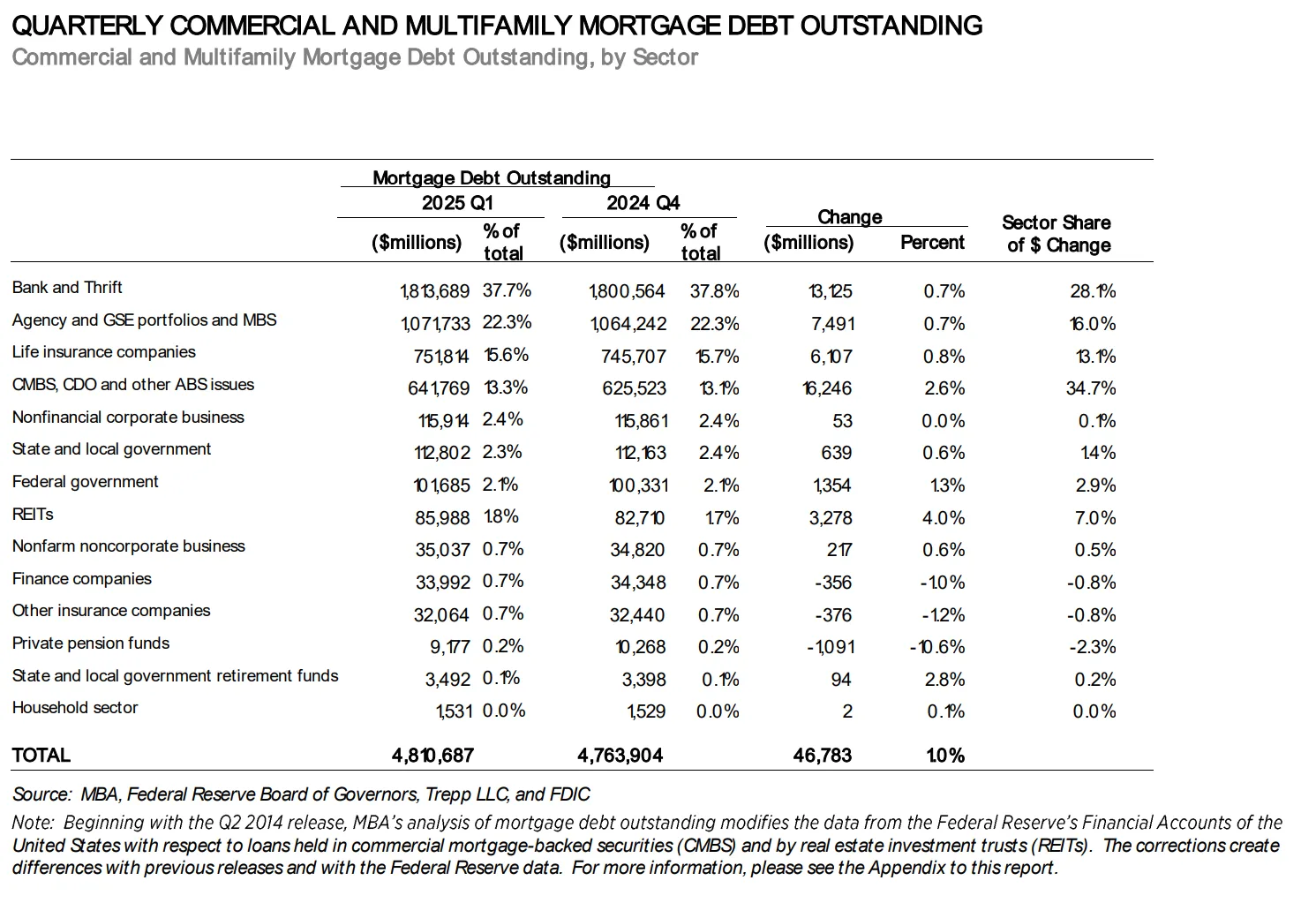

- Total commercial and multifamily mortgage debt outstanding rose to $4.81 trillion in Q1 2025, up 1.0% from Q4 2024.

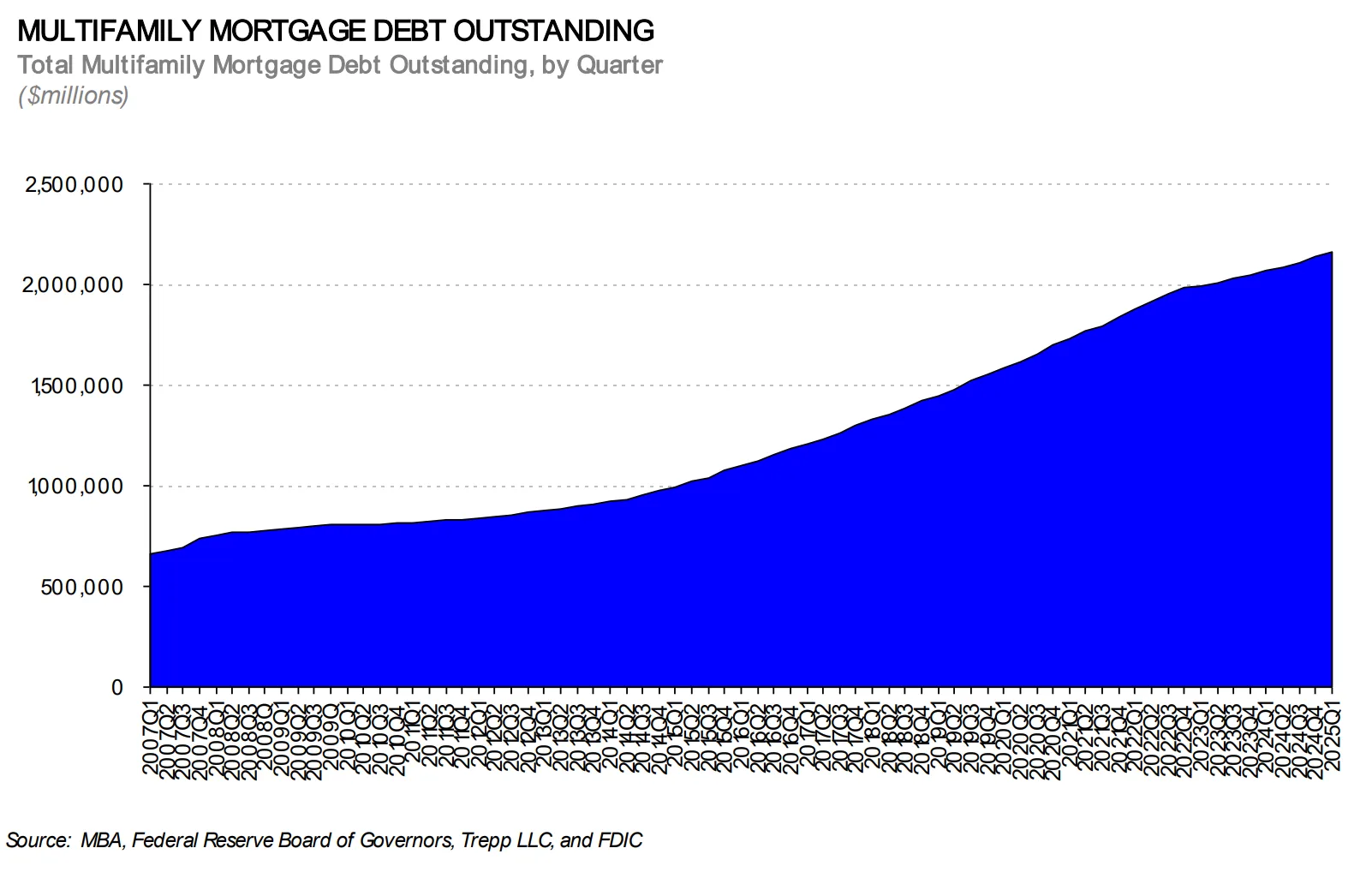

- Multifamily debt alone increased by $19.9B (0.9%), totaling $2.16 trillion.

- CMBS, CDO, and ABS issues led sector growth, adding $16.2B (2.6%), followed by banks and thrifts with a $13.1B (0.7%) increase.

- REITs posted the largest percentage gain in commercial/multifamily holdings, rising 4.0%, while private pension funds saw the steepest decline, down 10.6%.

