- Multifamily construction surged in low-density regions like micro counties and outlying metros, with market share increasing from 7.8% to 10% year-over-year.

- Large metro core counties saw their multifamily market share decline by 4.8 percentage points, signaling a construction slowdown in urban cores.

- Single-family construction growth slowed across the board, with the steepest drop seen in large metro areas.

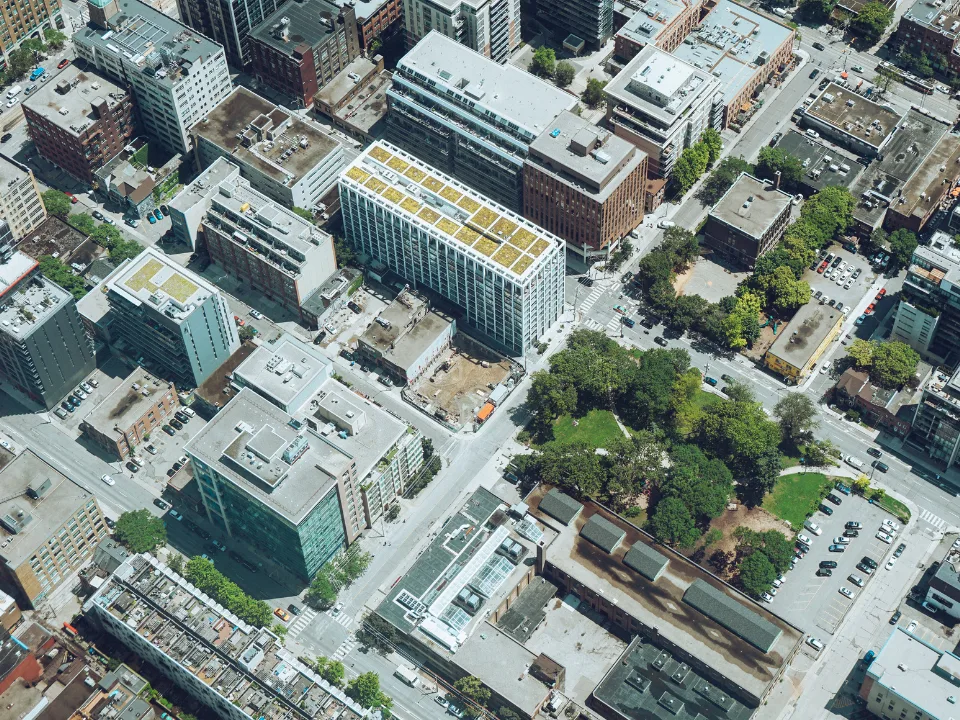

Multifamily construction is booming in unexpected places, per GlobeSt. According to the latest Home Building Geography Index (HBGI) from the National Association of Home Builders, the strongest growth in Q1 2025 came from smaller metros and rural regions—not the nation’s biggest cities.

Suburban Shift

The biggest construction gains occurred in low-density areas. Combined, small metro outlying counties, micro counties, and non-metro/micro areas grew their market share by 2.2 percentage points—from 7.8% to 10%.

Micro counties alone saw a 29.3% increase in multifamily permits. Large metro outlying areas rose by 33.2%, the highest level since mid-2022.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Urban Slowdown

Large metro core counties, which still lead in total construction volume, saw their market share drop by 4.8 percentage points. Developers appear to be shifting focus away from urban centers.

Renter Trends Confirm the Shift

These results line up with recent research from Point2Homes. That study found renter growth in suburbs is outpacing growth in five of the 20 largest US metros. Developers are now expanding in suburban towns and nearby communities.

Single-Family Slowdown

While multifamily construction surged, single-family growth declined. Large metro areas fell from 9.4% to 1.3%, a drop of 8.1 percentage points.

Small metro core counties saw the strongest single-family growth at 3.2%. Non-metro/micro areas declined by 0.4%.

Why It Matters

This geographic shift in development reflects changing affordability and lifestyle preferences. Builders are chasing demand where land is cheaper and buyers are moving.

What’s Next

Expect more multifamily investment in suburban and rural areas through 2025. As demand spreads outward, construction will likely continue to follow.