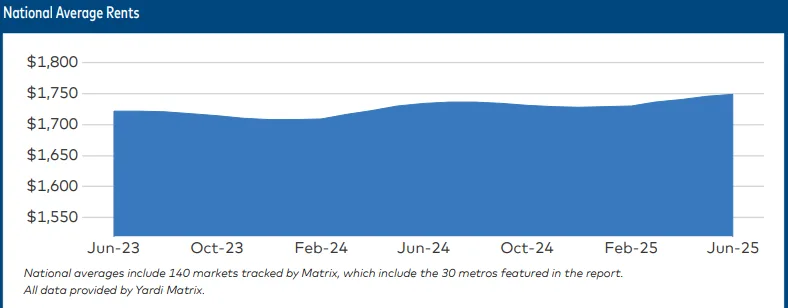

- US multifamily rents rose just 1.2% in the first half of 2025, with June rents up $3 month-over-month to $1,749—marking a stark slowdown from pre-pandemic norms.

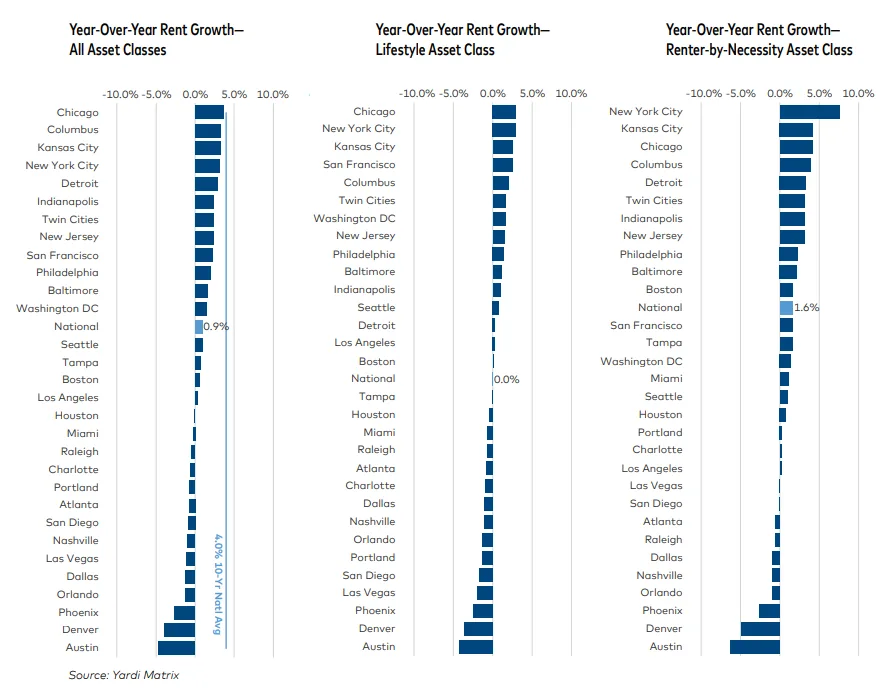

- Midwest metros such as Chicago (+3.6%), Columbus (+3.3%), and Kansas City (+3.2%) led national rent growth, while Sun Belt markets like Austin (-4.7%) and Denver (-3.9%) saw declines.

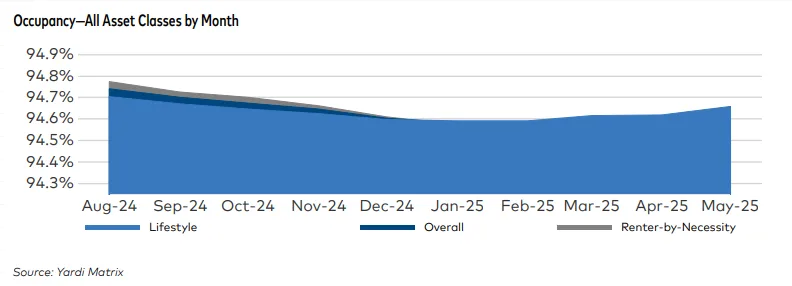

- Occupancy held steady at 94.6% in May, highlighting stable demand despite economic uncertainty and elevated new supply levels.

A Cooling Yet Resilient Market

Multifamily rent growth across the US is showing signs of strain midway through 2025, reports yardi matrix. The slowdown reflects mounting pressure from aggressive new supply and ongoing macroeconomic uncertainty. Advertised asking rents rose a modest $3 in June, bringing the national average to $1,749. Year-over-year rent growth remained at 0.9%—a far cry from the 2.4% typical during the pre-pandemic cycle.

Demand, however, remains robust. Over 250K units have been absorbed so far this year, signaling resilient renter interest even as new deliveries mount. Occupancy rates have remained flat at 94.6% for seven straight months.

The Midwest Stands Out

As Sun Belt and Mountain West markets struggle with oversupply, the Midwest is shining. Chicago posted the strongest year-over-year rent growth at 3.6%, followed by Columbus and Kansas City. These metros also benefit from more modest supply additions and steady job growth, insulating them from the pricing pressure seen elsewhere.

In contrast, pandemic-era darlings like Austin (-4.7%), Denver (-3.9%), and Phoenix (-2.6%) are now seeing rents fall as new units outpace demand.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Policy Shifts And Affordability Concerns

June brought some relief on the policy front. California enacted legislation to streamline development approvals. Meanwhile, a federal tax bill boosted LIHTC funding by 12.5%, expanding the affordable housing pipeline to $14B. Despite these moves, affordability remains a major concern. According to the Harvard Joint Center, over 22.6M US renters are now cost-burdened, spending more than 30% of income on housing.

Tepid Growth Ahead

With seasonal rent increases likely behind us, full-year 2025 rent growth is expected to remain tepid. Forecasts call for little to no improvement in many Sun Belt metros through year-end. In contrast, the Midwest is projected to continue outperforming, bolstered by constrained supply and stable economic conditions.

As developers and investors navigate this cooling market, the Midwest’s consistency may offer a rare bright spot in a landscape defined by transition.