A Rising Tide of Debt

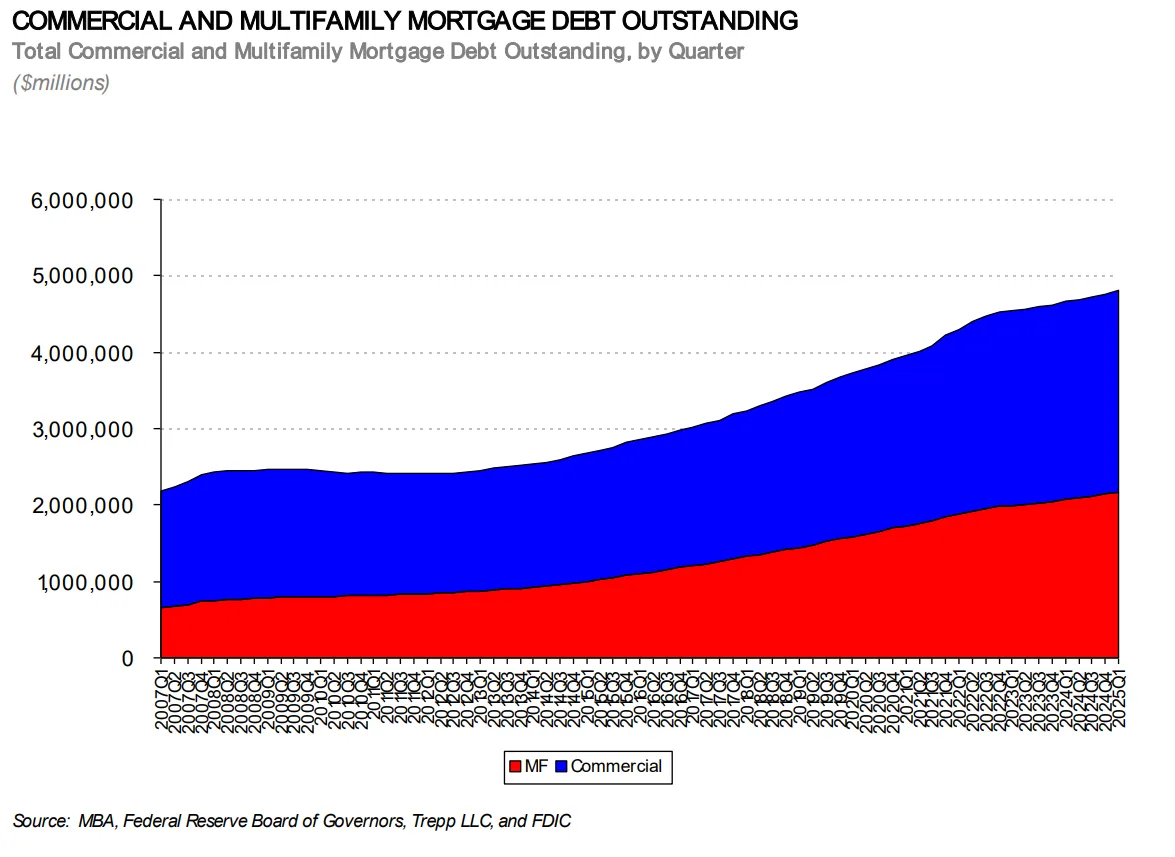

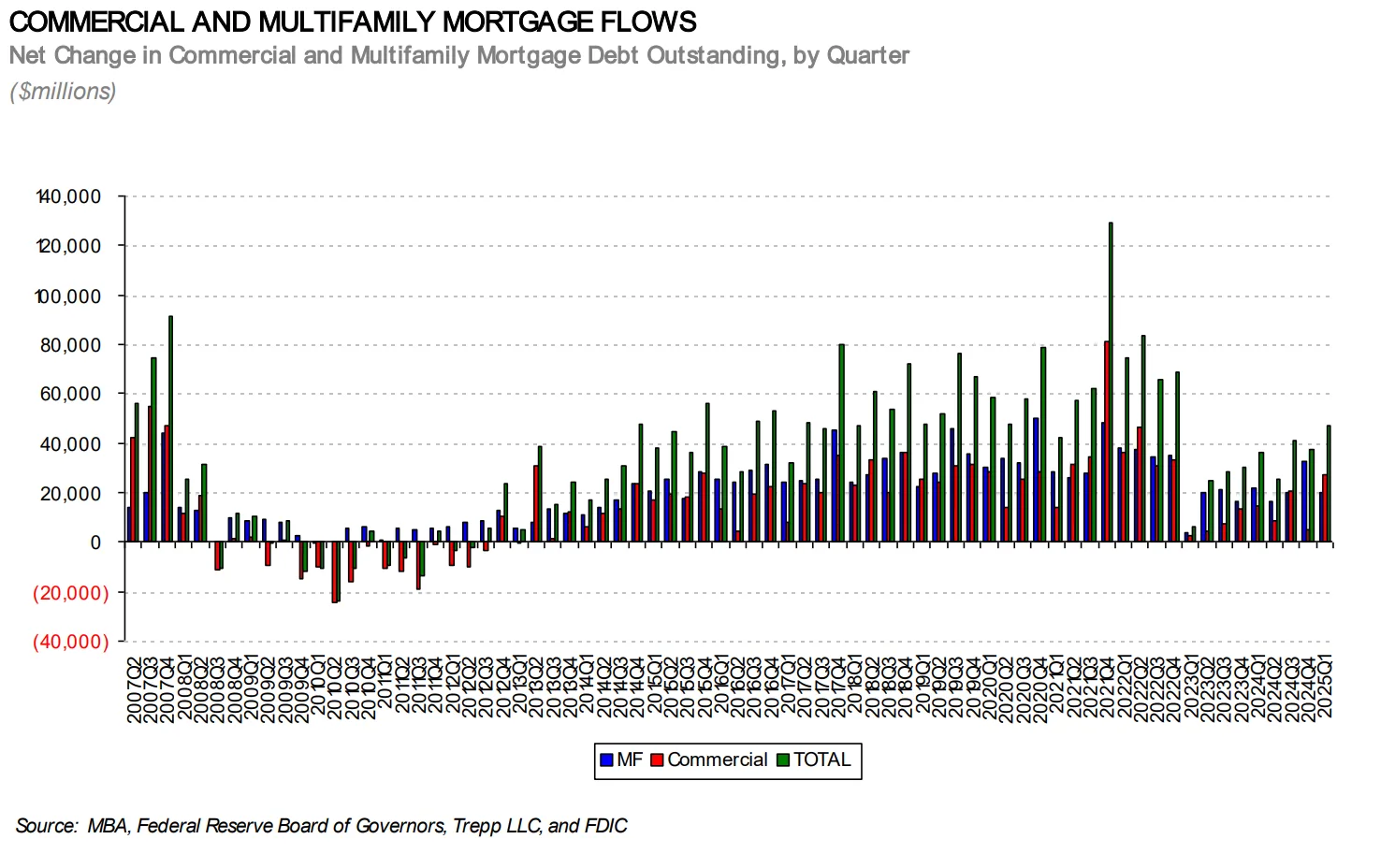

Commercial and multifamily mortgage debt outstanding continued to grow in early 2025, hitting $4.81 trillion, according to the Mortgage Bankers Association. This marks a $46.8B quarter-over-quarter gain, even as lending activity remains soft amid a cautious capital environment.

“Despite lower origination volumes, the overall level of commercial and multifamily mortgage debt rose,” said Reggie Booker, MBA’s Associate VP of Commercial Real Estate Research. “The increase reflects the longer duration of outstanding loans and continued demand from key investors.”.

Sector Snapshot

The four largest investor groups continue to dominate the market:

- Commercial Banks and Thrifts: Largest holders with $1.81 trillion (38%).

- Agency/GSE Portfolios and MBS: Second at $1.07 trillion (22%).

- Life Insurance Companies: Holding $752B (16%).

- CMBS, CDO, and ABS Issues: Up to $642B (13%).

Notably, many banks and insurers also invest in securitized debt, contributing to CMBS exposure indirectly.

Multifamily Growth

Multifamily mortgage debt rose to $2.16 trillion in Q1, driven primarily by:

- Banks and Thrifts: Up $10.0B (1.6%), accounting for 29.6% of multifamily debt.

- Agency/GSE Portfolios and MBS: Up $7.5B (0.7%), comprising 49.6% of total multifamily debt.

- Life Insurance Companies: Added $1.9B (0.8%).

REITs saw a strong 10.9% quarterly increase in multifamily holdings, while private pension funds dropped 12.7%, marking the steepest decline across investor types.

Why It Matters

The expansion of outstanding mortgage debt—despite tepid new originations—suggests investors are holding longer positions, either by design or necessity. Banks remain the primary debt holders, but growth in securitized products like CMBS indicates a shift toward higher-yield vehicles as capital markets adapt to changing interest rate expectations.

Looking Ahead

With total debt balances trending upward, especially in multifamily, industry watchers expect continued diversification across lender types. Market players will be watching origination pipelines and maturity schedules closely as the year progresses.

According to MBA, the total volume of outstanding commercial and multifamily mortgage debt has now grown nearly 40% since 2015—underscoring the resilience and scale of real estate finance in a volatile economic cycle.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes