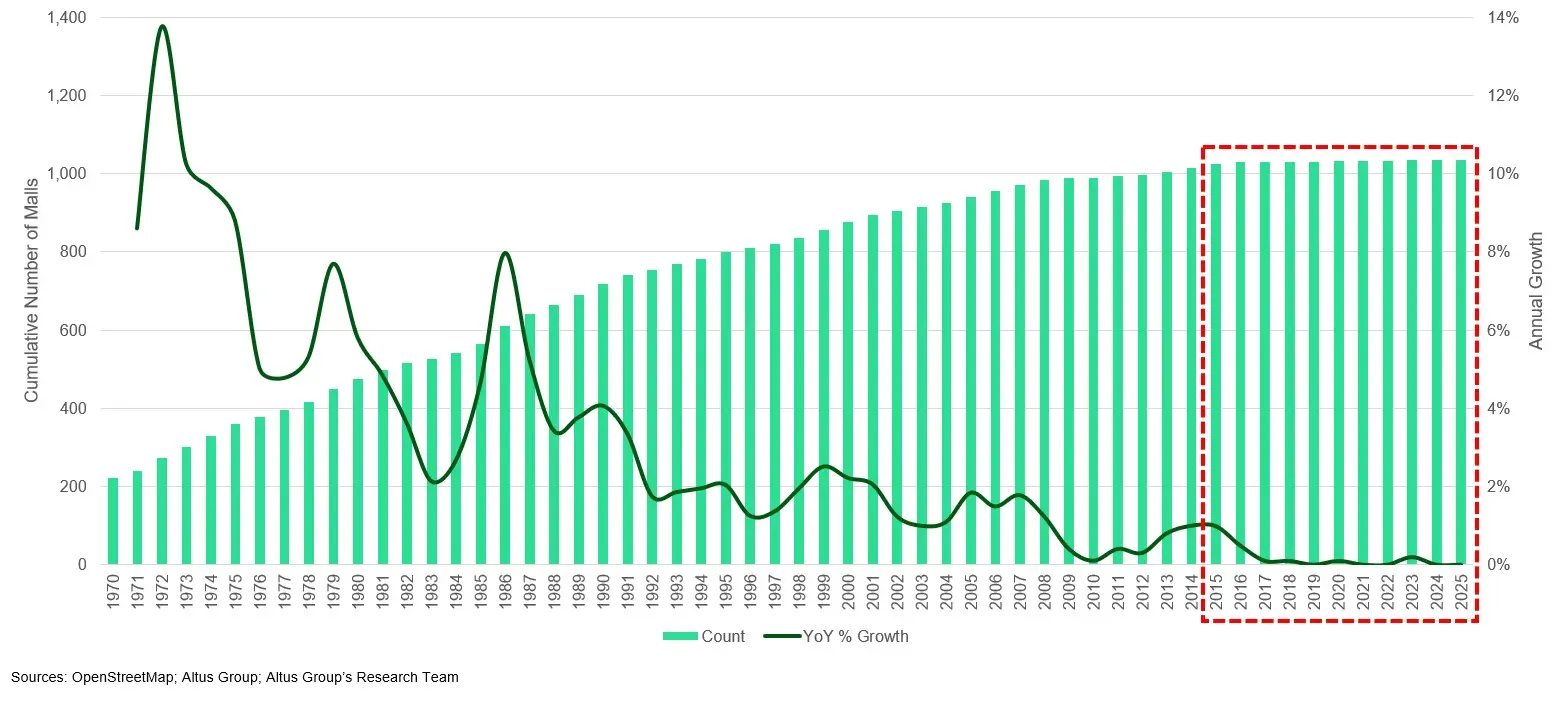

- More than 1K US malls remain in operation, with the vast majority built before 1990 and almost no new development since 2010.

- Mall fundamentals have improved significantly, with occupancies near pre-pandemic levels and strong rent spreads driving renewed investor interest.

