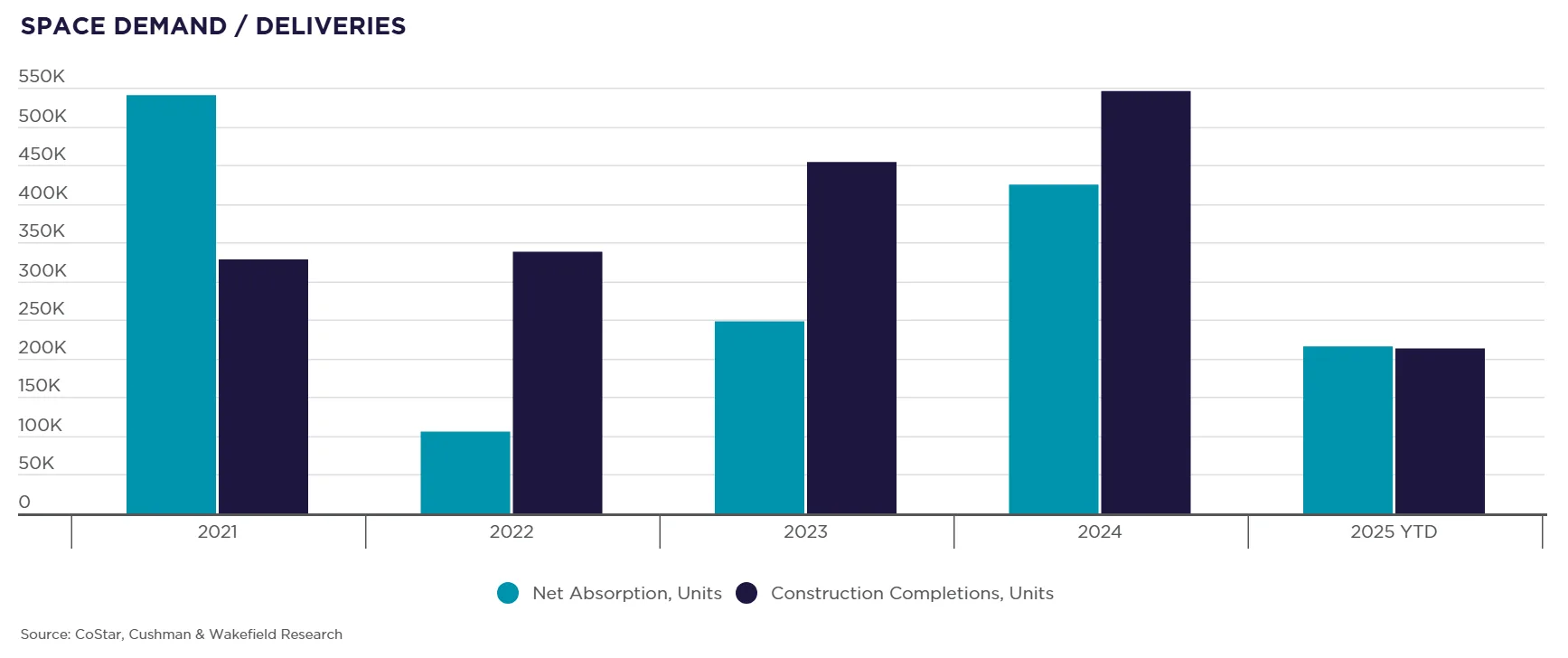

- Multifamily demand remains elevated, with 116,000 units absorbed in Q2 2025 — the sixth-highest quarterly absorption since 2000.

- Supply increased modestly, but the national construction pipeline dropped below 500,000 units for the first time since 2016.

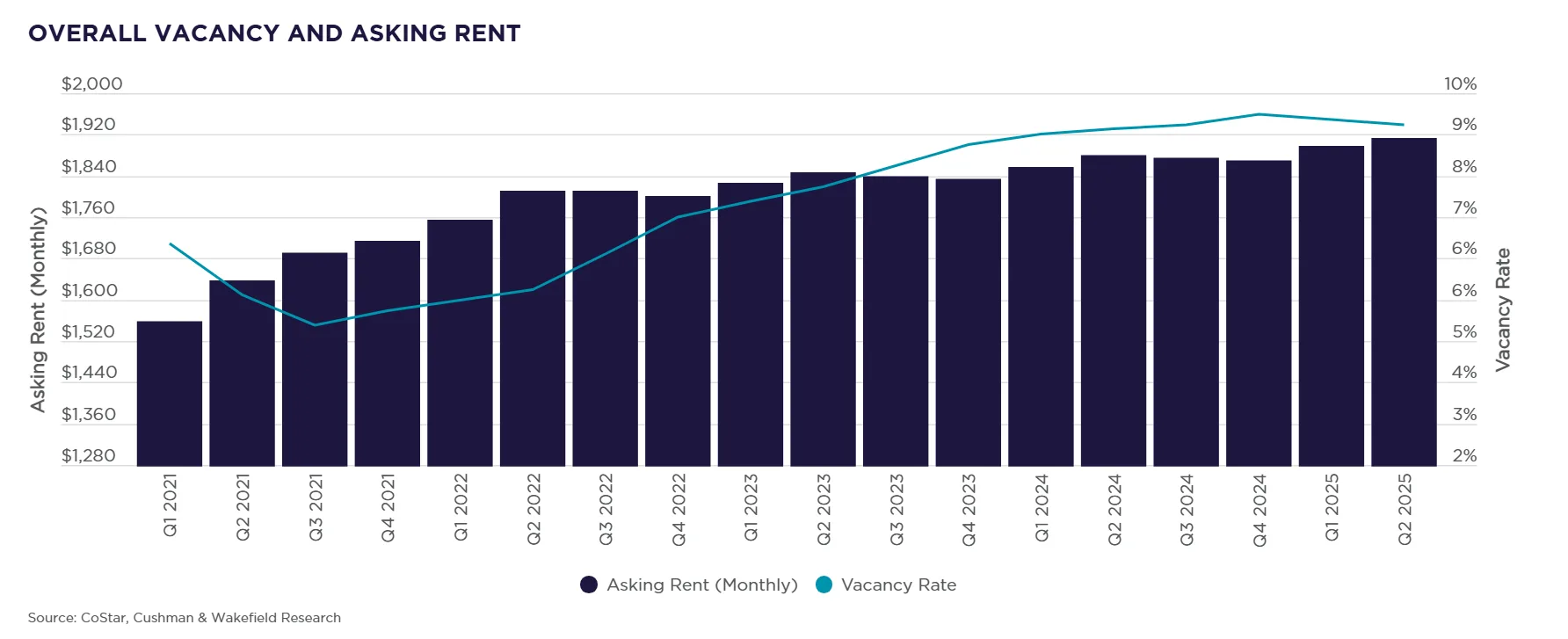

- Rent growth slowed to 1.7% annually, the sharpest deceleration since 2023, as property owners prioritized occupancy over pricing.

- Construction starts remain muted, with new development hindered by tight credit conditions and economic uncertainty.

Robust Demand, Subtle Signs of Cooling

Multifamily demand remained strong as the US multifamily sector absorbed over 116,000 units in Q2 2025, bringing year-to-date absorption to 216,000 — matching the pace of last year’s near-record total. For the second consecutive quarter, demand outpaced new supply, improving the vacancy rate for the first back-to-back quarterly decline since 2021.

However, seasonally adjusted data from Cushman & Wakefield shows early signs of softening. Historically, Q2 demand runs 30% higher than Q1; in 2025, it rose by only about half that. Consumer sentiment surveys also declined sharply during the quarter, hinting at potential demand headwinds ahead.

Occupancy Over Rent Growth

As economic uncertainty grows, multifamily owners have shifted toward maximizing occupancy rather than pushing rents. That approach is reflected in the Q2 rent data — annual rent growth slowed to 1.7%, a 50 basis point drop from Q1 and the sharpest QOQ deceleration in two years.

Rent growth also showed monthly weakness in May and June, coinciding with a surge in new supply and broader concerns about tariffs. While April rents rose 0.22% month-over-month, growth slipped to just 0.03% in June.

Still, some metros are outperforming. San Francisco led all US markets with 6.8% YOY rent growth, followed by San Jose and Chicago (both at 4.5%). New York and Northern New Jersey also posted over 3.5% gains — all ranking among the highest occupancy markets nationwide.

Construction Pipeline Hits 8-Year Low

The construction pipeline continues to shrink as financing remains tight. With just 3.8% of total multifamily inventory under construction, the market is seeing its lowest development levels since 2016. New starts have slowed to 2012-era levels, and total pipeline volume dropped below 500,000 units — a 50% reduction from 2023’s peak.

Out of all tracked markets, only 11 saw any increase in new starts over the past year, most adding just one or two projects. Major declines were seen in Dallas/Ft. Worth (-22,000 units), New York (-18,000), and Austin (-18,000), with Phoenix, Atlanta, and Houston also seeing notable pullbacks.

Why It Matters

With multifamily demand still outpacing supply but rent growth softening, the US multifamily sector is entering a more cautious phase. Developers face financing constraints, consumers are growing wary, and rent strategies are shifting — all pointing to a market that is healthy, but increasingly defensive.

As the pipeline continues to contract and construction delays persist, a tighter supply landscape could provide support for fundamentals heading into 2026 — assuming demand remains resilient.

What’s Next

Watch for how sustained economic uncertainty, interest rates, and consumer confidence impact multifamily absorption in the second half of 2025. With less new inventory on the horizon, markets with strong occupancy and limited supply could see upward pressure on rents in 2026.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes