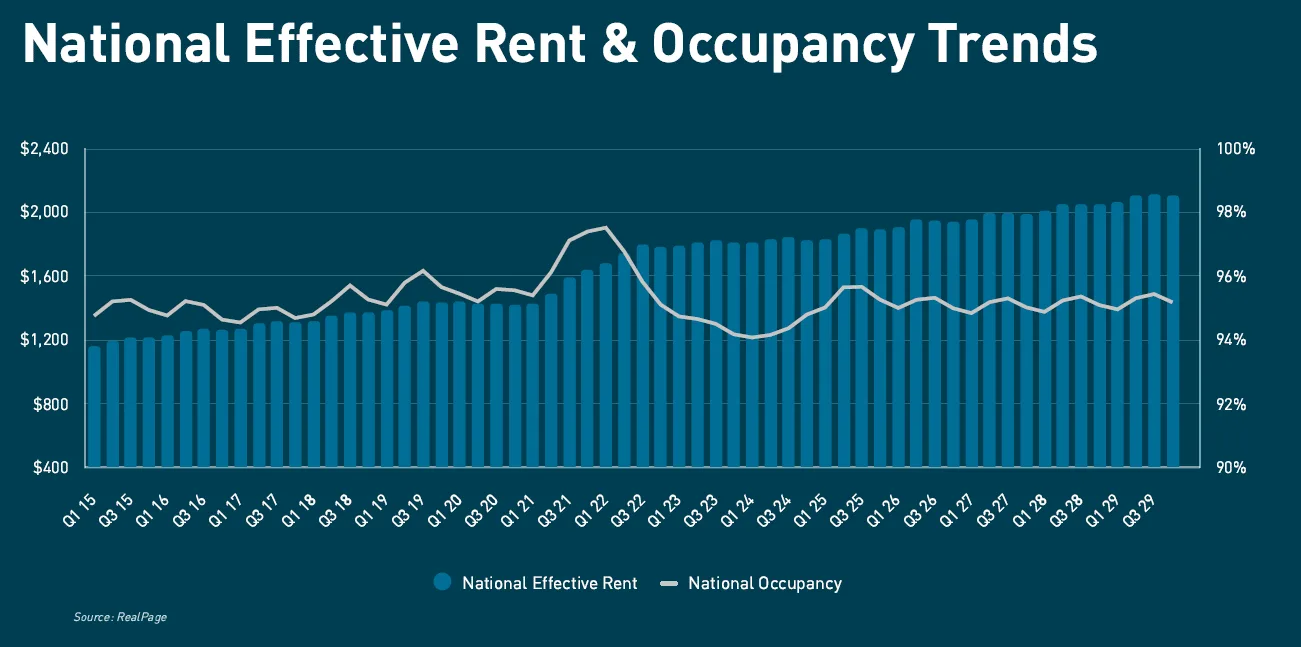

The standout aspect of 2025’s multifamily environment is the co-existence of rising rents and elevated occupancy. San Jose and Reno, for instance, reported effective rent growth of 5.0% and 4.9% respectively, while maintaining occupancy near or above 96%. Even stronger are Northern New Jersey, New York, and West Michigan, where occupancy has surpassed 97%. This marks a significant milestone in the market. It indicates a nearly full recovery from the supply-demand volatility seen earlier in the decade.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Development Still Surging In The Sun Belt