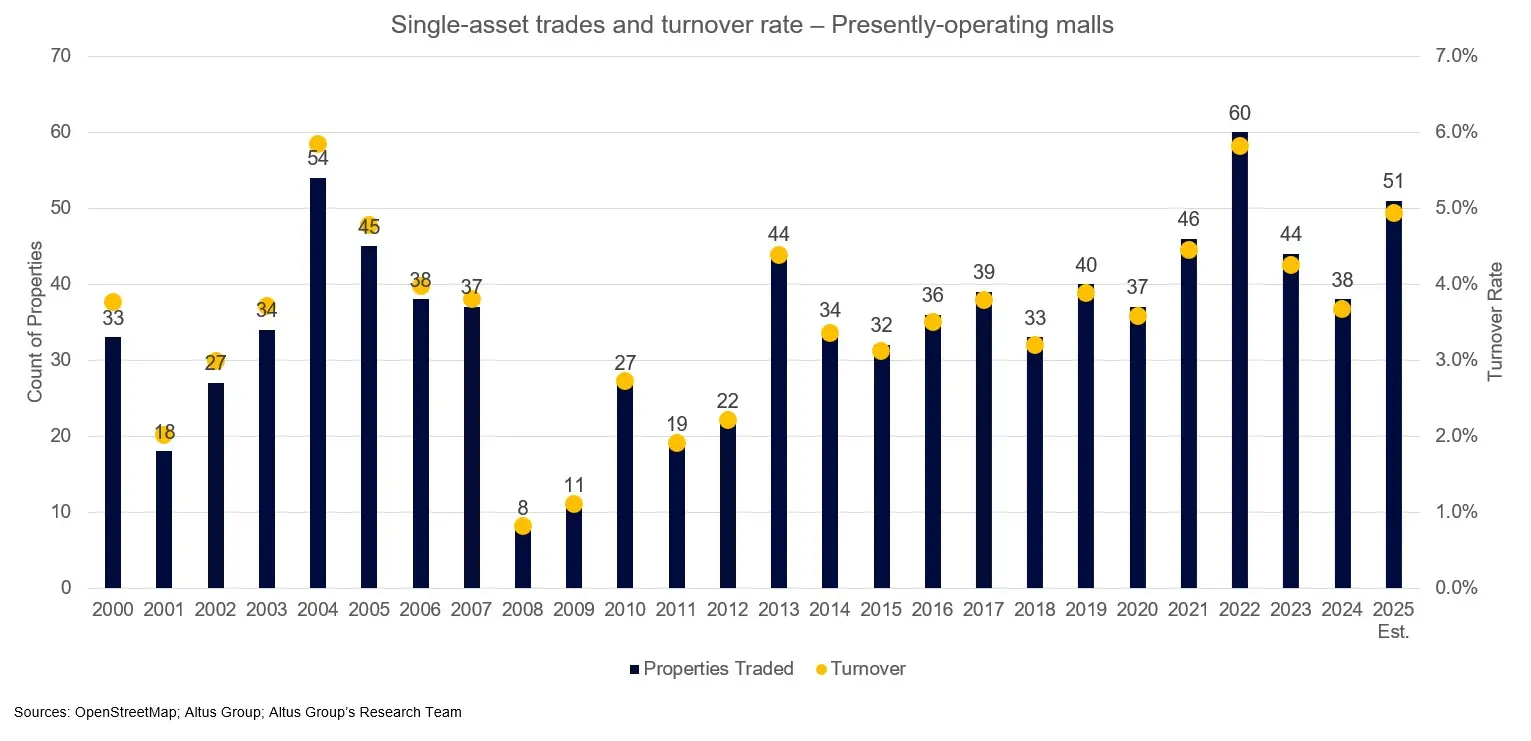

- Despite historically low consumer sentiment, mall transaction volume is rebounding, with 2025 poised to become one of the busiest years for single-asset mall sales in two decades.

- Investors are betting on long-term performance, even as overall retail property transactions remain slightly below pre-COVID averages.

Investor Appetite Returns To Malls

Malls, long considered a troubled retail asset class, are making a comeback, as reported by AltusGroup. Reonomy and Altus Group report 38 US malls sold in single-asset deals during the first three quarters of 2025. That figure matches the total number of mall transactions recorded for all of 2024. If the pace continues, more than 50 malls will trade by year-end, making 2025 one of the busiest years in two decades.

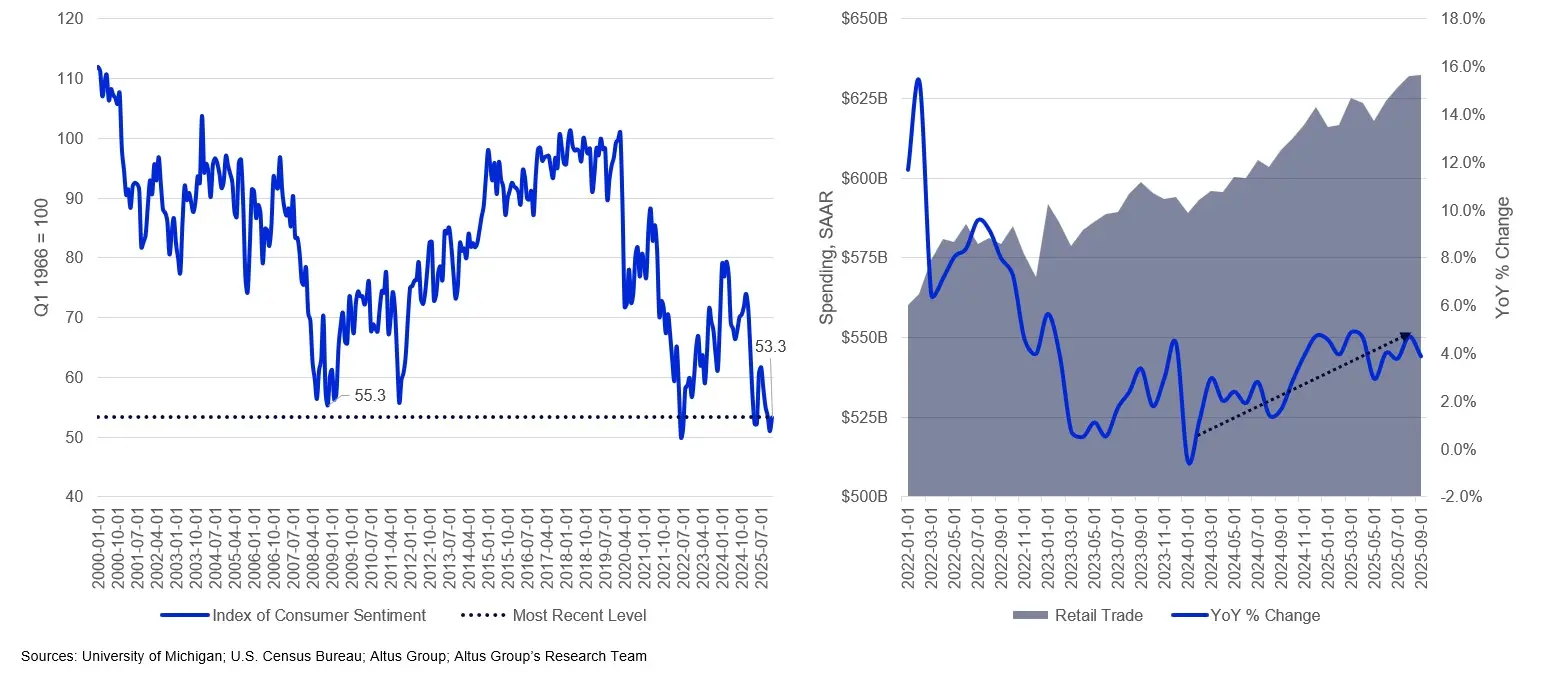

This renewed investor energy comes despite persistent concerns about the consumer. While retail sales are rising nominally, consumer sentiment remains deeply pessimistic, hovering near historic lows. Still, CRE investors appear unfazed, leaning into improving fundamentals in the mall sector.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Improved Fundamentals Drive Confidence

The recent uptick in investor interest is underpinned by a steady recovery in mall performance metrics:

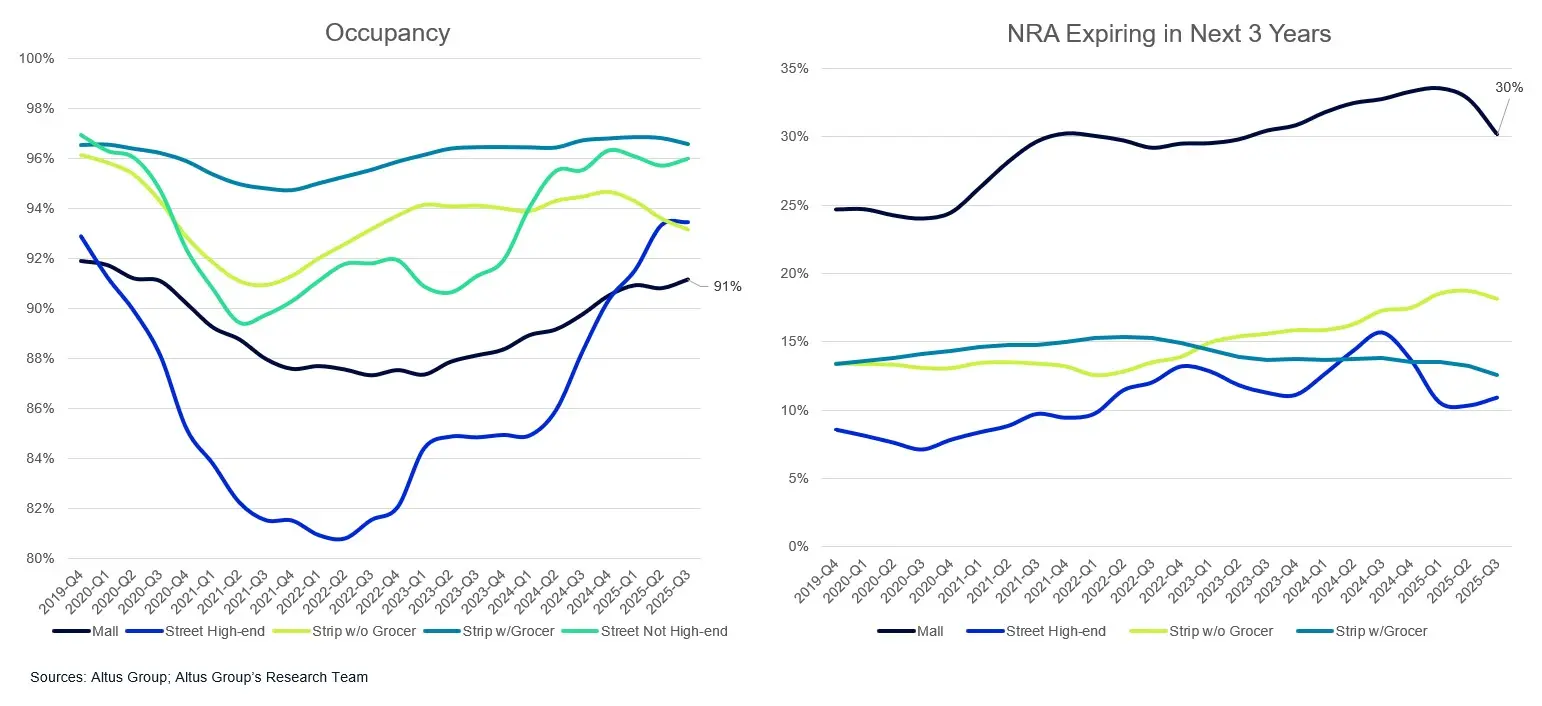

- Occupancy has returned to 91%, matching late-2019 levels.

- Lease rollover risks are easing, with the volume of leases expiring in the next three years trending downward.

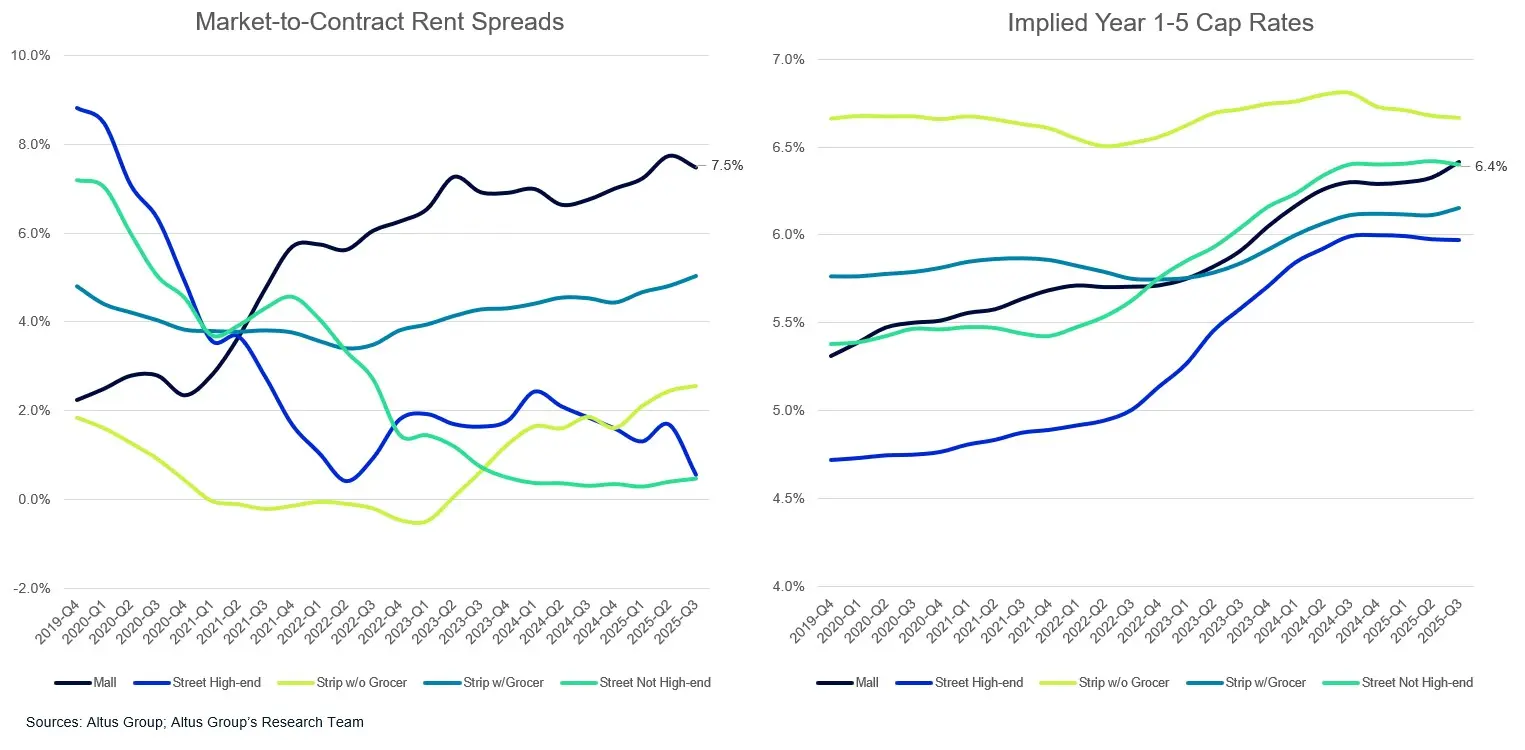

- Rent spreads stand at 7.5%, the highest among retail property types, signaling strong upside on re-leasing activity.

- Cap rates have stabilized around 6.3%, following previous increases tied to interest rate hikes.

These fundamentals indicate that the weakest assets have already exited the market, leaving behind stronger, more stable centers.

What’s Left Of The Mall Universe

Of the roughly 1,382 malls identified nationwide, just over 1K are estimated to still be in operation. Most are aging properties—nearly 70% were built before 1990, and fewer than 3% have been developed since 2010. These assets represent over 514M SF of primary parcel space and are valued at an average of $55M each.

Though fewer in number, malls are among the most high-profile and capital-intensive retail assets in the US.

Broader Retail Market Still Lagging

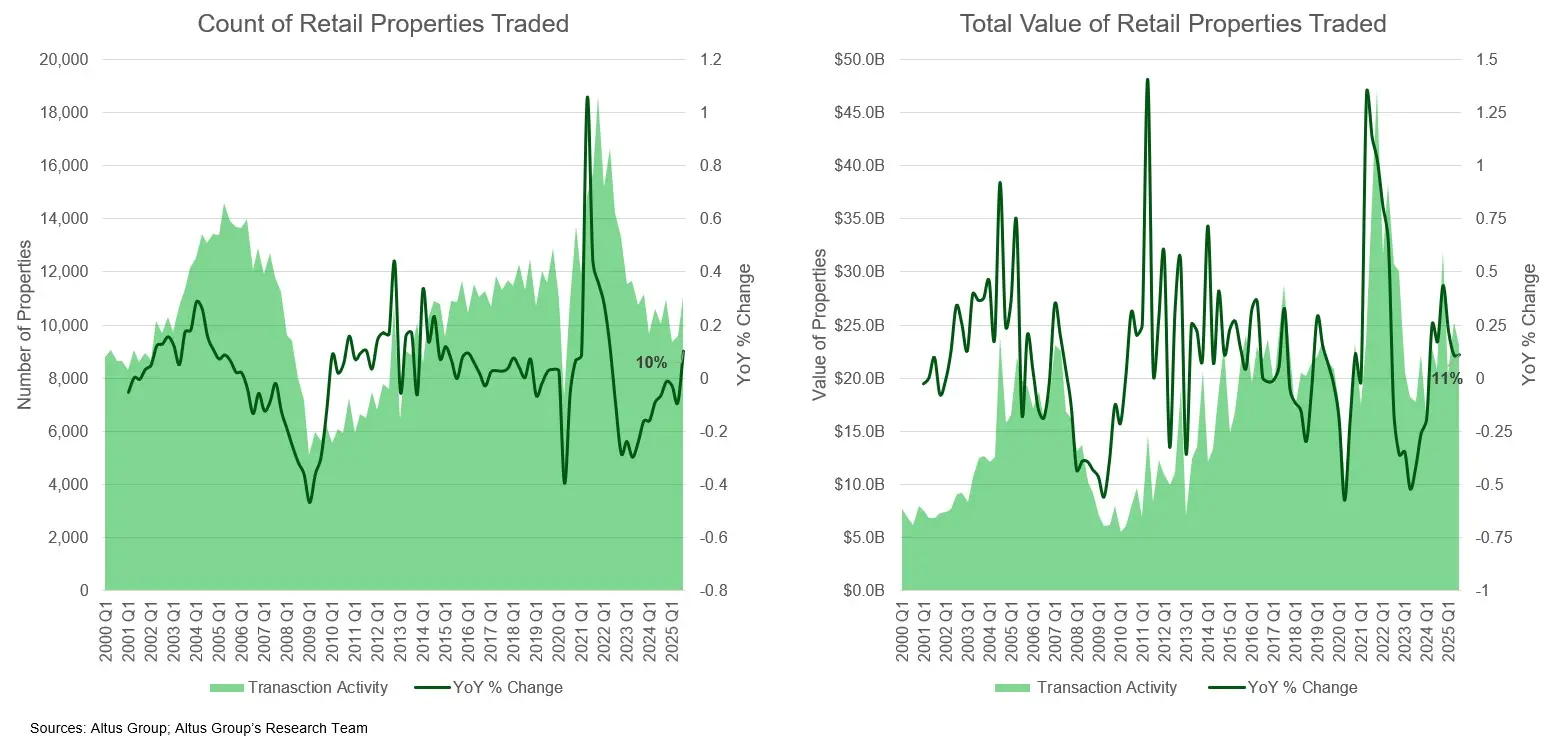

Despite strength in the mall segment, the broader retail real estate market hasn’t fully rebounded. Q3 2025 saw 11,039 retail property trades, still shy of the pre-pandemic quarterly average of 11,400. Similarly, the 88M SF of space traded in Q3 was 5.7% below the 2015–2019 average.

Total retail CRE investment reached $23.1B in Q3 2025, a marginal gain over historical averages but not yet signaling a full recovery.

Looking Ahead: Are Malls Signaling A Broader Retail Turnaround?

The uptick in single-asset mall transactions could be an early signal that retail real estate is turning a corner. Investors appear more focused on fundamentals than sentiment. With high-quality assets in limited supply, malls may again set the tone for retail CRE investment heading into 2026.

It’s unclear if this is a lasting shift or short-term rebound, but for now, malls are back in the spotlight.