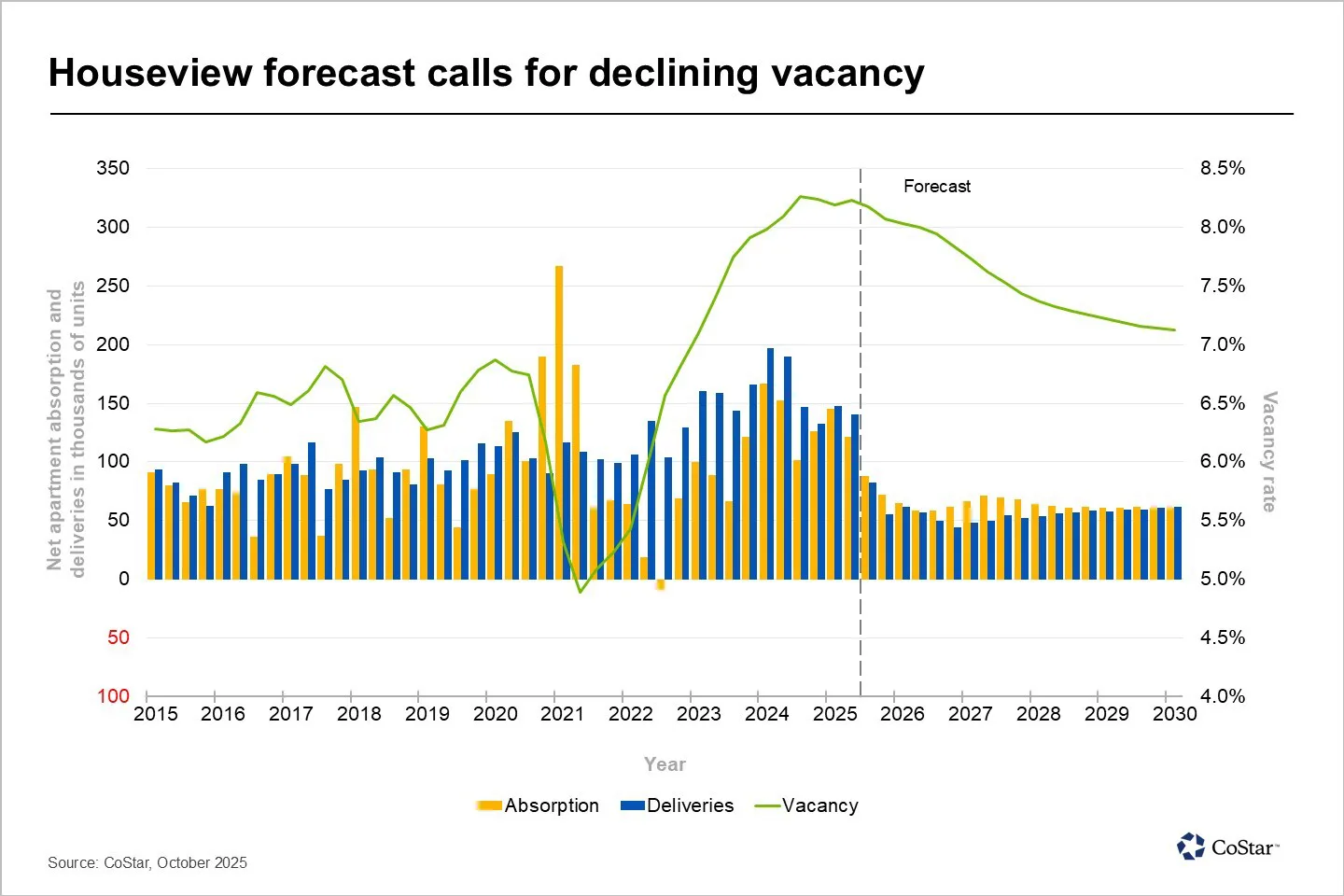

- CoStar revised its outlook, now expecting negative rent growth (-0.1%) in Q4 2025 and national vacancy to remain at 8.2% through year-end.

- Demand will outpace new supply for the first time in four years, but absorption will lag due to a weaker economy and slower immigration.

- New apartment deliveries are set to fall 28% in 2025 and another 55% in 2026, which could help vacancy improve in the long run.

- High-end apartments remain resilient, with falling vacancy and strong demand.

Rent Growth Turns Negative

Globe St reports that CoStar’s updated Houseview forecast takes a more cautious stance on multifamily performance. It now projects rents to decline by 0.1% in Q4 2025, a 160-basis-point drop from its previous estimate. Vacancy will stay at 8.2% through year-end, easing only slightly to 7.9% by the end of 2026.

Grant Montgomery, CoStar’s National Director of Multifamily Analytics, noted a shift ahead. In late 2025, renter demand is expected to exceed new supply for the first time since 2021. This shift may mark the start of a recovery, though a full rebound will take time.

Supply Drops, But So Does Demand

Apartment construction is slowing fast. CoStar expects deliveries to drop 28% in 2025 and 55% in 2026. Developers are pulling back amid higher costs and tighter lending.

At the same time, demand is losing steam. A weaker labor market, slower household formation, and reduced immigration will likely delay absorption in many oversupplied metros.

Montgomery added that lower immigration will continue to weigh on employment growth through 2030, putting long-term pressure on rental demand.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Luxury Assets Outperform

Top-tier apartments are holding up better than the broader market. CoStar reported that demand for 4- and 5-star properties is already outpacing new supply.

Vacancy in these high-end units fell from 11.9% in late 2024 to 11% in Q3 2025. CoStar expects another 30-basis-point drop by year-end. New luxury developments in lease-up are seeing strong absorption.

What It Means for Investors

Multifamily may see improvement, but not right away. Rents are likely to grow just 1.5% annually over the next five years—below the historical average.

Vacancy should decline in time, but investors can expect only modest gains. Markets with excess supply and weaker job growth may struggle longer.

Outlook

The multifamily sector is stabilizing, but slowly. Shrinking construction activity and steady demand will bring balance, though likely not before 2027.

Investors should prepare for a longer recovery window as macroeconomic headwinds persist.