- Mall anchors in 2025 include niche retailers, restaurants, and fitness centers that consistently drive strong foot traffic.

- Smaller tenants like Barnes & Noble and In-N-Out are outperforming traditional anchors in both visits and spend demographics.

- A visit-focused strategy helps balance daily and weekly traffic by aligning tenant types with consumer patterns and behaviors.

Shifting Anchor Strategies

The traditional mall anchor—a large-format department store drawing broad audiences—is no longer the sole driver of foot traffic, reports The Anchor. In 2025, malls are taking a more dynamic, visit-focused approach. The rise of niche retailers, popular dining chains, fitness centers, and strategic pop-ups is redefining how retail destinations think about anchoring.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Experiential Retail Reigns

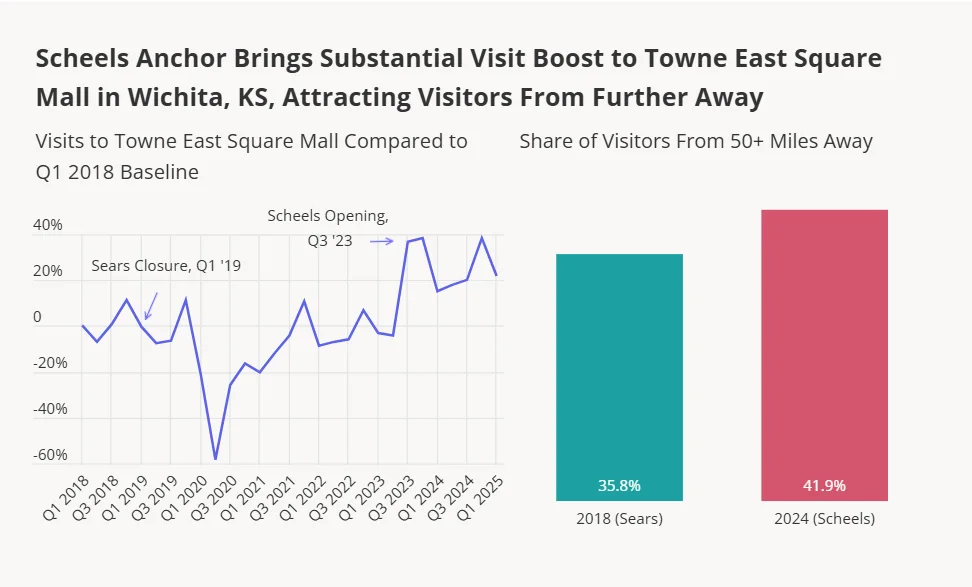

At Towne East Square Mall in Wichita, KS, Scheels has proven how experiential retail can deliver anchor-level traffic. Since opening in 2023, the destination has drawn a wider geographic customer base, with 42% of visitors traveling over 50 miles—up from 36% when Sears previously occupied the space.

