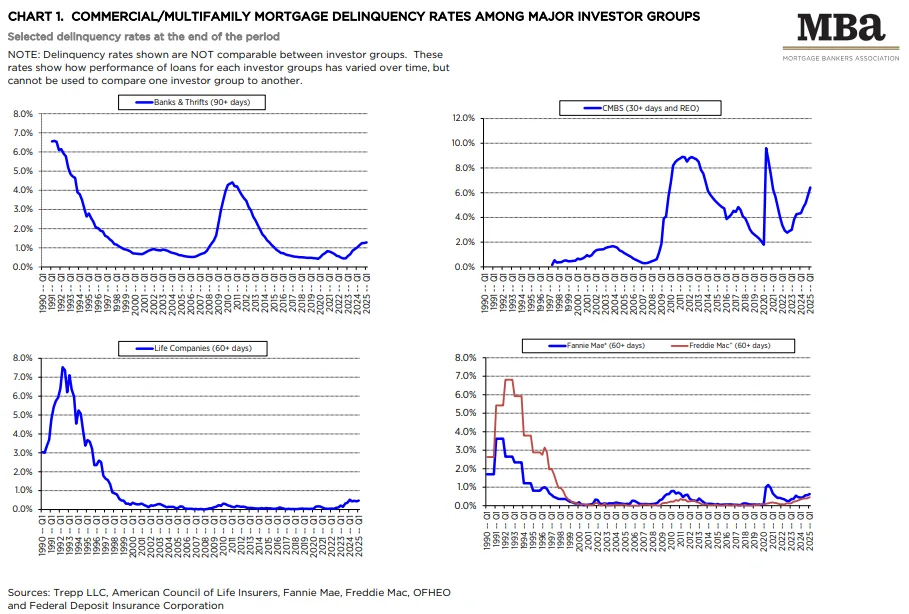

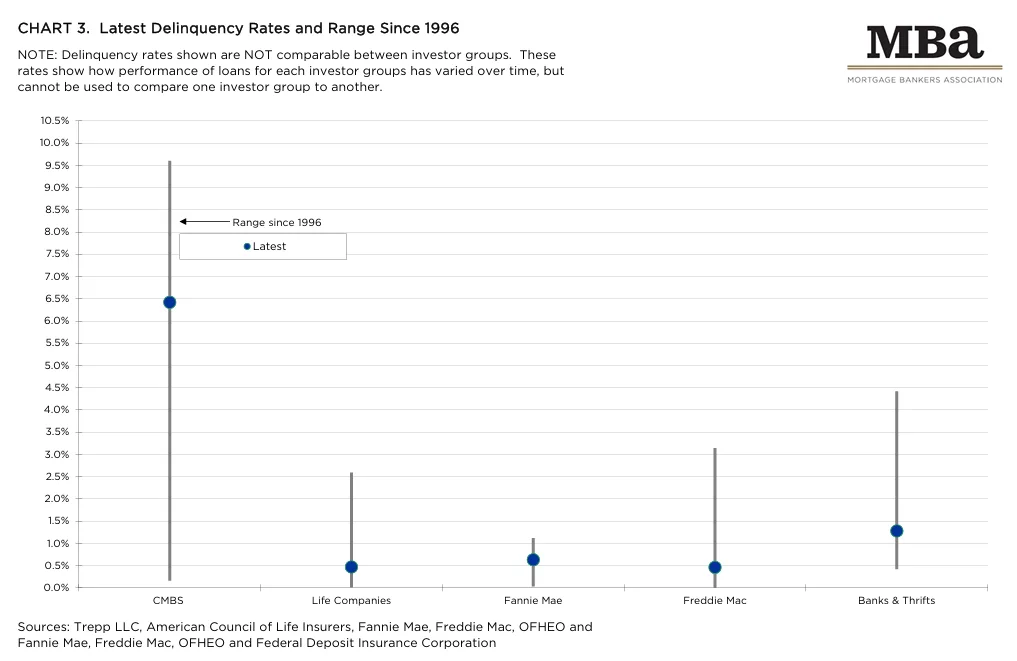

- CMBS delinquency rate climbed to 6.42% in Q1 2025, the highest among major investor groups.

- Delinquencies also rose for banks, life insurers, Fannie Mae, and Freddie Mac.

- The increases reflect rising pressure in specific CRE sectors and limited refinancing options.

Delinquencies On The Rise

As reported by the MBA, commercial mortgage delinquencies delinquencies increased across all major capital sources in Q1 2025. The trend points to stress in select property types and tightening credit markets. “While rates remain low for most lenders, the jump in CMBS delinquencies is notable,” said Reggie Booker, MBA’s Associate VP of Commercial Real Estate Research.

Latest Numbers

Here are the Q1 2025 delinquency rates based on unpaid principal balance:

- CMBS (30+ days delinquent or REO): 6.42% — up 64 bps from Q4

- Banks & Thrifts (90+ days or non-accrual): 1.28% — up 2 bps

- Life Companies (60+ days): 0.47% — up 4 bps

- Fannie Mae (60+ days): 0.63% — up 6 bps

- Freddie Mac (60+ days): 0.46% — up 6 bps

CMBS Continues To Lead

CMBS loans remain the most distressed. These loans are often backed by retail, office, or other properties more exposed to economic shifts. The current CMBS rate is more than five times that of bank-held loans.

Definitions Vary

Each capital source measures delinquencies differently. For example, Fannie Mae counts forbearance loans as delinquent. Freddie Mac does not, as long as the borrower complies with modified terms. This makes cross-group comparisons difficult.

Why It Matters

Rising mortgage delinquencies reflect the ongoing adjustment in commercial real estate. With higher interest rates and falling property values, many borrowers are struggling to refinance or meet loan terms.

What’s Next

If current conditions persist, delinquencies could rise further in 2025. CMBS and other lenders exposed to office and retail sectors may face more risk in the months ahead.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes