- Manhattan multifamily achieved 5.7% YoY rent growth, topping all tracked US markets.

- Occupancy for stabilized units reached 98.3% in October 2025, well above the national average.

- Developers delivered 2,678 units year-to-date, with 13,234 under construction and 45,000 planned or permitted.

- Multifamily transaction volume reached $1.4B year-to-date, lower than previous years amid broader US market caution.

Rent Growth Maintains Lead

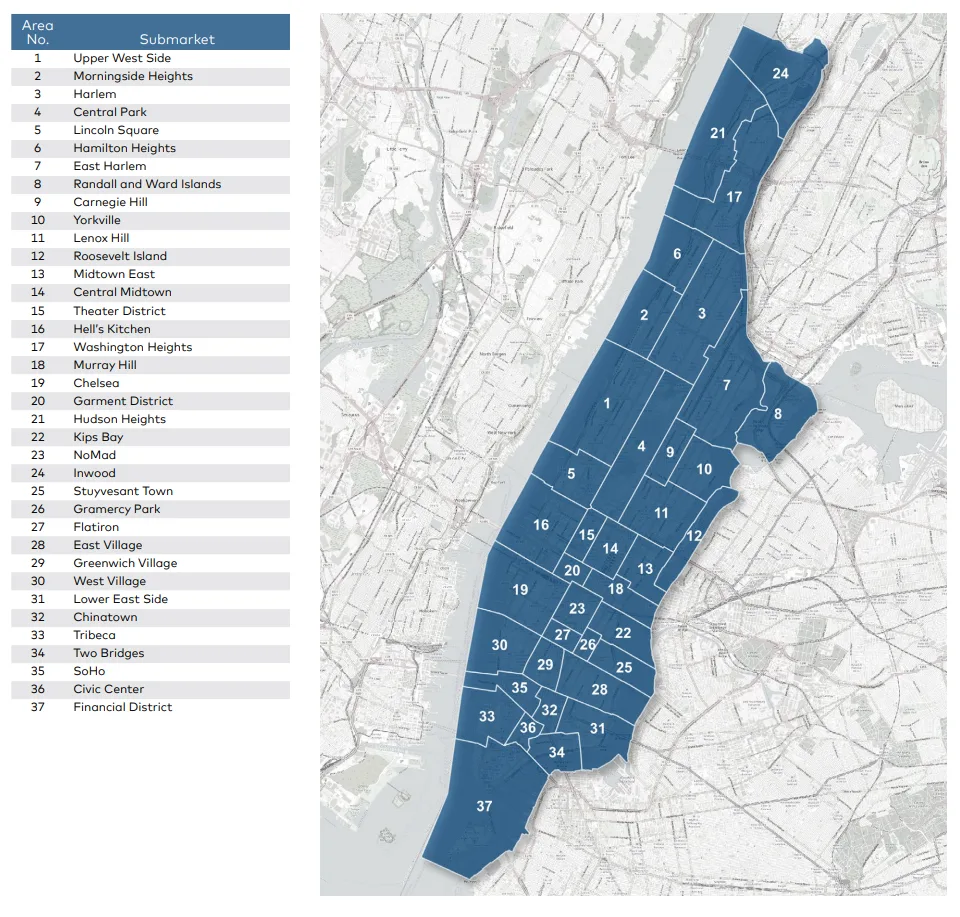

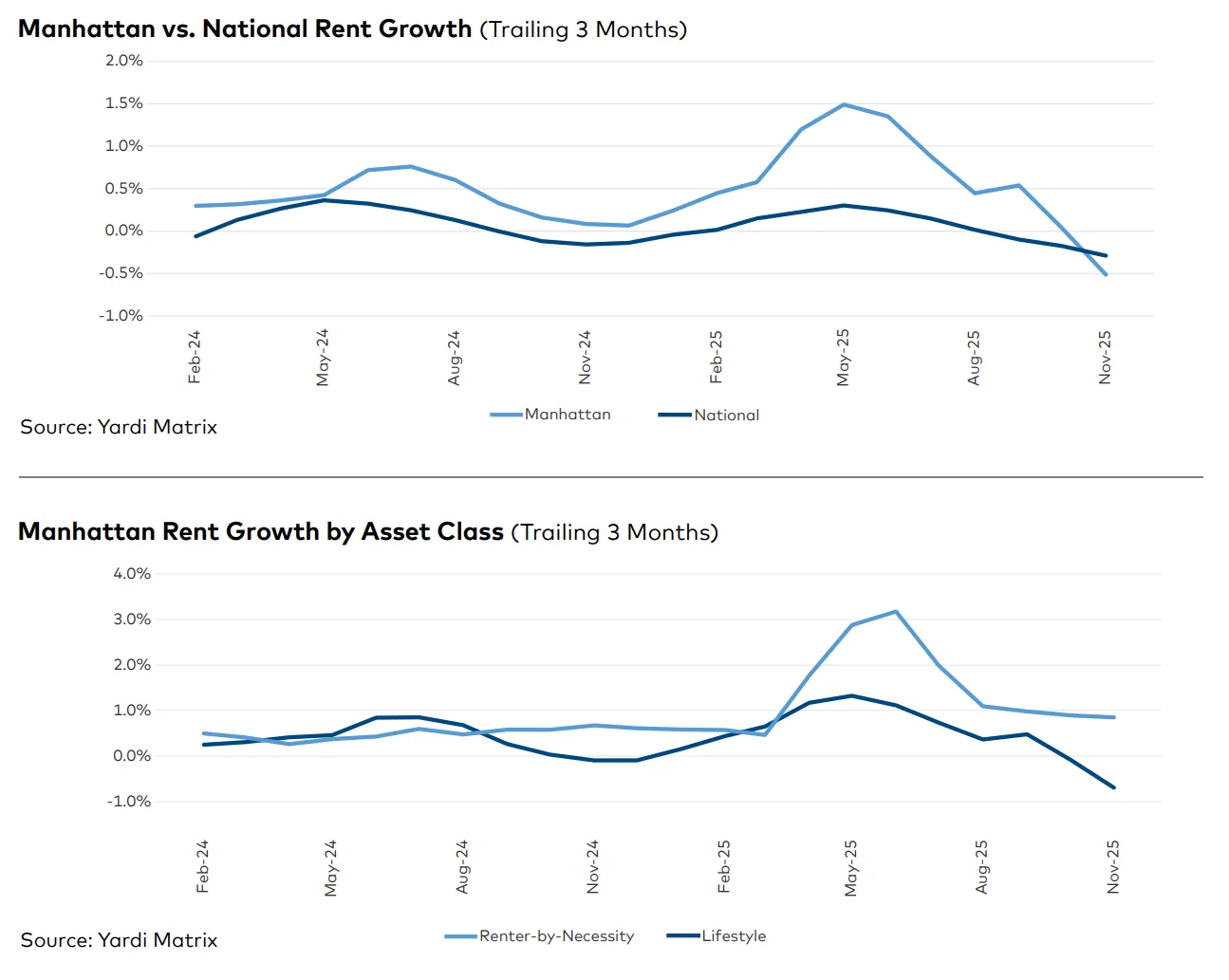

Manhattan multifamily fundamentals remained robust through late 2025, with rents and occupancy both showing national outperformance. Year-over-year advertised asking rent climbed 5.7% through November, the highest among all major US metros tracked by Yardi Matrix. By contrast, the US market saw a slight 0.2% decrease.

Though trailing three-month averages dipped 0.5% seasonally to $5,607, Manhattan continued to outpace peers like Chicago and the Twin Cities. The Lifestyle asset segment saw more pressure, with rents down 0.7%, while Renter-by-Necessity rates rose 0.9%. Occupancy for stabilized assets grew to 98.3%, 360 bps above the US figure.

Employment and Economic Context

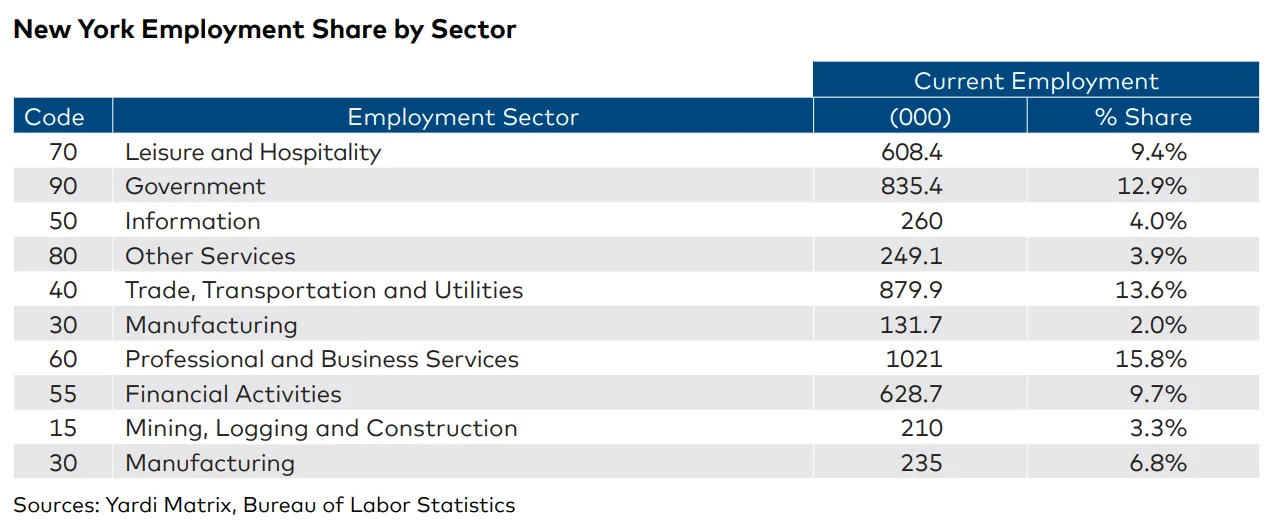

New York City’s job market stayed solid, posting 1.5% annual gains through August—70 bps above the national rate. The metro added 113,400 net jobs over 12 months, led by education/health services and leisure/hospitality sectors. While job growth in other major metros like Orlando has surged faster, Manhattan’s scale and sector diversity continue to support long-term demand for multifamily housing. The city’s 5.1% unemployment rate, while higher than state and national averages, nevertheless marked improvement over the prior year.

Population estimates showed slight contraction, but broader trends remain positive. New policy initiatives by the new administration aim to balance affordability, building on the frameworks of the previous City of Yes and 467-m tax programs.

Get Smarter About What Matters in New York

Subscribe to our free newsletter covering the biggest commercial real estate stories across the five boroughs — delivered in just 5 minutes.

Steady Supply Pipeline

Developers added 2,678 units to Manhattan’s supply in 2025, roughly in line with historical averages. Construction remained active with 13,234 units underway and an additional 45,000 in the planning or permitting stage. Just under 80% of construction centers on Lifestyle product, while affordable housing units under construction trail national shares.

Conversions have become significant, with both of the nation’s largest office-to-residential projects underway in Manhattan—one being the Pfizer HQ conversion and another at 25 Water St. Construction starts jumped to 6,468 units year-to-date, up from 4,848 in the previous year.

Transaction and Pricing Trends

Multifamily investment reflected caution, consistent with other major US metros. Year-to-date Manhattan sales hit $1.4B, lagging the $3.1B average seen earlier in the decade. Only 11 significant transactions closed in 2025, split between Lifestyle and Renter-by-Necessity properties. Per-unit pricing spiked to an average $534,659, though this was influenced by Naftali Group’s $810M, 208-unit purchase at 800 Fifth Ave.

With a solid rent outlook, robust construction, and employment resilience, Manhattan multifamily is positioned for continued, albeit more measured, growth in 2026 as economic and policy shifts unfold.