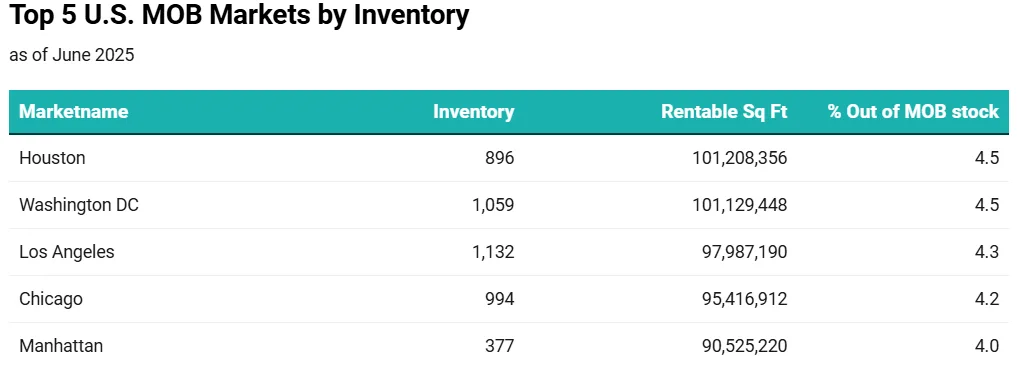

- Houston and Washington, DC, top the nation in medical office inventory, each with over 100M SF.

- Dense markets like Los Angeles and Manhattan show strong demand despite limited new development.

- Chicago sees rising investor activity and large institutional projects led by top health systems.

- Medical office demand is fueled by outpatient care trends, aging populations, and stable tenant bases.

A Durable Sector For Health-Care Real Estate

Medical office buildings have proven to be among the most resilient asset types in commercial real estate, reports Commercial Search. With a nationwide inventory exceeding 2.2B SF across nearly 29K properties, the sector continues to attract strong institutional and private investment. According to Yardi Research Data, five metro areas dominate in terms of medical office SF and future viability.

Houston – National Leader in MOB Growth

- Inventory: 101.2M SF across 896 properties

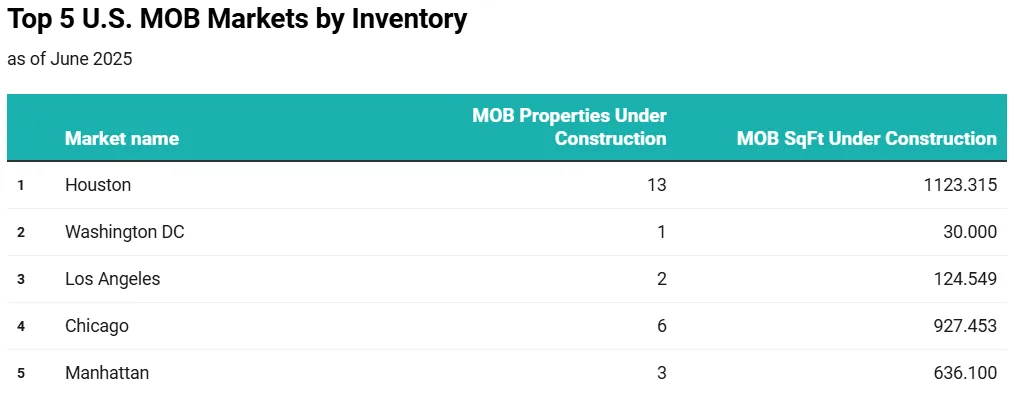

- Under Construction: 1.1M SF

- Key Insight: Houston leads in both total SF and annual net absorption (1.3M SF), reflecting unmatched momentum.

Home to the Texas Medical Center, Houston has become a global health-care destination. The market benefits from low development barriers, strong population growth, and investor interest in suburban clusters like Sugar Land and The Woodlands.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Washington, DC – Embedded In The Region’s Infrastructure

- Inventory: 101.1M SF across 1,059 properties

- Under Construction: 30K SF

- Key Insight: High MOB-to-office ratio and a dense network of academic and regional health systems support consistent demand.

While new development is minimal, ongoing expansions by MedStar, Inova, and Georgetown University Hospital keep the market competitive. The area’s affluent and aging population further solidifies long-term demand for outpatient services.

Los Angeles – High Demand, Tight Supply

- Inventory: 98M SF across 1,132 properties

- Under Construction: 124K SF

- Key Insight: Dense urban environment limits supply, keeping occupancy above 92% and pushing rents higher.

With health systems like UCLA and Cedars-Sinai expanding aggressively, LA’s medical office sector benefits from a shift toward outpatient care. Large redevelopment projects, like UCLA’s overhaul of Olympia Medical Center, illustrate long-term confidence.

Chicago – Institutional Anchors Drive Expansion

- Inventory: 95.4M SF across 994 properties

- Under Construction: 927K SF

- Key Insight: Major health-care institutions continue to invest in underserved neighborhoods and expand their outpatient footprint.

The city is home to multiple large-scale projects, including the AbbVie Foundation Cancer Pavilion. Investment activity has surged, with outpatient facility sales increasing 34% year-over-year.

Manhattan – Limited Supply, High Institutional Demand

- Inventory: 90.5M SF across 377 properties

- Under Construction: 636K SF

- Key Insight: Development constraints maintain high asset values, while redevelopment and vertical expansion define growth.

With top-tier institutions like NYU Langone and Mount Sinai anchoring demand, Manhattan remains a premium MOB market. Projects like the 30-story 403 E. 79th St. outpatient tower illustrate how health systems are adapting to space limitations.

Why It Matters

These five metros not only dominate by inventory but also offer strategic advantages in demographics, institutional presence, and long-term viability. As health systems expand outpatient care models, medical office buildings will remain a core component of real estate investment. This is especially true in markets with proven demand and constrained supply.

What’s Next

With the aging US population and demand for decentralized, cost-effective care delivery, the medical office sector is poised for continued growth. Expect high-traffic metros and suburban nodes in these top markets to attract further capital and development in the years ahead.