Niche Brands, Big Pull

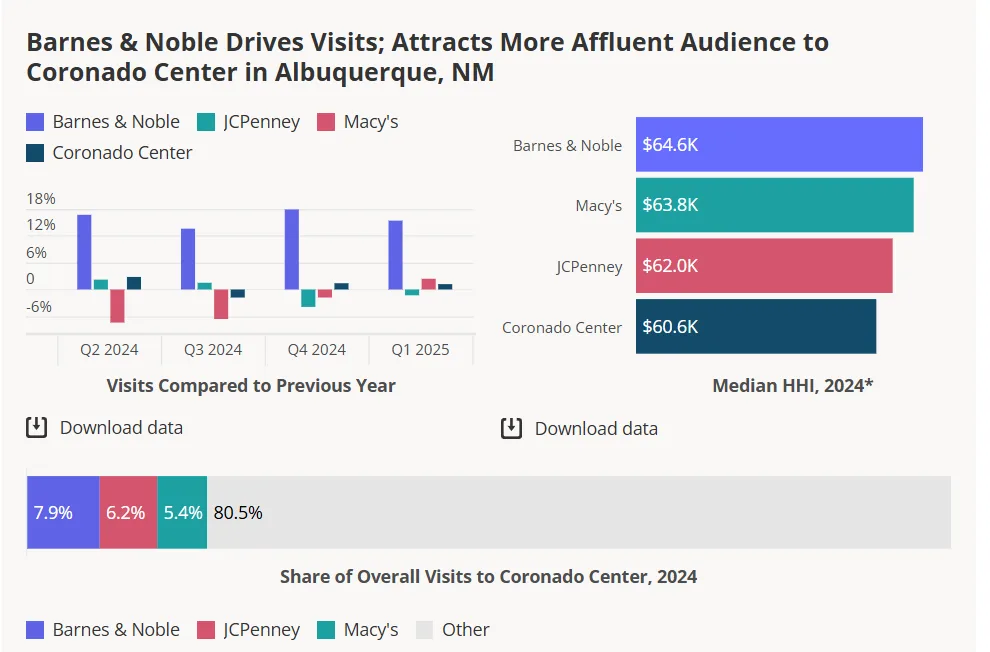

Barnes & Noble’s Coronado Center location in Albuquerque illustrates how niche can be mighty. Drawing 7.9% of mall visits in 2024—more than Macy’s or JCPenney—the bookseller has re-emerged as a magnet for affluent shoppers, lifting overall foot traffic despite its smaller footprint.

Dining Drives Daily Visits

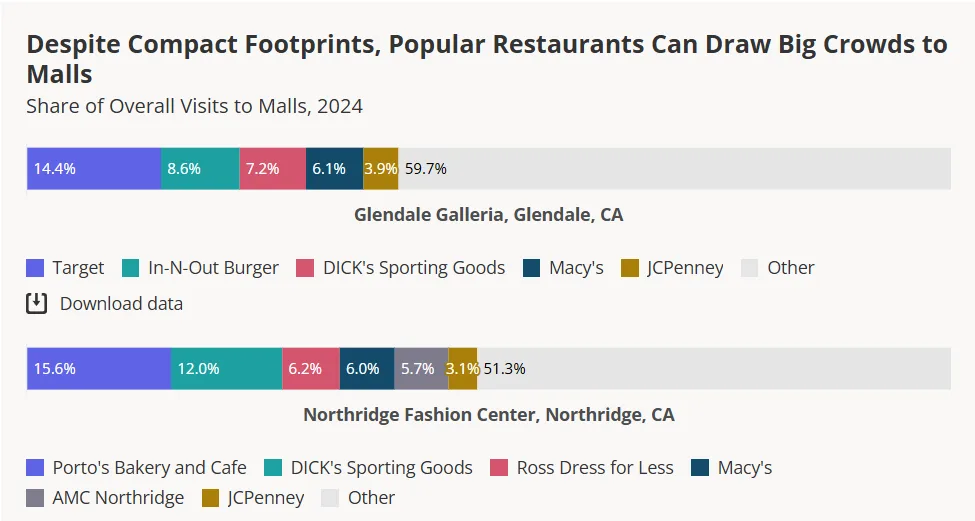

Food-focused tenants are also proving their anchor potential. In-N-Out at Glendale Galleria captured 8.6% of mall traffic in 2024, while Porto’s Bakery at Northridge Fashion Center drew an outsized 15.6%—beating out larger anchors. These examples underscore how dining chains can serve as compact, high-impact traffic drivers.

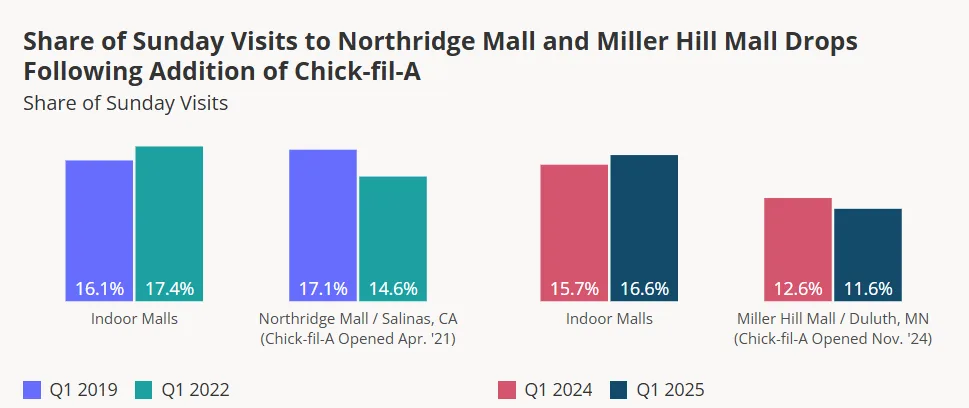

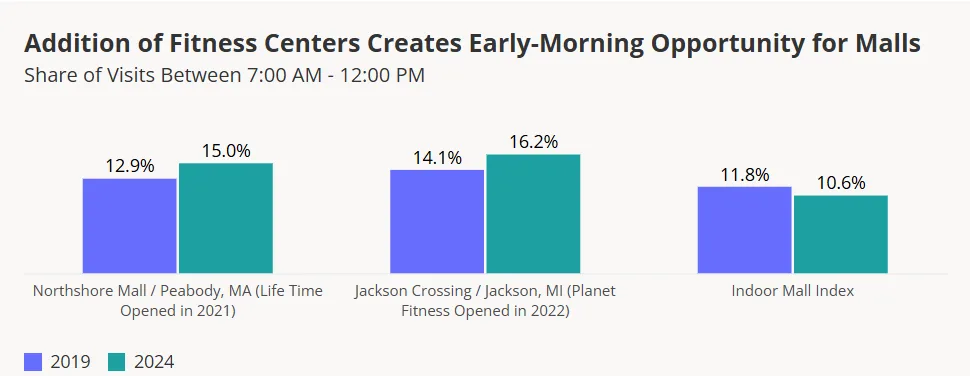

Daypart And Day-Of-Week Targeting

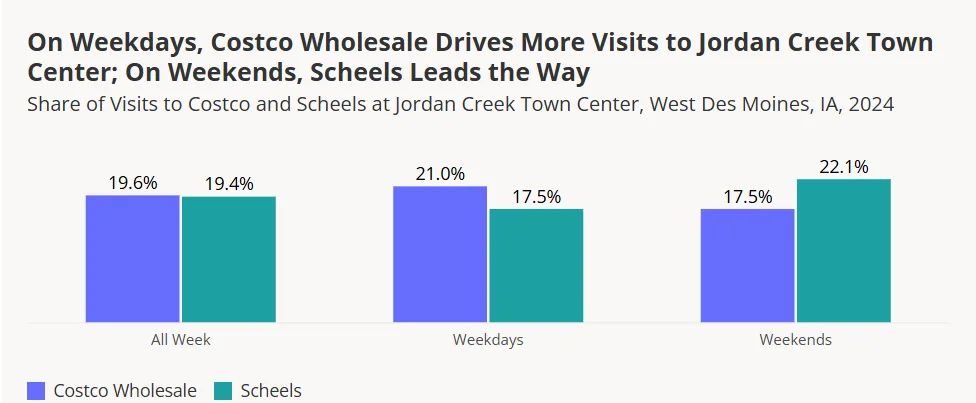

Anchor planning is becoming more granular. At Jordan Creek Town Center in Iowa, Scheels drives weekend visits while Costco dominates weekdays—helping smooth out foot traffic. Chick-fil-A locations, despite their Sunday closures, shift visit patterns toward weekdays. Meanwhile, early-opening gyms are helping malls capture morning traffic previously left untapped.

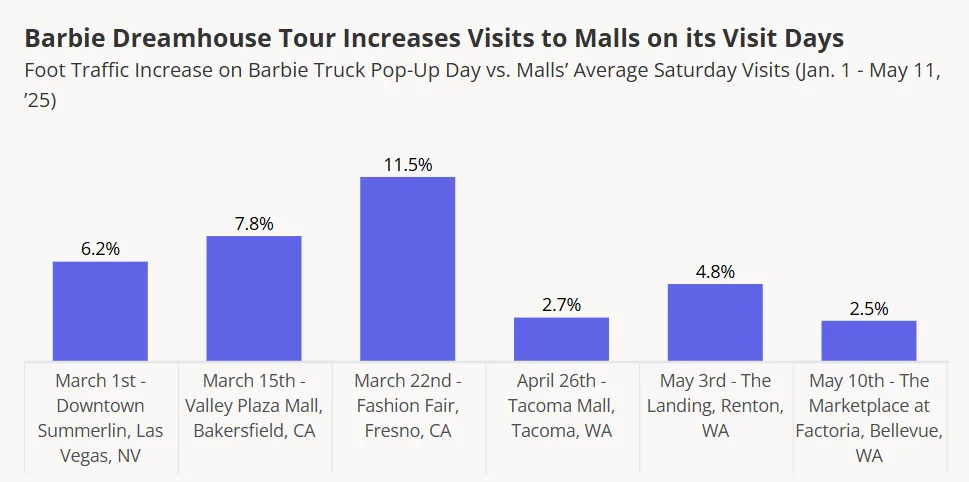

Pop-Ups As Anchor Alternatives

Temporary activations, like the Barbie Dreamhouse Living Truck Tour, are delivering big foot traffic boosts. These events can outperform regular weekend traffic and serve as short-term anchors. Malls offering flexible leases and visibility perks to such pop-ups can fill seasonal or experiential gaps.

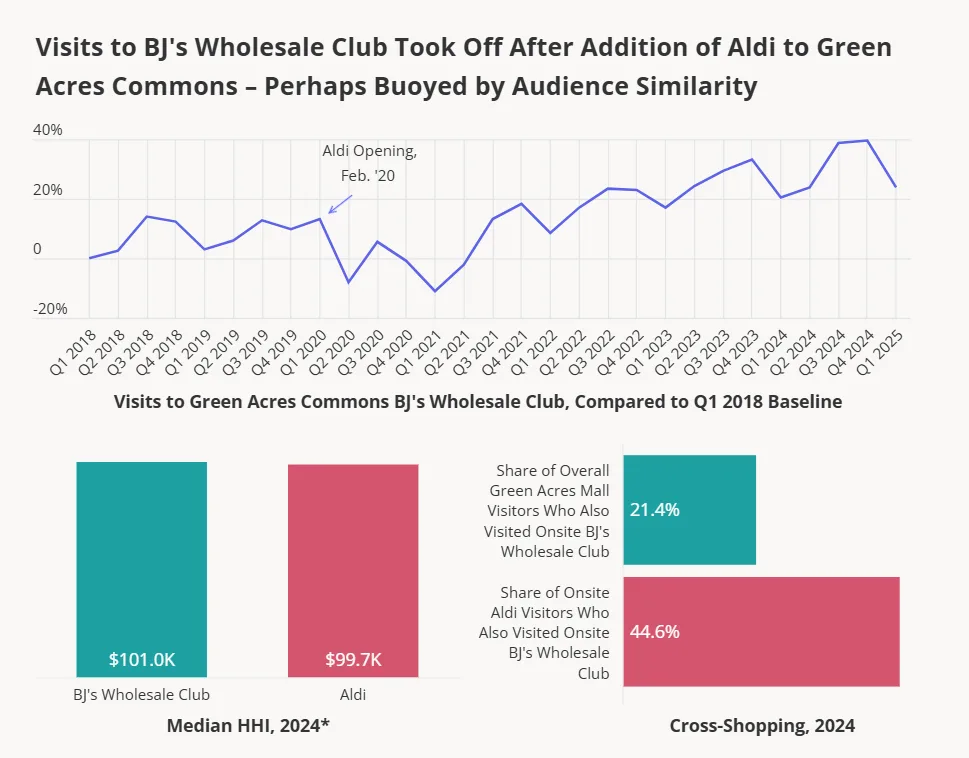

Collaborative Category Impact

Adding tenants with overlapping customer bases can create positive spillovers. At Green Acres Commons in NY, Aldi’s 2020 debut boosted visits to the adjacent BJ’s, showing that similar retailers can grow the overall traffic pie rather than cannibalize it.

Beyond Square Footage

In 2025, success in mall anchor strategy is measured less by size and more by impact. From experiential concepts to boutique eateries, a tenant’s ability to drive consistent, quality visits matters most. Mall operators embracing this visit-focused model are well-positioned to meet shifting consumer preferences—and to turn their centers into must-visit destinations.