- The multifamily sector posted 5.48% annualized returns in Q3 2025, beating the NCREIF All Property Index for the sixth straight year.

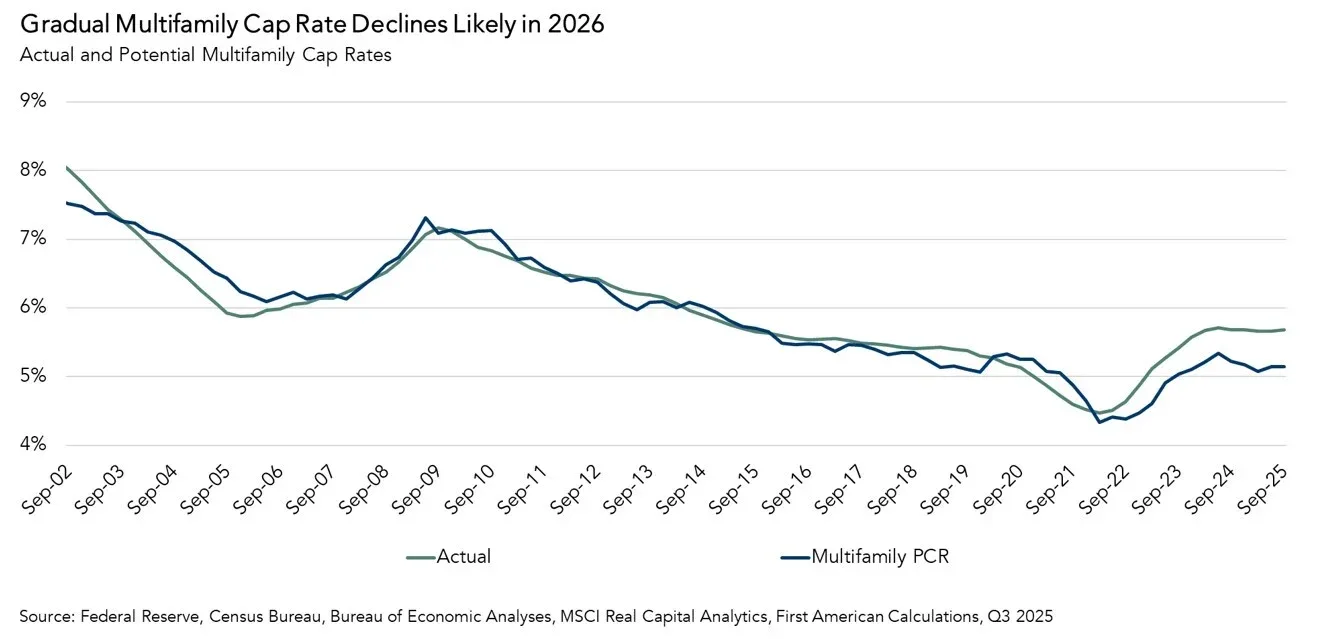

- Fundamentals, easing credit, and distress resolution are expected to bring cap rates down after a prolonged plateau.

- San Jose, Houston, and Miami topped the charts in Q3 returns, each above 8.4%, driven by supply constraints and demographic demand.

- A 60-basis-point gap highlights that cap rates remain elevated despite improving fundamentals.

Multifamily Still Leading CRE Performance

According to Globe St, multifamily continues to be the outperformer in commercial real estate. The Newmark’s latest report found that the sector returned 5.48% in Q3 2025, outpacing the broader NCREIF All Property Index at 4.65%. This marks the sixth consecutive year that multifamily has outperformed other property types.

Investor interest remains strong, especially in Core and Core Plus segments, despite slight increases in transactional cap rates, which rose to 5.63%. At the same time, REIT-implied cap rates dropped slightly to 5.23%, and NCREIF-reported rates fell more sharply to 4.94%.

Geographic Leaders and Laggards

West Coast tech hubs led the nation in returns:

- San Jose: 9.3% annualized returns – highest nationally.

- Orange County, San Diego, and San Francisco: All posted 7%+ returns, driven by tight supply and sustained demand.

- Seattle: Delivered 7.9%, while Riverside reached 7.2%.

In the Sun Belt, Houston stood out with 9% returns, second only to San Jose. Miami followed closely at 8.4%, benefiting from migration and rent growth. West Palm Beach (7.3%), Orlando (6.7%), and Tampa (6.5%) also showed strength, though oversupplied markets like Austin (2%) and Raleigh (4.3%) underperformed.

The Midwest and Northeast posted mixed results. Chicago and Suburban Maryland exceeded 8%, while Minneapolis and New York lagged at 4.1% and 6.3%, respectively, due in part to regulation and slower recoveries.

Cap Rates: Stuck for Now, But Set to Shift

Multifamily cap rates have held steady at 5.7% for seven quarters—the longest such streak in 25 years. But that trend may be ending. Analysts expect cap rates to decline gradually in 2026 as several temporary market frictions begin to ease.

According to First American’s Potential Cap Rate (PCR) model, the “true” cap rate supported by market fundamentals sits at 5.1%, creating a 60-basis-point gap with the observed rate. This gap signals that cap rates are currently higher than justified by market conditions.

Why Cap Rates Are Expected to Decline in 2026

A combination of improving fundamentals and easing market friction is setting the stage for cap rates to gradually move lower next year. Three key forces are driving this shift:

- Distress Resolution: Commercial mortgage distress is starting to unwind, increasing the likelihood of sales at market-clearing prices. As more distressed assets change hands and valuations reset, transaction volumes are expected to rise—applying downward pressure on cap rates.

- Easing Credit Conditions: As lenders resolve troubled loans and regain balance sheet capacity, more capital will return to the multifamily market. Improved debt availability should help boost deal activity and support lower cap rates.

- Resilient Renter Demand: Renter household formation rose 2.7% year-over-year in Q2 2025, reflecting strong leasing demand. This supports net operating income growth and valuations, reinforcing investor confidence and justifying tighter yields.

Together, these factors point to a gradual normalization of cap rates more in line with underlying fundamentals

Looking Ahead

While the pace will vary by market, fundamentals suggest cap rates will gradually move lower in 2026. Rising valuations and better refinancing conditions could benefit current owners. Investors may see a short window of opportunity to buy ahead of potential pricing shifts. Meanwhile, tenants could face firmer rent growth as steady demand and tighter competition take hold.

With transaction activity expected to rebound as distressed sales increase and credit loosens, all signs point to a multifamily sector entering a new chapter—one driven more by fundamentals than friction.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes