- For the first time in years, more CRE markets are in recovery than recession, according to Integra Realty Resources’ (IRR) mid-year report.rn

- A “flight to quality” is shaping investment and leasing, with capital and tenants focusing on high-performing, well-located assets.rn

- Office, multifamily, retail, and industrial markets show diverging trends, with strong performance in certain asset classes and geographies while oversupply and legacy challenges weigh on others.rnrnrn

Recovery Trend Emerges

According to Globe St, after years of mixed performance, commercial real estate is tilting toward recovery, IRR’s mid-year analysis shows. The report found more markets recovering than in recession, marking a meaningful shift in momentum even as economic uncertainty continues to cloud decision-making.

“Confidence is uneven, but the trend line is improving,” said Integra CEO Anthony Graziano. “The market is rewarding fundamentals and resilience over broad momentum.”

Flight to Quality Accelerates

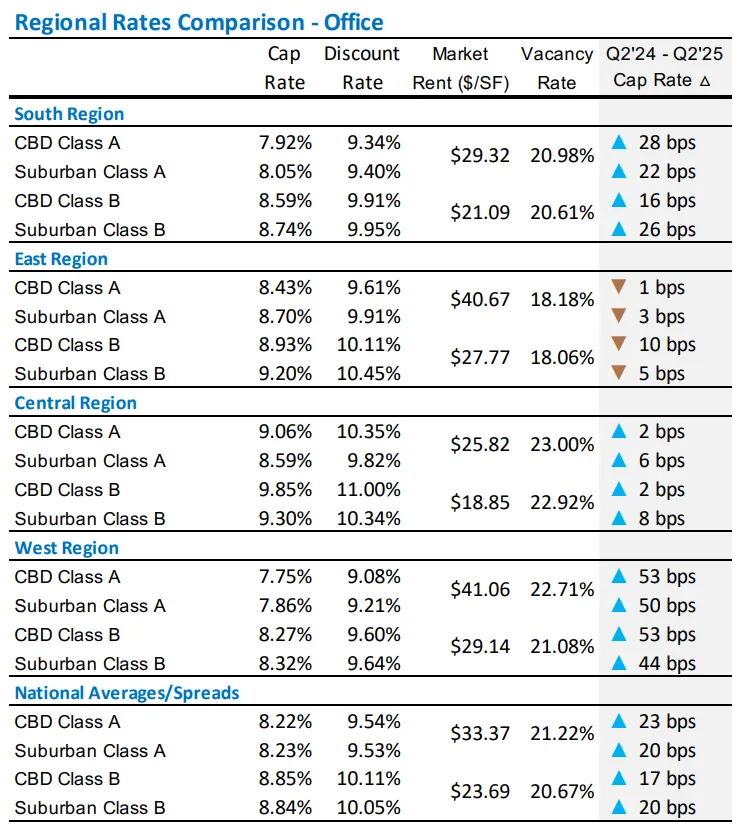

Investors and occupiers alike are favoring modern, high-performing assets. The bifurcation is most pronounced in the office sector, where Class A towers in prime locations are capturing demand while commodity space lags.

- CBD Class A office cap rates: up 23 bps to 8.22%

- Vacancy: Class A at 21.22%, Class B at 20.67%

- Rents: Class A rose 1.15% to $33.37 PSF; Class B rose 0.84% to $23.69 PSF

Most new office activity is concentrated in build-to-suit, life sciences, and medical office projects, with speculative development slowing sharply.

Multifamily: Stabilization and Supply Pressures

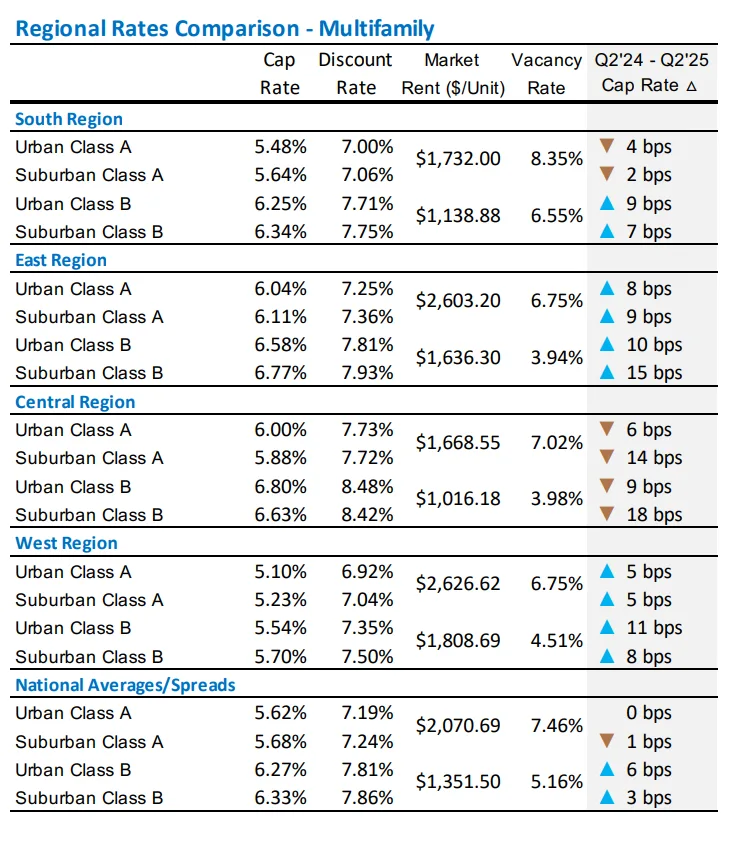

Multifamily markets are balancing strong demand in some metros with oversupply in others.

- Leaders in stabilization: Chicago, Philadelphia, Minneapolis

- Supply overhang: Austin, Phoenix

- High-barrier growth markets: Indianapolis, Northern New Jersey, Los Angeles, San Diego

Urban multifamily development is slowing as construction and capital costs rise.

- Cap rates: Class A at 5.68% (down 1 bps), Class B at 6.27% (up 6 bps)

- Vacancy: Class A at 7.46%, Class B at 5.16%

Retail Outperforms Expectations

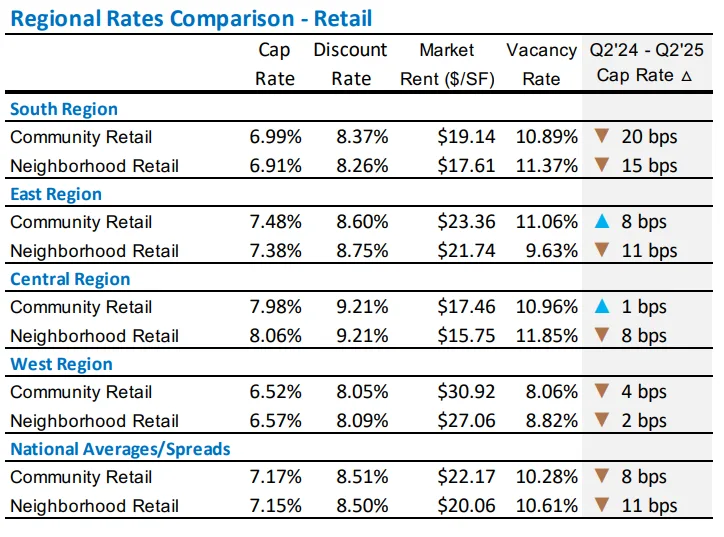

Retail remains one of the strongest segments, driven by grocery-anchored, mixed-use, and lifestyle centers.

- Top growth markets: Austin, Tampa, Orange County

- Headwinds: Legacy mall formats, urban cores like Detroit and San Francisco

Vacancy continues to decline across most retail formats:

- Community retail cap rates: down 8 bps to 7.17%

- Neighborhood retail cap rates: down 11 bps to 7.15%

Industrial: Still Healthy, but Moderating

Industrial remains resilient, though speculative development is creating vacancy pressures in certain metros such as Dallas-Fort Worth, Indianapolis, and Philadelphia.

- Warehouse cap rates: up 6 bps to 6.48%

- Flex industrial cap rates: up 3 bps to 6.97%

New projects are increasingly build-to-suit or adaptive reuse, with rent growth holding strongest in land-constrained infill markets.

Why It Matters

The cre market is showing early signs of balance after years of uneven performance. The broader trend toward recovery reflects a disciplined focus on fundamentals—location, asset quality, and long-term resilience—over speculative bets.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes