- Multifamily construction in Dallas-Fort Worth is set to slow sharply in 2026, with starts on track for a major reduction.

- Net absorption fell into negative territory in Q4 2025, at -301 units, while occupancy declined to 93.1%.

- Average asking rent dropped to $1,482, but is forecast to recover in 2026 alongside improved demand and occupancy.

- Colliers projects a significant market rebound in late 2026, with demand set to surge and construction levels halved.

Development Activity Contracts

Globe St reports that a sluggish finish to 2025 is reshaping the outlook for multifamily construction in Dallas-Fort Worth. The market saw new supply decrease to 8,115 units in the fourth quarter, down from over 10,500 a year earlier. Simultaneously, the number of units under construction fell for the 13th straight quarter, hitting 42,702.

This contraction in multifamily construction comes after a strong run-up in new deliveries and follows a region-wide trend of developers pulling back. For 2026, Colliers expects construction activity to slow even further, with units underway dropping to around 22,973 by year end. The anticipated slowdown is expected to help restore balance to the market.

Short-Term Pressure on Fundamentals

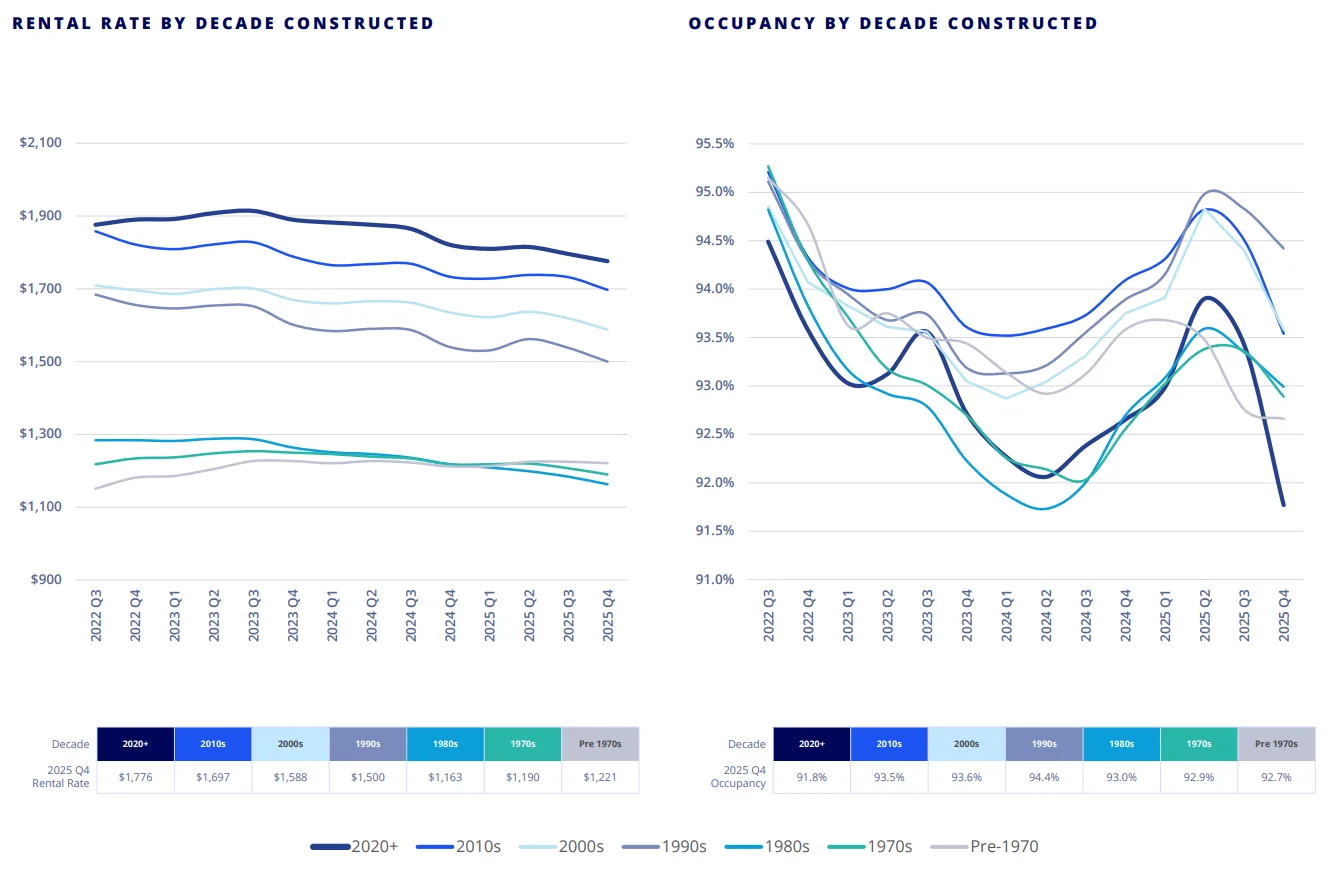

The impact of past supply is still weighing on fundamentals in the near term. Net absorption dropped to -301 units in Q4 2025, a sharp reversal from the prior year’s robust gains. Occupancy moved lower across all asset classes, sitting at 93.1% at year-end.

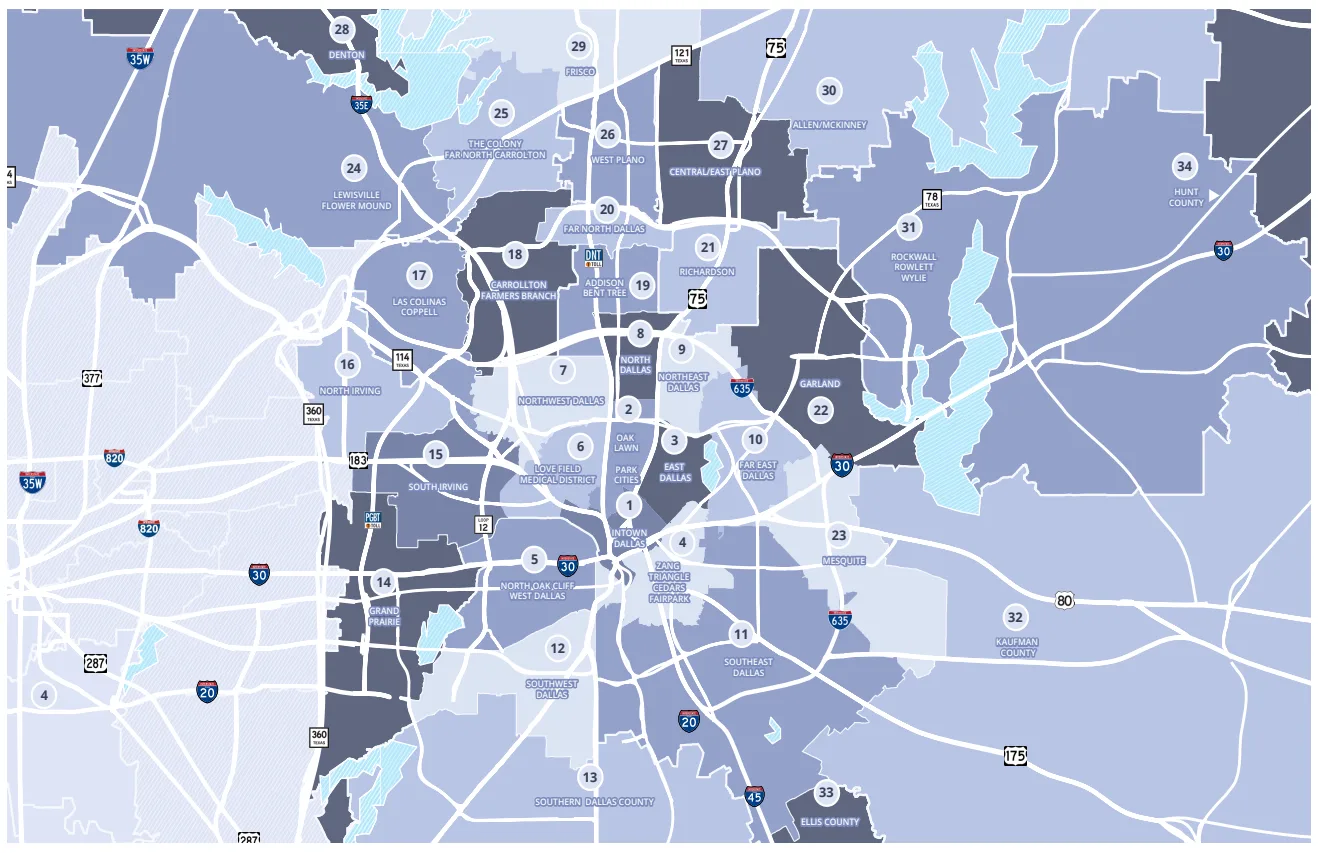

Weaker demand and heightened competition led to a decline in average asking rent, which finished 2025 at $1,482, down $12 from the previous year. The softening was most pronounced in Intown Dallas and Oak Lawn/Park Cities submarkets, both showing negative net absorption over the quarter.

Market Outlook – Recovery Ahead

Dallas-Fort Worth’s multifamily market is on track for a strong rebound by late 2026. Colliers projects average rents to rise to $1,517, while occupancy edges up to 93.5%. Net demand should surge to 25,689 units as developers break ground on fewer projects and inventory growth slows.

The market has shifted focus from expansion to stability. Slower construction is expected to ease new supply and reduce vacancies over time. Investor interest, which remained strong through the first half of 2025 despite broader volatility, signals continued confidence in long-term fundamentals. Investors and analysts will watch closely to see how this shift boosts property values and acquisition strategies in the next cycle.

Get Smarter About What Matters in Texas

Subscribe to our free newsletter covering the biggest commercial real estate stories across Texas — delivered in just 5 minutes.