- Market growth to resume in 2026, especially in cities with prior negative job trends.

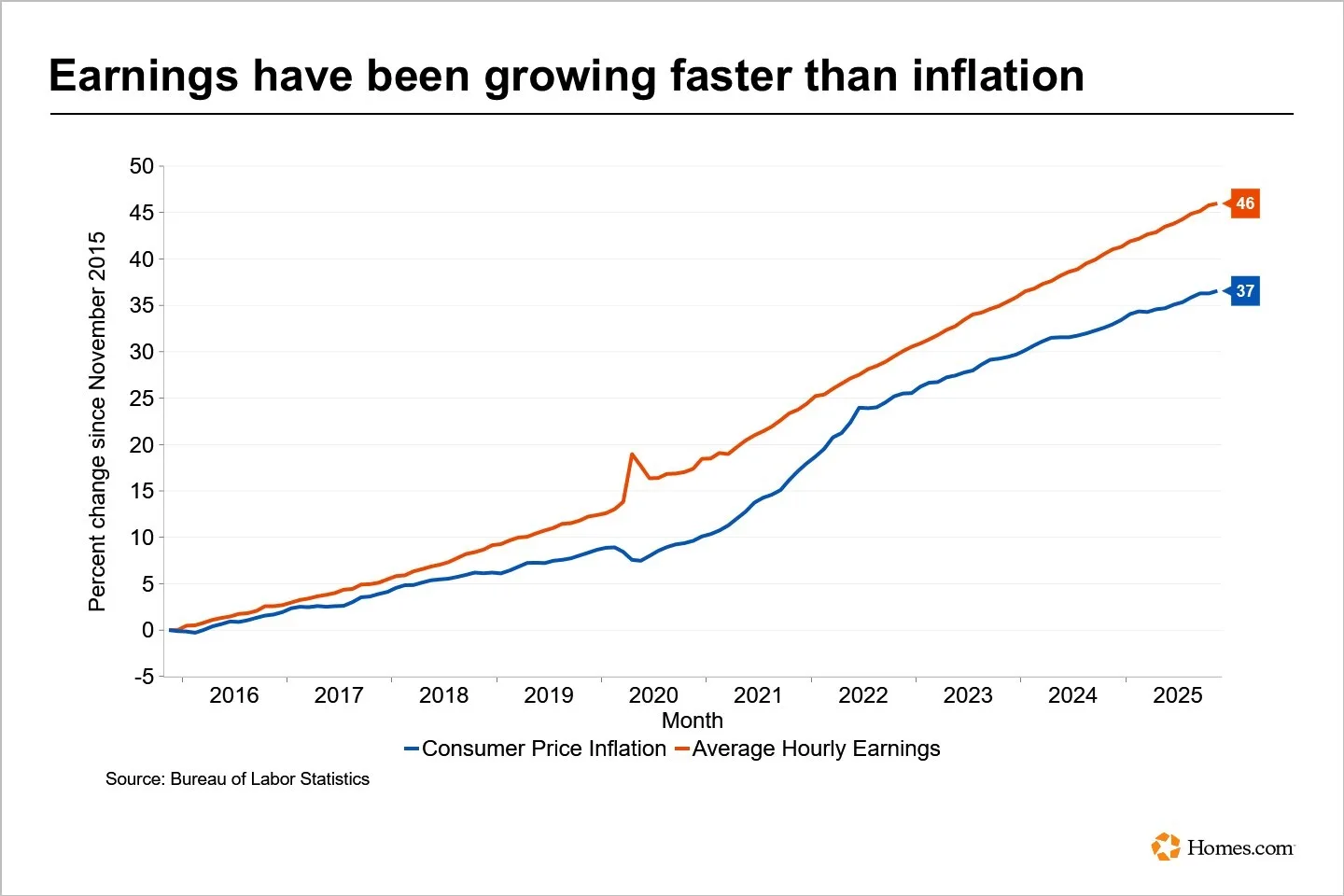

- Affordability to improve as wage growth continues to outpace inflation.