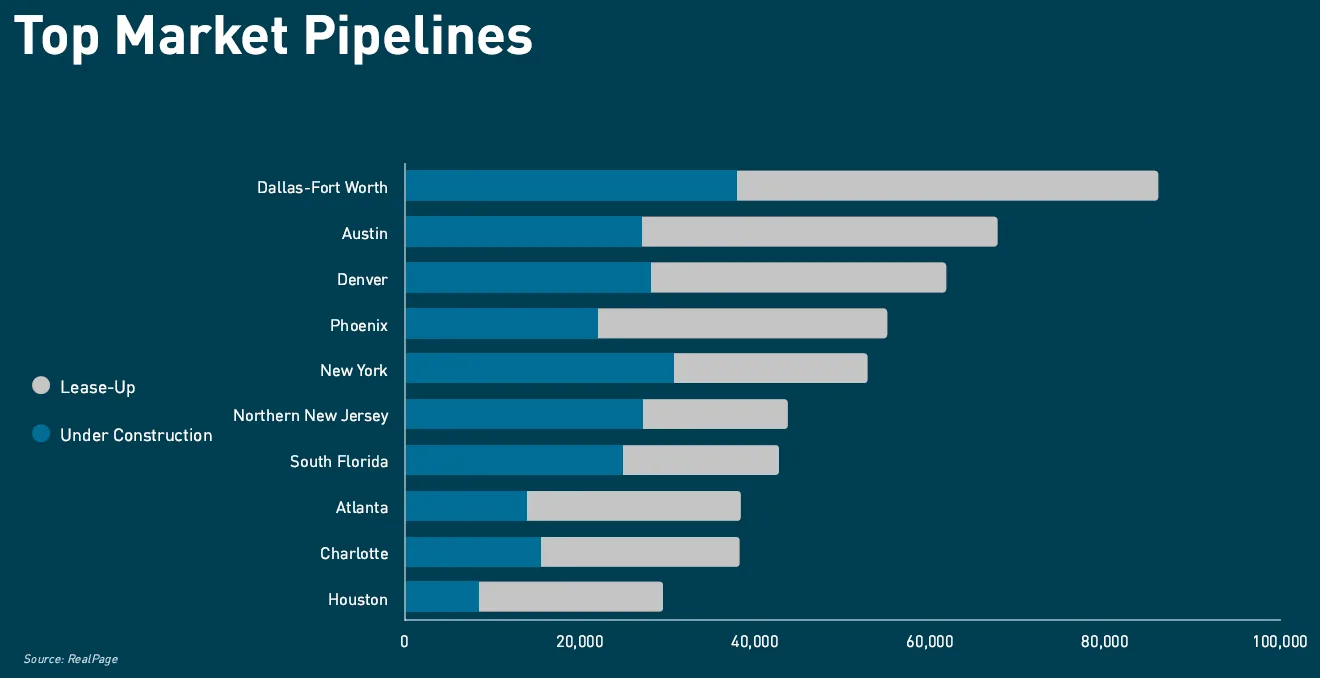

While demand is strong, supply hasn’t slowed in key markets. Dallas–Fort Worth continues to dominate the development pipeline, with more units under construction or in lease-up than any other US metro. Other cities with substantial pipelines include Austin, Denver, Phoenix, New York, and South Florida—highlighting continued investor confidence in high-growth regions.

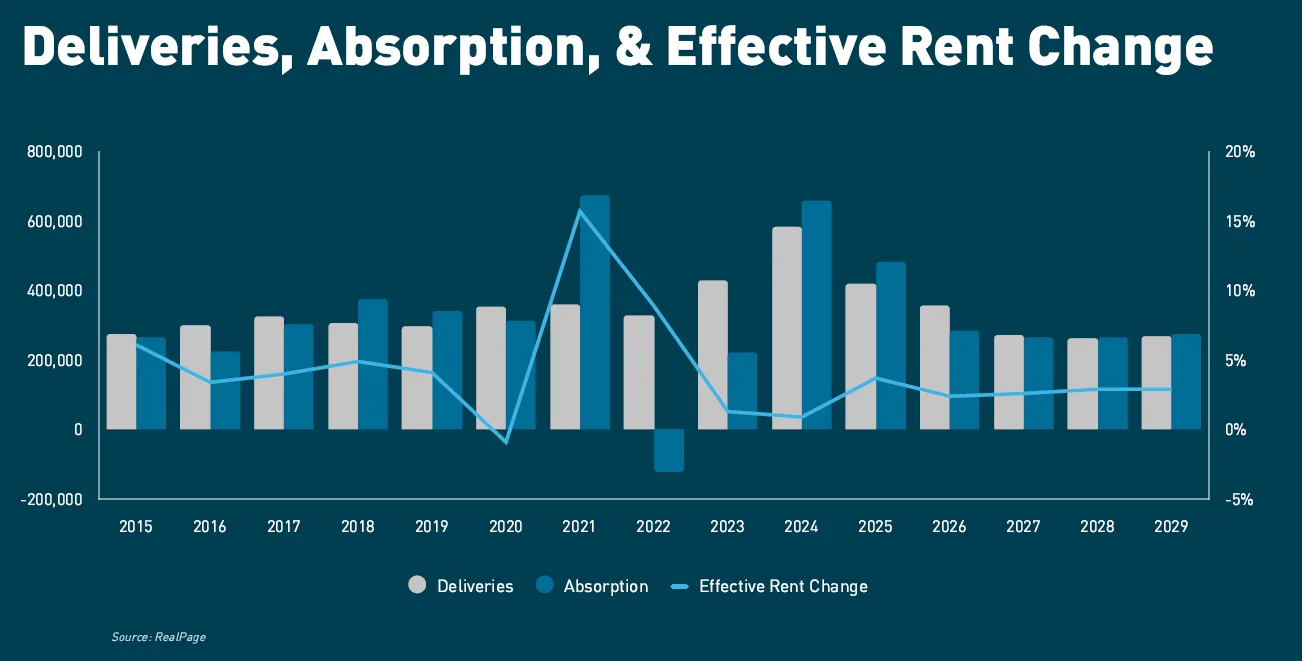

Despite concerns of oversupply, absorption is holding firm. Year-to-date absorption sits at nearly 379K units nationally, outpacing new deliveries of roughly 225K units—a trend expected to continue through the rest of 2025.

Labor Trends Powering Demand

Key to multifamily momentum is strong employment growth, particularly in healthcare and private education. As the Baby Boomer population ages, demand for healthcare services has spurred job creation, especially in metros that are seeing growing medical and educational hubs. This labor expansion supports household formation and apartment absorption even as interest rates remain high.

Rent VS. Mortgage: Rentals Stay Competitive

Nationally, effective rent rose 2.1% year-over-year to $1,869 in Q2 2025. Class A properties saw even stronger growth at 3.1%, with rents averaging $2,370—still $264 below the average monthly mortgage. High interest rates and home prices continue to steer households toward rentals. This trend is especially clear in urban areas, where homeownership remains out of reach for many.

Outlook: Resilience Amidst New Supply

With national occupancy hitting 95.7%—a three-year high—and rent growth holding steady, the multifamily sector appears poised for a strong finish in 2025. Markets with solid job growth, affordability advantages, and balanced supply pipelines are emerging as investor favorites. The report concludes that high occupancy and sustained rent growth are not mutually exclusive, but rather, increasingly linked in today’s high-demand environment.