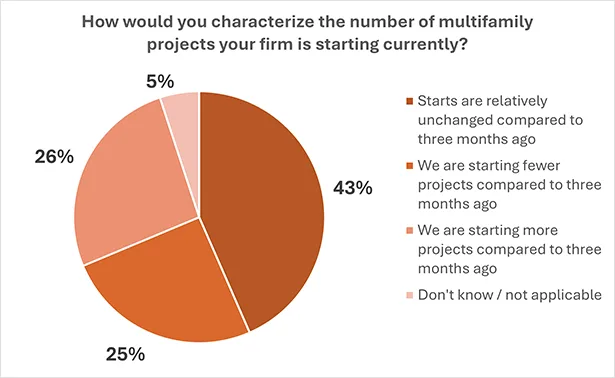

- Construction starts have stabilized, with 43% of developers reporting activity unchanged from three months ago, signaling a potential turning point after sustained declines since 2022.

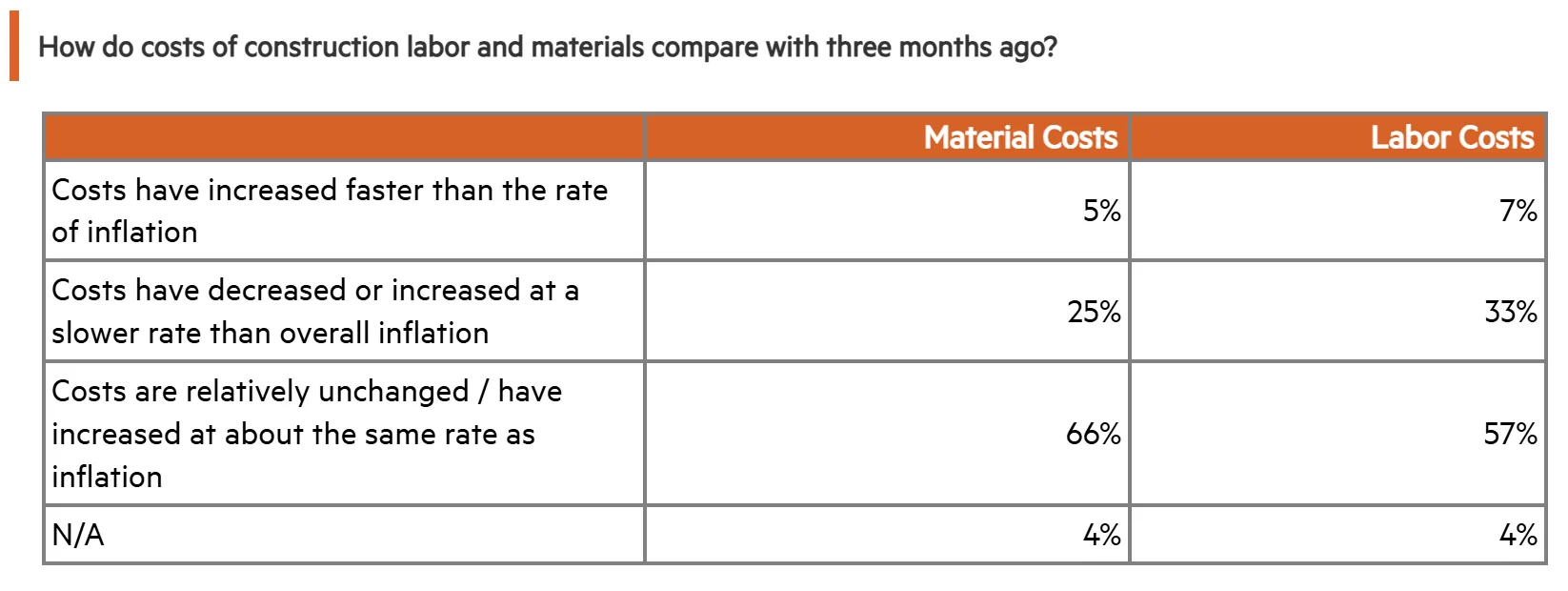

- Labor and material costs are easing, with one-third of developers citing decreased labor costs and 25% reporting lower material costs over the past quarter.

- Long-term optimism is rising, as 70% of developers expect market conditions to improve over the next 6–12 months, despite near-term caution.

A Stabilizing Trend

Multifamily construction may have hit a floor, according to the December 2025 National Multifamily Housing Council (NMHC) Quarterly Survey of Construction & Development Activity. Connect CRE reports that the survey, conducted with 81 leading construction and development firms, showed that 43% of respondents reported starts were unchanged from the prior quarter—a shift after two years of steady decline.

While 25% reported fewer project starts, a nearly equal share (26%) said they started more, further supporting signs of stabilization in a sector long weighed down by rising interest rates, reduced rent growth, and tightening financing conditions.

“Starts have pulled back drastically over the past two years,” said NMHC Chief Economist Chris Bruen. “But developers are now seeing lower input costs and are increasingly optimistic about long-term conditions.”

Cost Pressures Easing

Labor and material costs—a major drag on development since 2022—appear to be moderating. One-third of respondents reported lower construction labor costs, while 25% said material costs decreased or grew more slowly than inflation.

- Only 5% said material costs were rising faster than inflation.

- Just 7% said the same about labor.

Construction delays have also become less of a concern, with 30% of respondents seeing fewer delays, and over half reporting no significant change. This marks a shift from earlier this year, when delays were still weighing heavily on development timelines across the multifamily sector.

Economic Conditions Still Pose Challenges

Despite some positive signs, developers continue to cite economic feasibility, slow rent growth, and access to financing as persistent hurdles. Among those who reported a decline in starts:

- 18% cited project economics,

- 14% pointed to weak rent growth,

- 12% blamed broader economic uncertainty.

Outlook: Cautious but Improving

While 77% expect construction conditions to remain flat over the next three months, sentiment improves over longer horizons:

- 70% anticipate better conditions within 6–12 months, with fewer delays, continued easing of costs, and potential rate cuts on the horizon.

- However, respondents also expect labor and material costs to resume outpacing inflation in the next year, which could complicate the recovery.

Why It Matters

The survey findings suggest that the sharp contraction in multifamily construction may be bottoming out, which could help address the sector’s ongoing supply-demand imbalance. According to Yardi Matrix, demand still exceeds supply nationally—even as rent growth has slowed—suggesting developers may regain momentum once macro conditions stabilize.

With improved market confidence and moderating costs, the multifamily sector could be positioning for a gradual rebound in 2026.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes