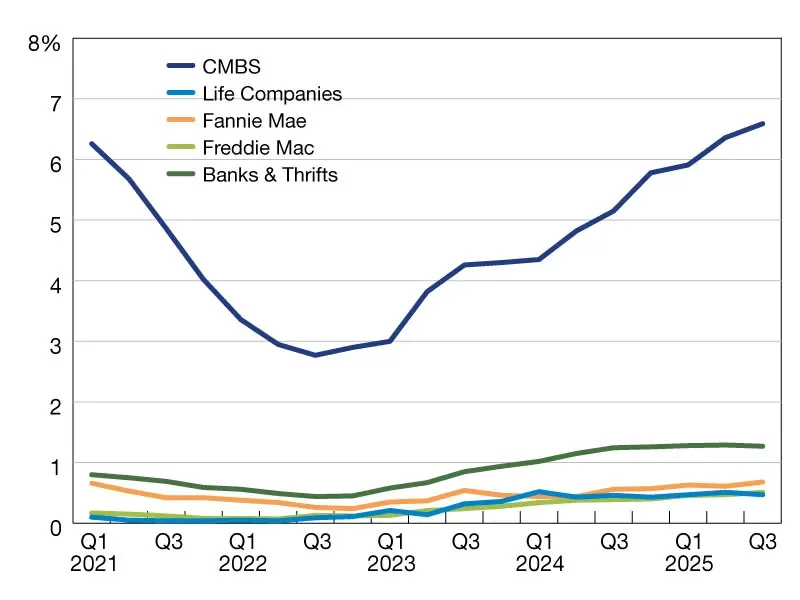

- Delinquency rates rose for CMBS and GSE loans (Fannie Mae and Freddie Mac), while banks and life companies saw slight declines in late payments.

- CMBS loans reported the highest delinquency rate at 6.59%, a 0.23 percentage point increase from Q2.

- Ongoing challenges like higher vacancies and slower rent growth are weighing on loan performance, though property values have largely stabilized.

- Delinquency levels remain highly dependent on property type and individual loan structure.

Loan Performance Diverges

Multi-housing News reports that according to the Mortgage Bankers Association’s (MBA) Q3 Commercial Delinquency Report, performance across commercial and multifamily mortgages continues to diverge, reflecting pressures from shifting market fundamentals. While some sectors show signs of stabilization, others face increased stress.

The report tracks five major investor groups — banks, CMBS, life insurance companies, Fannie Mae, and Freddie Mac — which together hold over 80% of outstanding commercial mortgage debt.

By the Numbers

Here’s how delinquency rates shook out at the end of Q3 2025:

- CMBS (Commercial Mortgage-Backed Securities):

Delinquencies rose to 6.59%, up 0.23 percentage points from Q2.

- Freddie Mac:

Increased to 0.51%, up 0.04 percentage points.

- Fannie Mae:

Rose to 0.68%, a 0.07 percentage point uptick.

- Banks and Thrifts:

Slightly declined to 1.27%, down 0.02 percentage points.

- Life Companies:

Dropped to 0.47%, down 0.04 percentage points.

These rates reflect each entity’s own method of tracking loan performance, which can vary. For instance, Fannie Mae counts forbearance loans as delinquent, while Freddie Mac does not, provided the borrower complies with forbearance terms.

What It Means

Despite property values leveling out, performance is being tested by shifts in leasing dynamics, particularly in office and retail segments. Vacancy rates and slower rent growth are playing a growing role in delinquency trends.

The elevated CMBS delinquency rate, in particular, highlights ongoing stress in securitized loan portfolios, which tend to be more exposed to underperforming retail and office assets.

Looking Ahead

While banks and life companies continue to show relative stability, distress in securitized and agency-backed mortgages has been building throughout the year, signaling broader weakness ahead, particularly if property fundamentals don’t improve. Investors and lenders will need to stay vigilant, especially as loan maturities and refinancing risks loom in 2026.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes