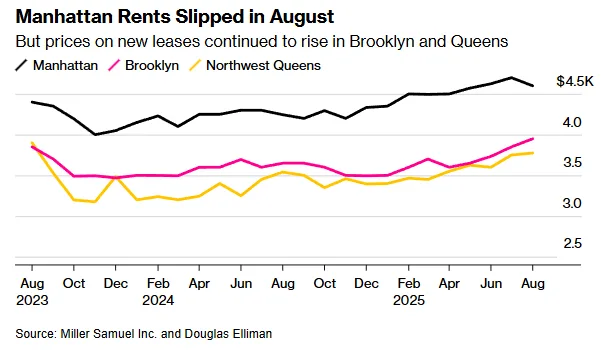

- Manhattan median rent dropped 2.1% in August to $4,600, ending a four-month streak of record-setting price increases.

- Falling mortgage rates have opened the door for potential buyers, reducing rental demand in Manhattan.

- Outer boroughs see price gains as renters seek affordability — with Brooklyn and northwest Queens posting rent increases and more bidding wars.

Rent Relief, At Last

After months of escalating rents, Manhattan’s apartment market finally cooled in August, reports Bloomberg. The median rent for new leases dropped 2.1% from July to $4,600. This marks the first decline in five months, according to Miller Samuel and Douglas Elliman. That said, prices remain elevated, up 8.4% compared to the same time last year.

Cooling Market, Rising Options

The shift comes as falling mortgage rates make home buying more appealing. Borrowing costs dropped to an 11-month low, while softer job numbers and hopes of future interest rate cuts could bring rates down further. Leasing activity slowed in August — typically a peak rental month — signaling that Manhattan’s rental frenzy may be easing.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Inventory, Policy & Pressure

Inventory in Manhattan tightened slightly, with available listings down 9% month-over-month to 9,625. The drop follows confusion around a new law — the Fairness in Apartment Rental Expenses Act — which bars landlords from charging tenants broker fees. As a result, some landlords have withheld listings while awaiting legal clarity.

Outer Borough Demand Heats Up

Meanwhile, renters priced out of Manhattan are increasingly turning to Brooklyn and northwest Queens, where competition is intensifying. In Brooklyn, one in three leases involved a bidding war, while more than 25% of rentals in northwest Queens saw multiple bids.

- Brooklyn rents climbed to a median of $3,950 in August, up 8% year-over-year and $100 from July.

- Northwest Queens rents rose nearly 7% year-over-year to $3,775, a $25 month-over-month increase.

What’s Next

Analysts suggest the steep climb in Manhattan rents may be nearing its end. Buyers are returning to the market, and affordability concerns are growing. As a result, the rental landscape may be shifting toward greater stability — at least for now.