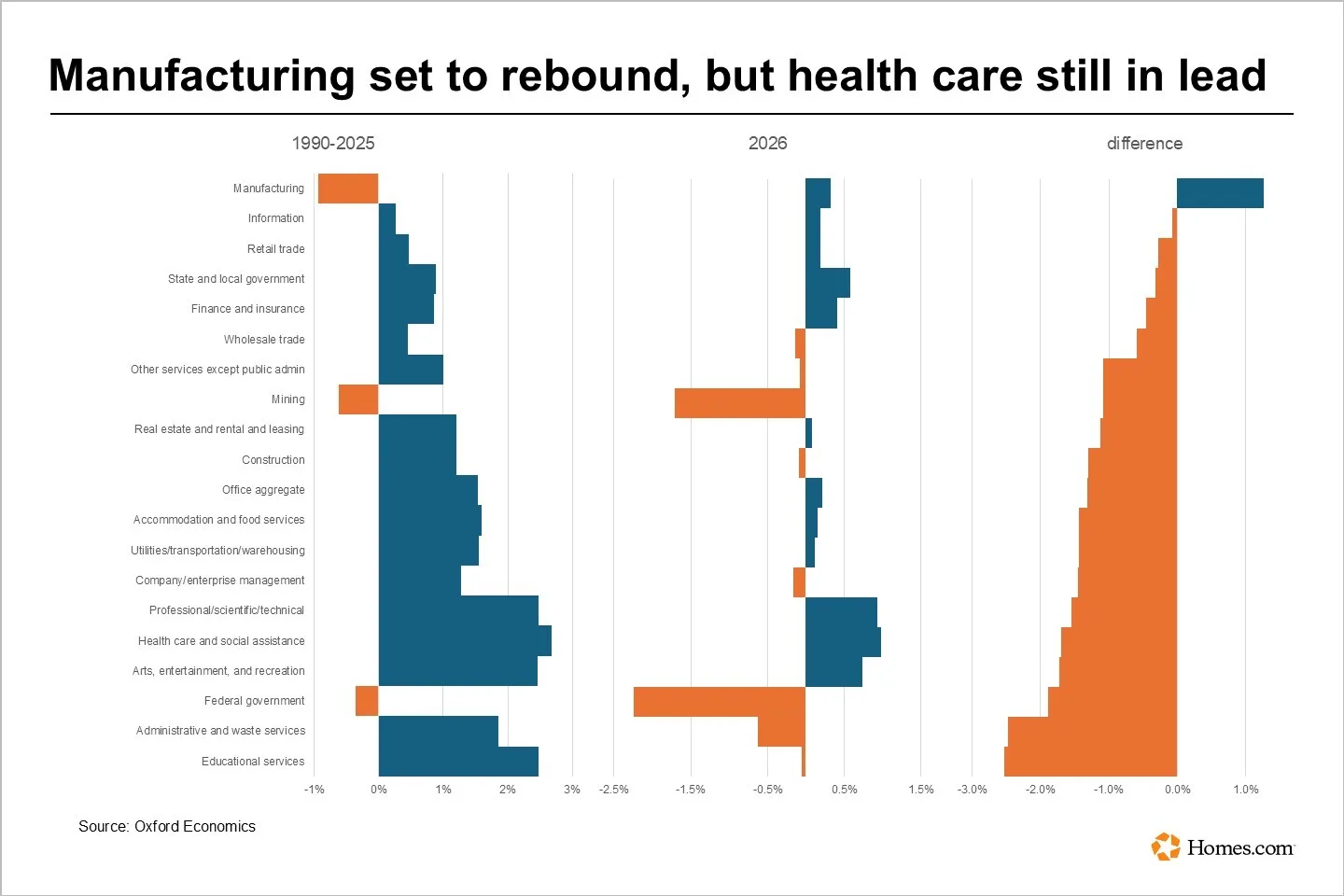

- Job migration will slow, but non-Sun Belt and manufacturing markets see gains.

- Real estate markets bidding for normalcy as inventory rises and prices stabilize.

Where Market Growth Returns

According to CoStar, after decades of lagging job expansion, several large markets that saw negative or flat growth since 1990 are projected to regain momentum in 2026. Cities like Greensboro, Pittsburgh, and Cleveland are expected to experience positive market growth, reversing long-term trends. This resurgence comes as migration patterns slow but broaden in scope, supporting growth beyond typical Sun Belt leaders.

Steady Economic Gains Drive Demand

The US economy is forecast to maintain moderate, steady growth through 2026. Consumer spending and increasing disposable income will bolster both residential and commercial markets. Market growth will be reinforced by business investment, predicted to advance by 3.5% next year, contributing to broader job creation and household confidence.

Improving Affordability, New Opportunities

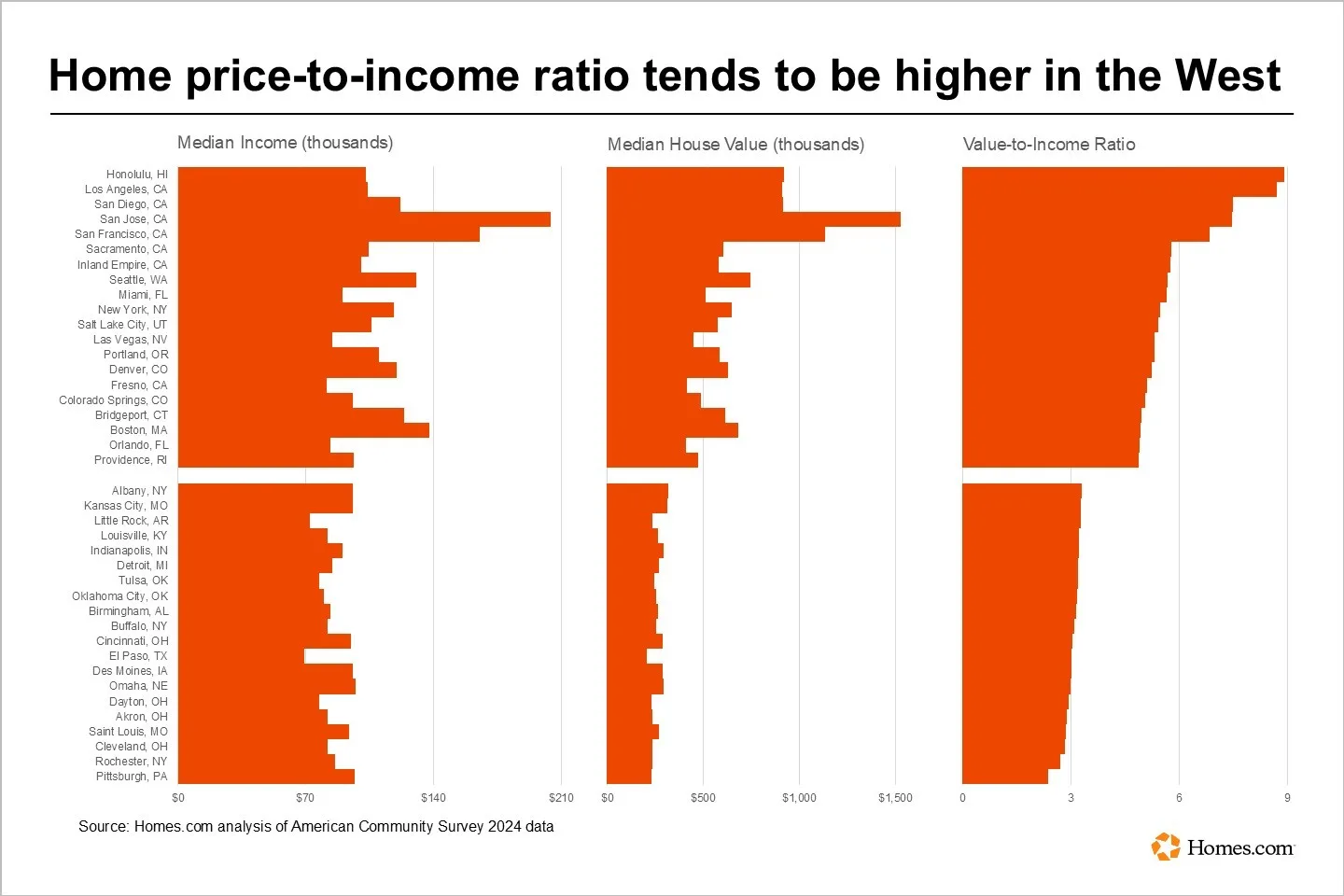

While housing affordability remains challenging in high-cost metros, steady wage and income gains are helping close the gap. Though interest rates will likely stay above pandemic-era lows, growing incomes are helping ease affordability pressures. More people are expected to migrate to affordable cities like Cleveland, St. Louis, and Kansas City, where median home values better match local incomes.

Shifts in Job and Housing Patterns

Labor market turnover remains subdued, which limits job-related moves but increases market stability. Health care and manufacturing sectors are projected to add jobs, driving demand for housing beyond the Sun Belt. Older Americans are showing a preference for remaining in place, supporting market growth in their home regions and near expanding health care infrastructure. At the same time, shifting rent dynamics are revealing how apartment pricing is increasingly disconnected from local employment trends, further complicating traditional housing demand models.

Return to Real Estate Normalcy

Following pandemic-era volatility, 2026 signals a move toward more balanced and predictable markets. Inventory has grown, buyer selection is improving, and price increases have moderated. Overall indicators point to a stable, healthy outlook for market growth across US real estate sectors in the coming year.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes